Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

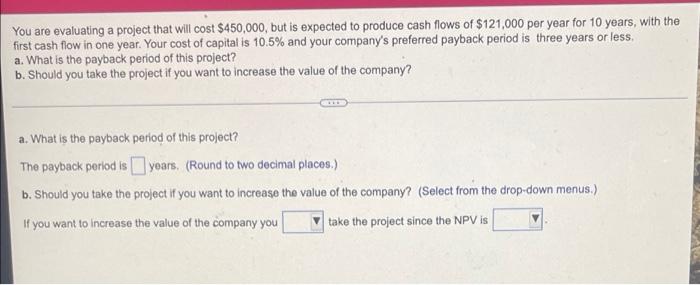

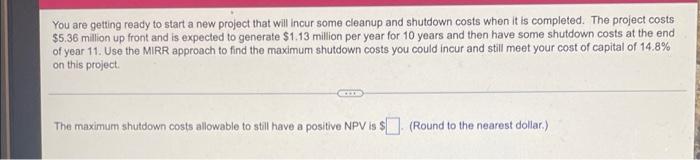

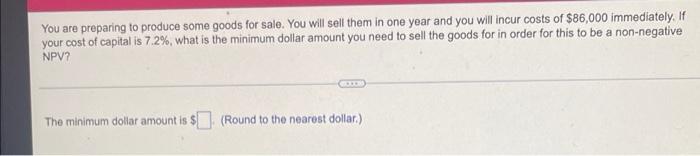

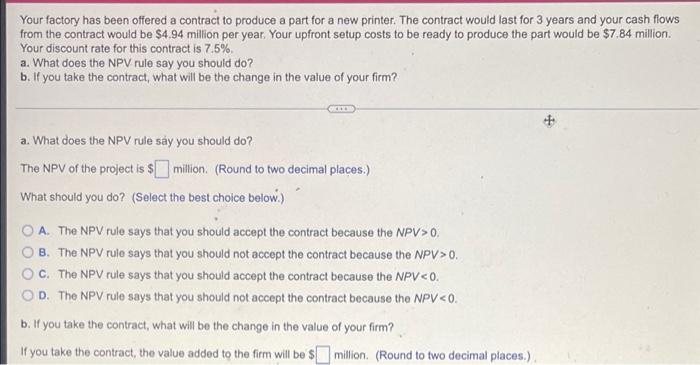

You are evaluating a project that will cost $450,000, but is expected to produce cash flows of $121,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.5% and your company's preferred payback period is three years or less, a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) if you want to increase the value of the company you take the project since the NPV is You are getting ready to start a new project that will incur some cleanup and shutdown costs when it is completed. The project costs $5.36 million up front and is expected to generate $1.13 million per year for 10 years and then have some shutdown costs at the end of year 11. Use the MIRR approach to find the maximum shutdown costs you could incur and still meet your cost of capital of 14.8% on this project The maximum shutdown costs allowable to still have a positive NPV is $). (Round to the nearest dollar) You are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $86,000 immediately. If your cost of capital is 7.2%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $ (Round to the nearest dollar.) Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.94 million per year. Your upfront setup costs to be ready to produce the part would be $7.84 million. Your discount rate for this contract is 7.5% a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million (Round to two decimal places.) What should you do? (Select the best choice below.) O A. The NPV rulo says that you should accept the contract because the NPV>0 B. The NPV rulo says that you should not accept the contract because the NPV>0. C. The NPV rule says that you should accept the contract because the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts