Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

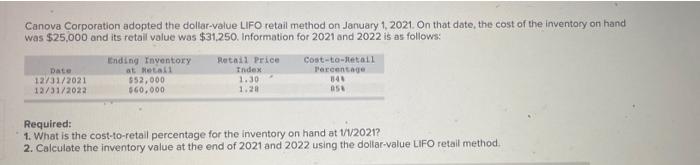

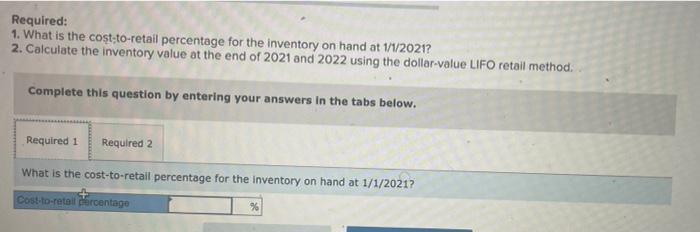

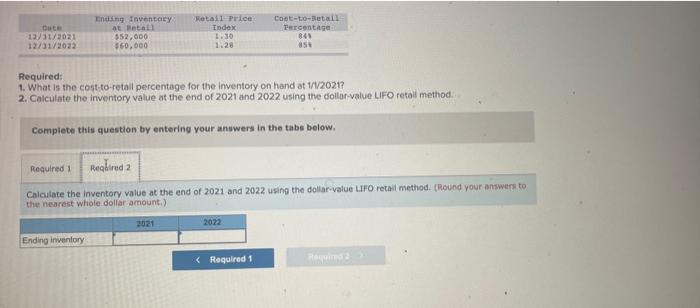

Canova Corporation adopted the dollar-value LIFO retail method on January 1, 2021. On that date, the cost of the inventory on hand was $25,000 and its retail value was $31,250. Information for 2021 and 2022 is as follows: Cost-to-Retail Retail Price Index Date Ending Inventory at Retail $52,000 $60,000 1.30 Percentage 84% 12/31/2021 12/31/2022 1.28 054 Required: 1. What is the cost-to-retail percentage for the inventory on hand at 1/1/2021? 2. Calculate the inventory value at the end of 2021 and 2022 using the dollar-value LIFO retail method. Required: 1. What is the cost-to-retail percentage for the inventory on hand at 1/1/2021? 2. Calculate the inventory value at the end of 2021 and 2022 using the dollar-value LIFO retail method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the cost-to-retail percentage for the inventory on hand at 1/1/2021? Cost-to-retail percentage % Cost-to-Retail Ending Inventory. Retail Price at Betail $52,000 Index Percentage: 84% 1.30 $60,000 1.28 Required: 1. What is the cost-to-retail percentage for the inventory on hand at 1/1/2021? 2. Calculate the inventory value at the end of 2021 and 2022 using the dollar-value LIFO retail method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the inventory value at the end of 2021 and 2022 using the dollar-value LIFO retail method. (Round your answers to the nearest whole dollar amount.) 2021 2022 Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts