Question: hello, please answer the 5 following multiple-choice questions with NO EXPLANATION NEEDED. I just want to make sure my answers are correct, answers are all

hello, please answer the 5 following multiple-choice questions with NO EXPLANATION NEEDED. I just want to make sure my answers are correct, answers are all i need to verify. thanks in advance.

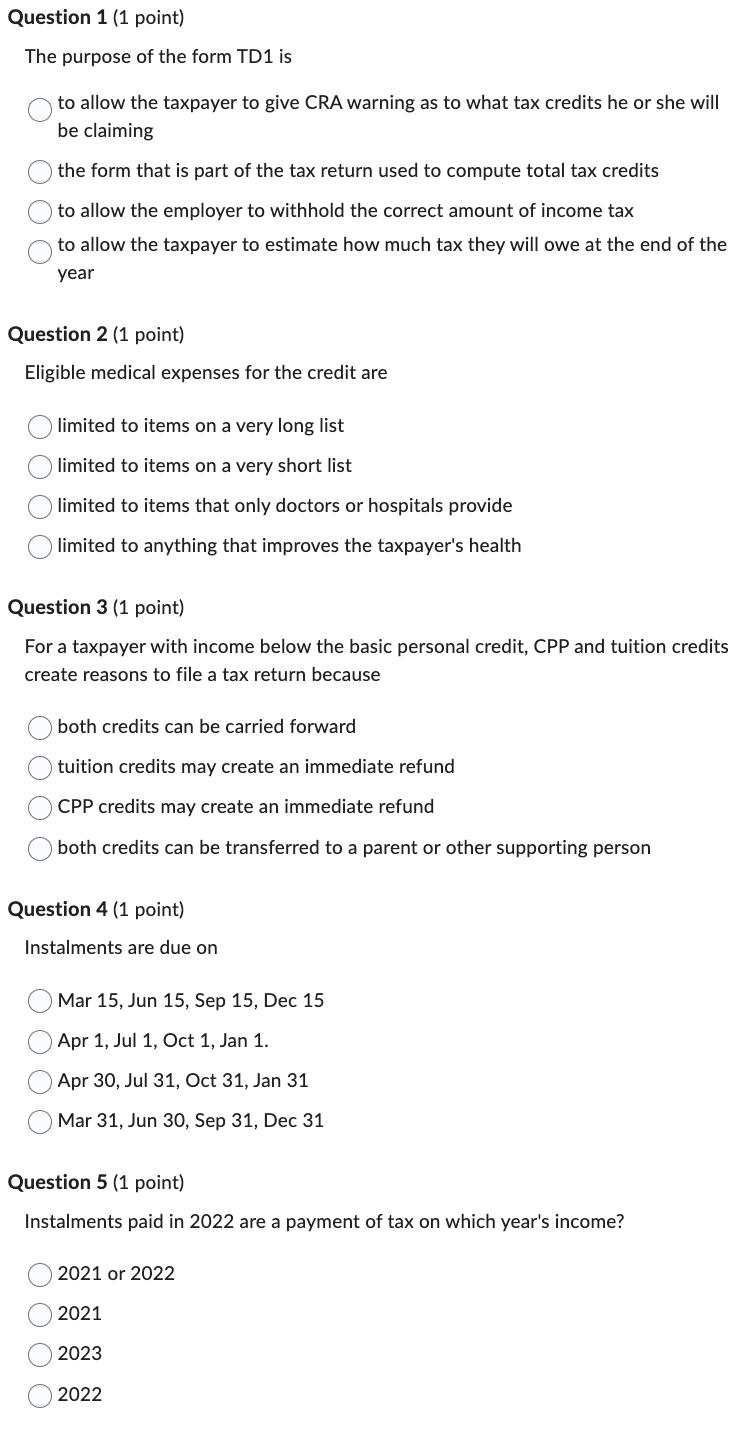

Question 1 (1 point) The purpose of the form TD1 is to allow the taxpayer to give CRA warning as to what tax credits he or she will be claiming the form that is part of the tax return used to compute total tax credits to allow the employer to withhold the correct amount of income tax to allow the taxpayer to estimate how much tax they will owe at the end of the year Question 2 (1 point) Eligible medical expenses for the credit are limited to items on a very long list limited to items on a very short list limited to items that only doctors or hospitals provide limited to anything that improves the taxpayer's health Question 3 (1 point) For a taxpayer with income below the basic personal credit, CPP and tuition credits create reasons to file a tax return because both credits can be carried forward tuition credits may create an immediate refund CPP credits may create an immediate refund both credits can be transferred to a parent or other supporting person Question 4 (1 point) Instalments are due on Mar 15, Jun 15, Sep 15, Dec 15 Apr 1, Jul 1, Oct 1, Jan 1. Apr 30, Jul 31, Oct 31, Jan 31 Mar 31, Jun 30, Sep 31, Dec 31 Question 5 (1 point) Instalments paid in 2022 are a payment of tax on which year's income? 2021 or 2022 2021 2023 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts