Question: Hello! Please answer these questions, DO NOT USE EXCEL , only handwritten with clear solutions and equations. 6. A financial institution has the following portfolio

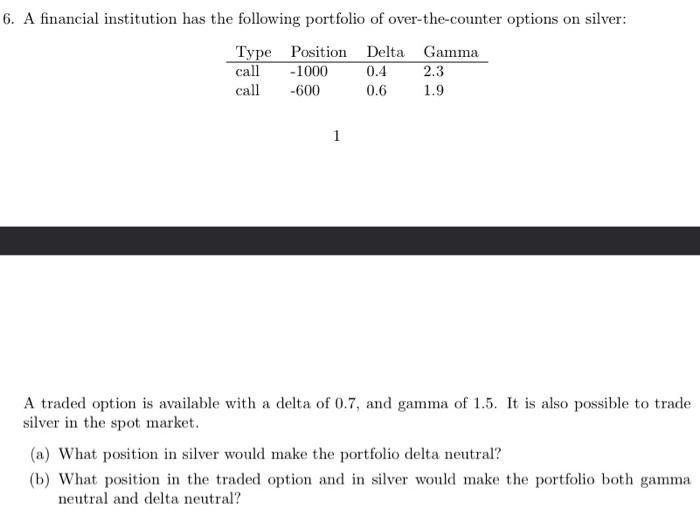

6. A financial institution has the following portfolio of over-the-counter options on silver: Type Position Delta Gamma call -1000 0.4 2.3 call -600 0.6 1.9 1 A traded option is available with a delta of 0.7, and gamma of 1.5. It is also possible to trade silver in the spot market. (a) What position in silver would make the portfolio delta neutral? (b) What position in the traded option and in silver would make the portfolio both gamma neutral and delta neutral

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts