Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you!

provide the answer TO EACH QUESTION CLEARLY please!!!

PLEASE CLEARLY LABLE THE ANSWER

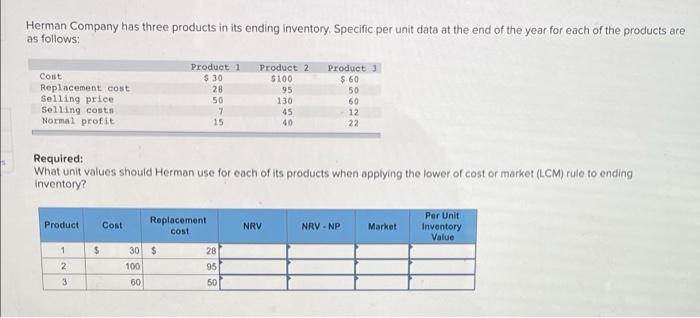

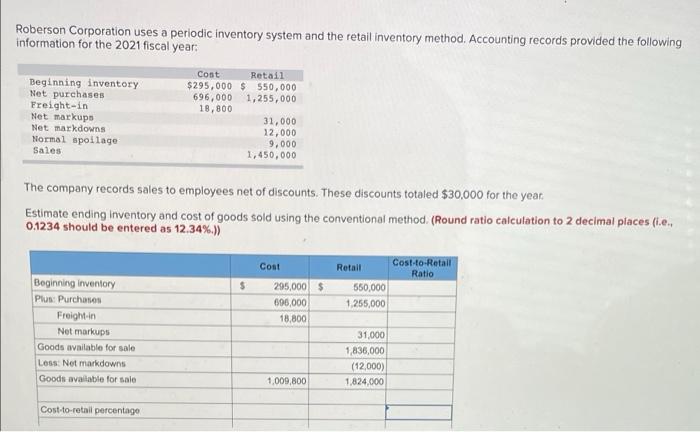

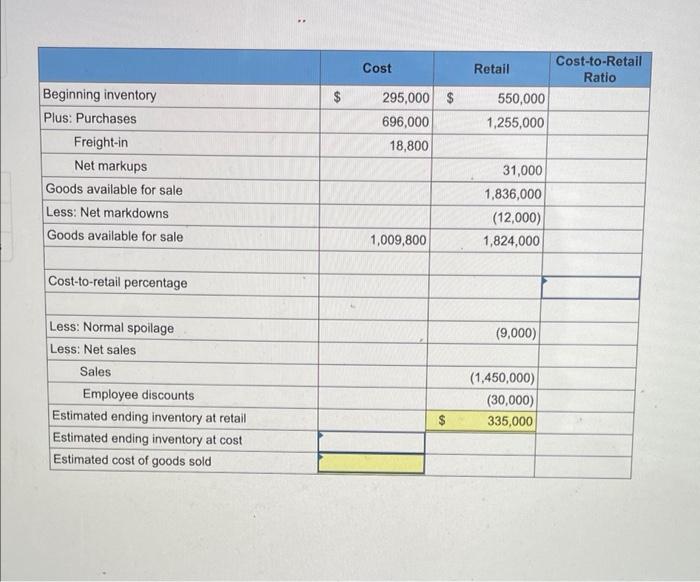

Herman Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows: Product 1 Product 2 Product 3 Cost $ 30 $100 $ 60 28 95 50 Replacement cost Selling price 50 130 60 Selling costs 7 45 12 Normal profit 15 40 22 Required: What unit values should Herman use for each of its products when applying the lower of cost or market (LCM) rule to ending inventory? Replacement Product Cost NRV NRV - NP Market Per Unit Inventory Value cost 1 2 3 $ 30 $ 100 60 28 95 50 Roberson Corporation uses a periodic inventory system and the retail inventory method. Accounting records provided the following information for the 2021 fiscal year: Beginning inventory Net purchases Freight-in Net markups Cost Retail $295,000 $ 550,000 696,000 1,255,000 18,800 31,000 Net markdowns 12,000 Normal spoilage 9,000 Sales 1,450,000 The company records sales to employees net of discounts. These discounts totaled $30,000 for the year. Estimate ending inventory and cost of goods sold using the conventional method. (Round ratio calculation to 2 decimal places (i.e.. 0.1234 should be entered as 12.34%.)) Cost Retail Cost-to-Retail Ratio Beginning inventory $ Plus: Purchases Freight-in Net markups Goods available for sale Less: Net markdowns Goods available for sale Cost-to-retail percentage 295,000 $ 696,000 18,800 1,009,800 550,000 1,255,000 31,000 1,836,000 (12,000) 1,824,000 Beginning inventory Plus: Purchases Freight-in Net markups Goods available for sale Less: Net markdowns Goods available for sale Cost-to-retail percentage Less: Normal spoilage Less: Net sales Sales Employee discounts Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold $ Cost 295,000 $ 696,000 18,800 1,009,800 $ Retail 550,000 1,255,000 31,000 1,836,000 (12,000) 1,824,000 (9,000) (1,450,000) (30,000) 335,000 Cost-to-Retail Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts