Question: Hello, please answer the following questions with a clear explenation on how to do the formulas in excel Hamilton Landscaping's dividend growth rate is expected

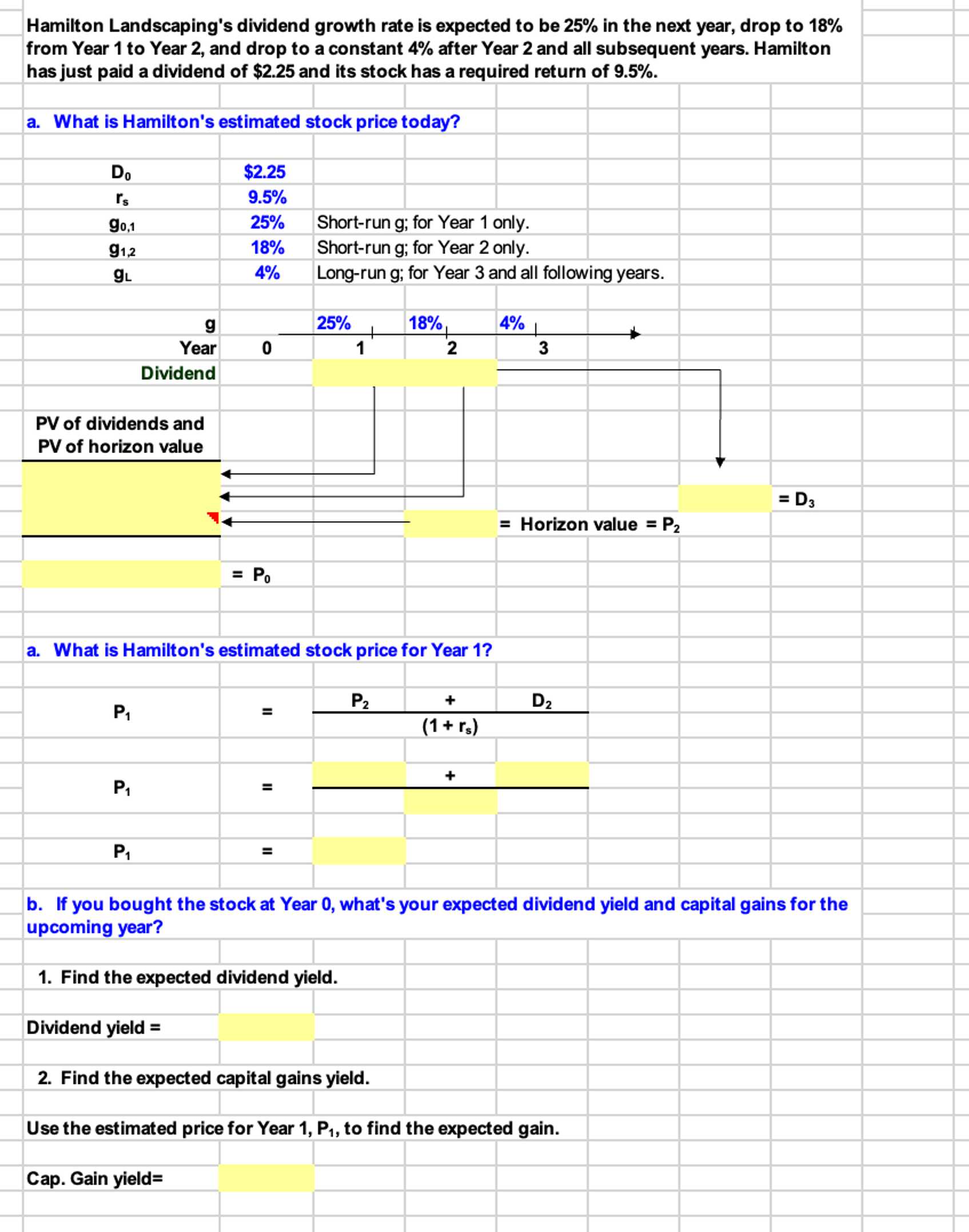

Hamilton Landscaping's dividend growth rate is expected to be 25% in the next year, drop to 18% from Year 1 to Year 2, and drop to a constant 4% after Year 2 and all subsequent years. Hamilton has just paid a dividend of $2.25 and its stock has a required return of 9.5%. a. What is Hamilton's estimated stock price today? Do go,l $2.25 9.5% 18% 40/0 Short-run g; for Year 1 only. Short-run g; for Year 2 only. Long-run g; for Year 3 and all following years. 180/01 2 Year Dividend PV of dividends and PV of horizon value 3 = Horizon value a. What is Hamilton's estimated stock price for Year 1? 1 + rs) b. If you bought the stock at Year O, what's your expected dividend yield and capital gains for the upcoming year? 1. Find the expected dividend yield. Dividend yield = 2. Find the expected capital gains yield. Use the estimated price for Year 1, Pl, to find the expected gain. Cap. Gain yield:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts