Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

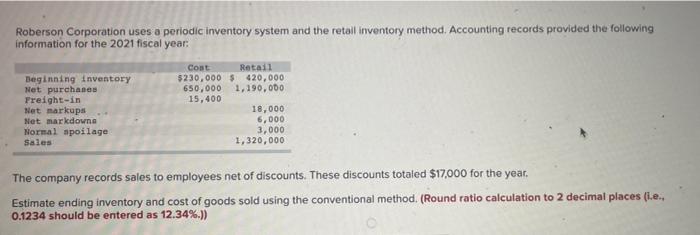

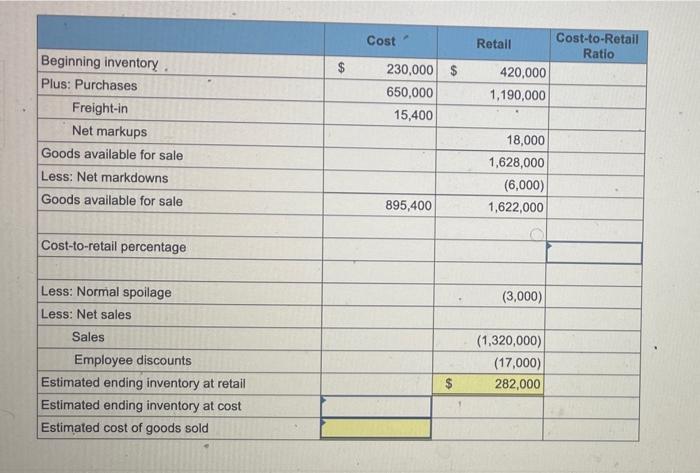

Roberson Corporation uses a periodic inventory system and the retail inventory method. Accounting records provided the following information for the 2021 fiscal year: Cont Retail $ 420,000 Beginning inventory Net purchases Freight-in $230,000 650,000 1,190,000 15,400 Net markups 18,000 Net markdowns 6,000 Normal spoilage Sales 3,000 1,320,000 The company records sales to employees net of discounts. These discounts totaled $17,000 for the year. Estimate ending inventory and cost of goods sold using the conventional method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.)) O Beginning inventory. Plus: Purchases Freight-in Net markups Goods available for sale Less: Net markdowns Goods available for sale Cost-to-retail percentage Less: Normal spoilage Less: Net sales Sales Employee discounts Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold $ Cost 230,000 $ 650,000 15,400 895,400 $ Retail 420,000 1,190,000 18,000 1,628,000 (6,000) 1,622,000 (3,000) (1,320,000) (17,000) 282,000 Cost-to-Retail Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts