Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

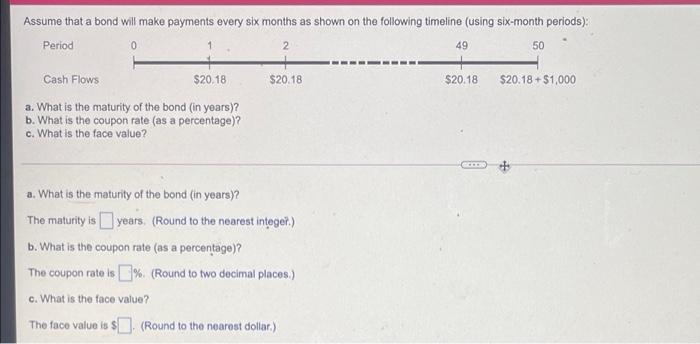

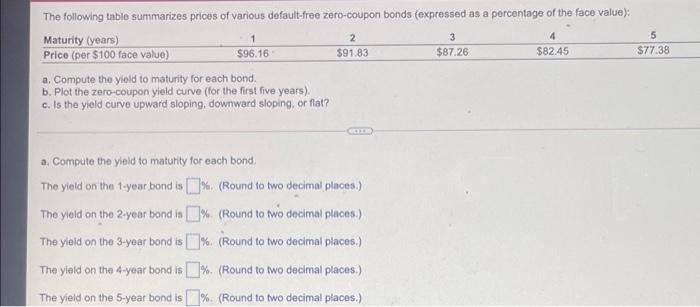

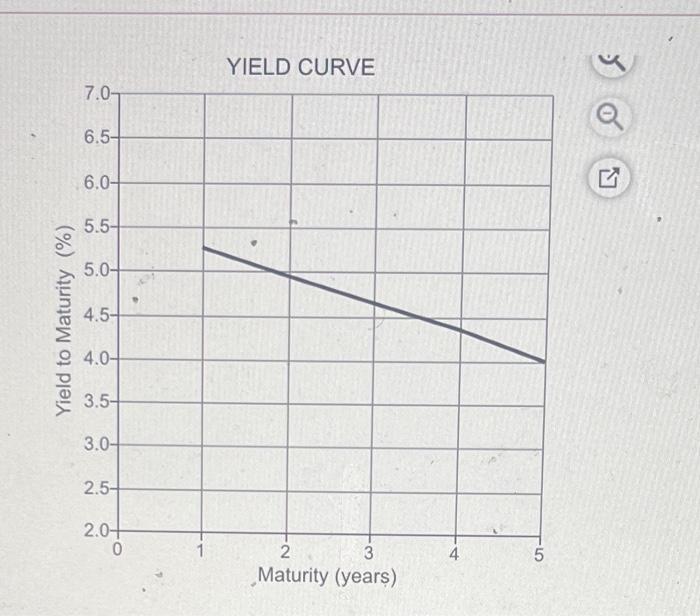

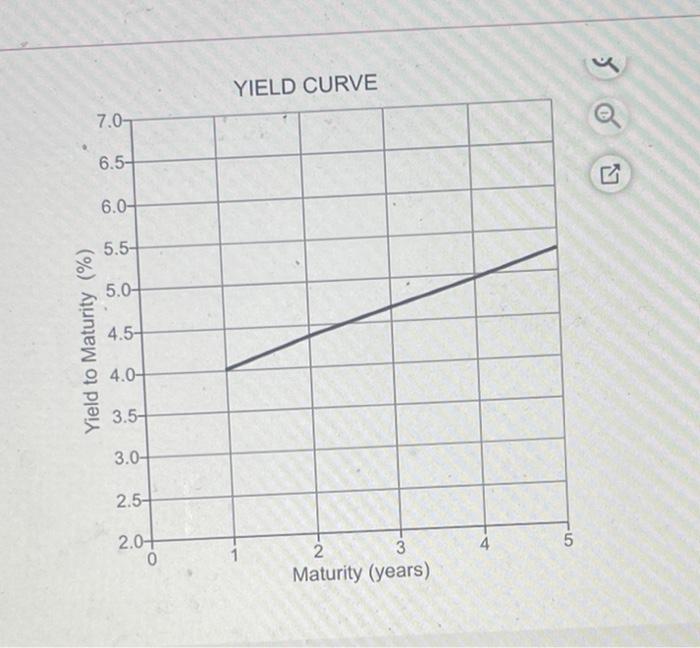

Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): Period 50 0 49 $20.18 $20.18 $20.18 +$1,000 Cash Flows $20.18 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? a. What is the maturity of the bond (in years)? The maturity is years, (Round to the nearest integer.) b. What is the coupon rate (as a percentage)? The coupon rate is 0% (Round to two decimal places.) c. What is the face value? The face value is $. (Round to the nearest dollar) 1 2 4 The following table summarizes prices of various default-froe zero-coupon bonds (expressed as a percentage of the face value); Maturity (years) 3 5 Price (per $100 face value) $96.16 $91.83 $87.26 $82.45 $77.38 a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years) c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to matunity for each bond. The yield on the 1-year bond is % (Round to two decimal places.) The yield on the 2-year bond is 3% (Round to two decimal places.) The yield on the 3-year bond is % (Round to two decimal places.) The yield on the 4-year bond is 1% (Round to two decimal places) The yield on the 5-year bond is % (Round to two decimal places.) b. Plot the zero-coupon yield curve (for the first five years). The following graph is the zero-coupon yield curve: (Select the best choice below.) YIELD CURVE 7.0- 6.5- 6.0- 5.5- 5.0- Yield to Maturity (%) 4.5- 4.0- 3.5- 3.0 2.5- 2.0+ 0 4 5 2. 3 Maturity (years) YIELD CURVE 50 7.0 6.5- 6.0- 5.5-1 5.0- 4.5- Yield to Maturity (%) 4.0 3.5- 3.0- 2.5- 2.0+ 0 4 5 1 2. 3 Maturity (years) C. Is the yield curve upward sloping, downward sloping, or flat? (Select from the drop-down menu.) The yield curve is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts