Question: hello, please do all thank you. all the drop downs are provided below Loan contracts are set for different time periods. Contracts that mature between

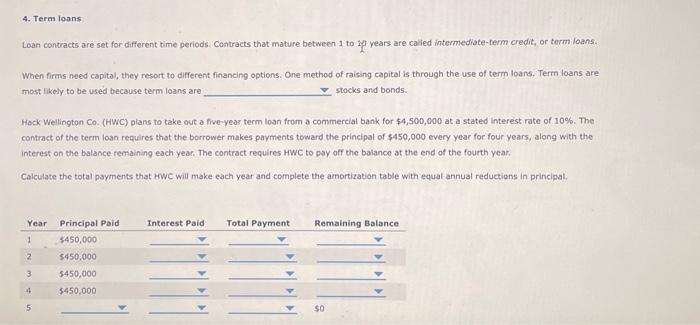

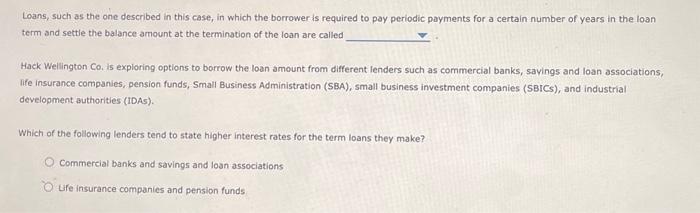

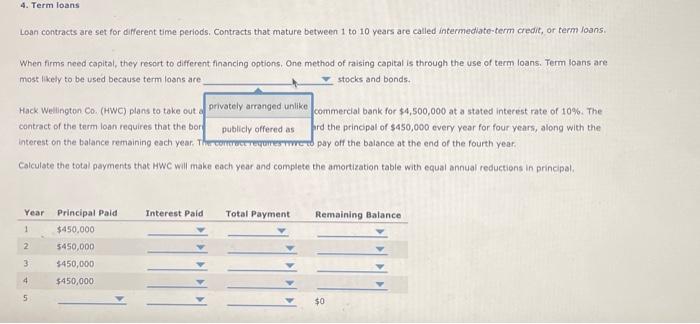

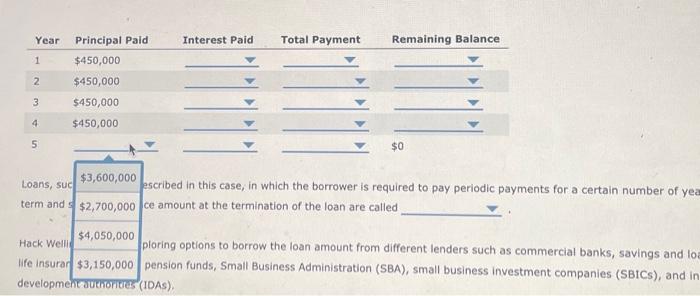

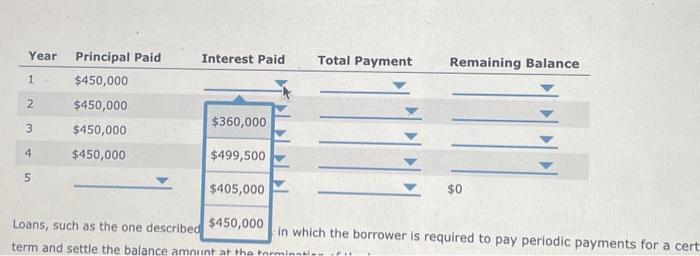

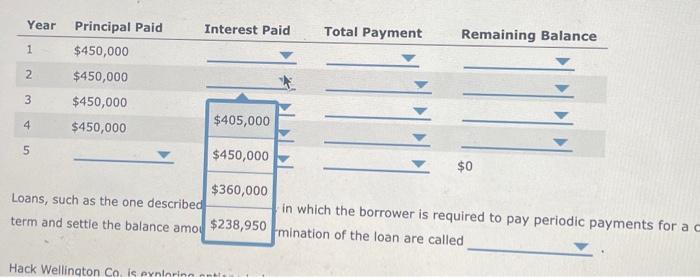

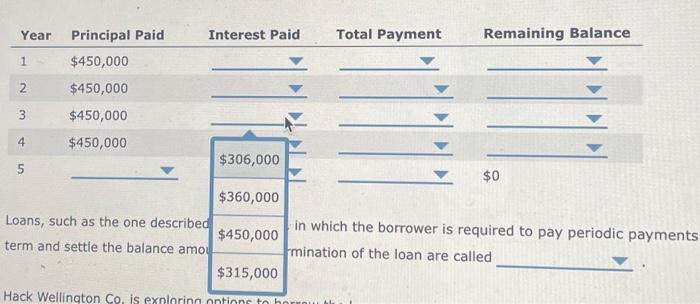

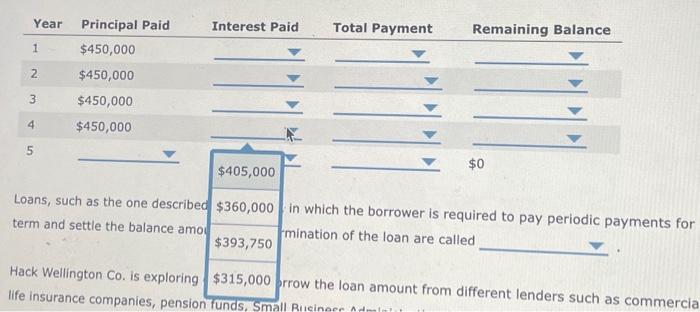

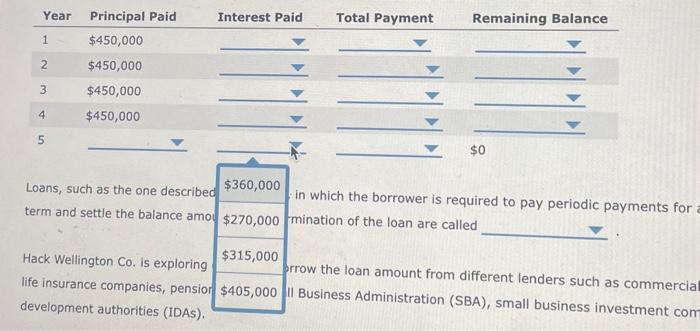

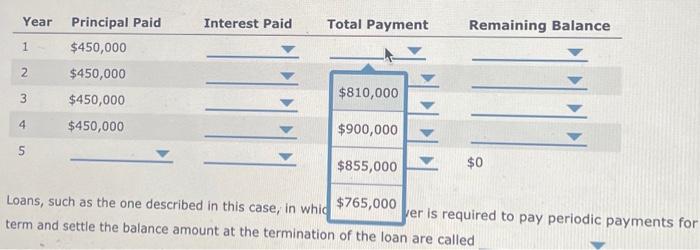

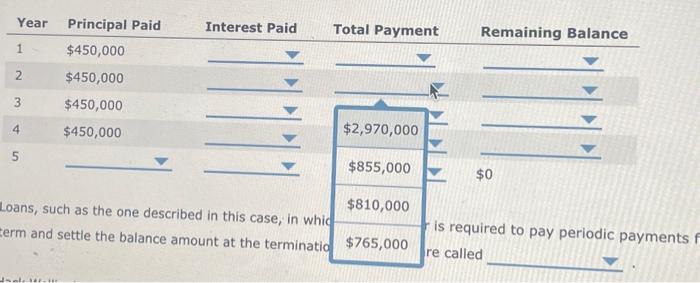

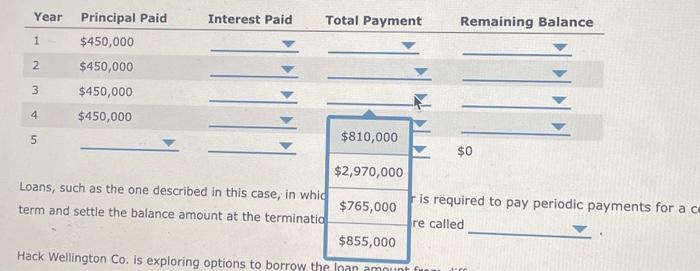

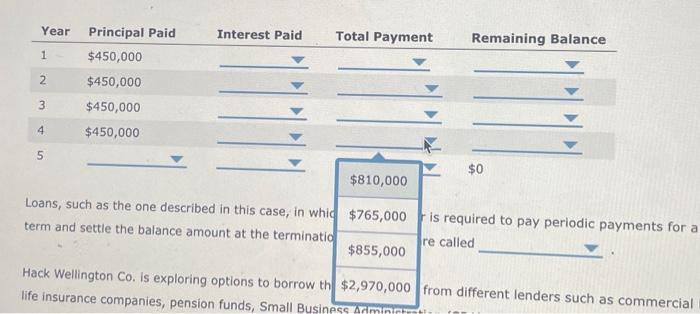

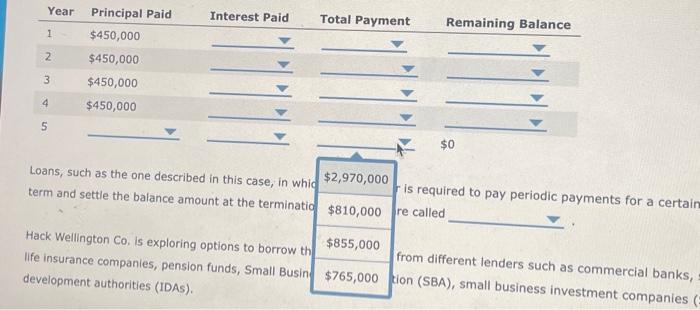

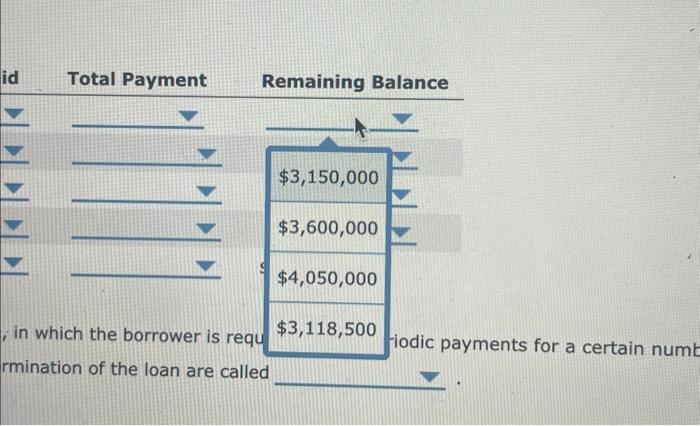

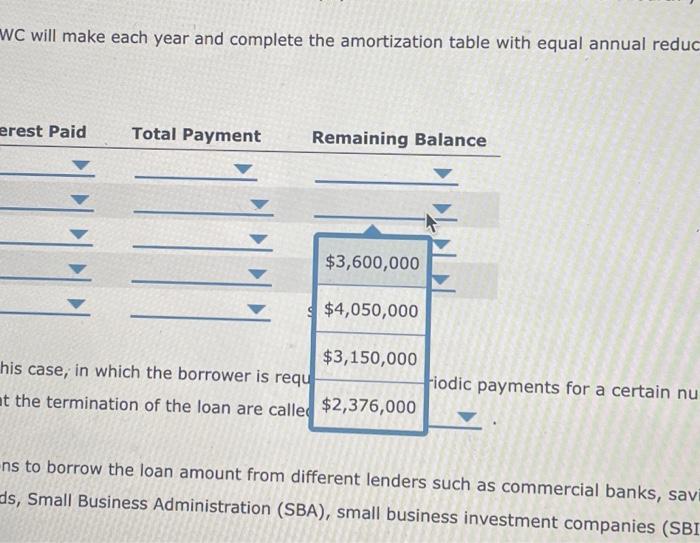

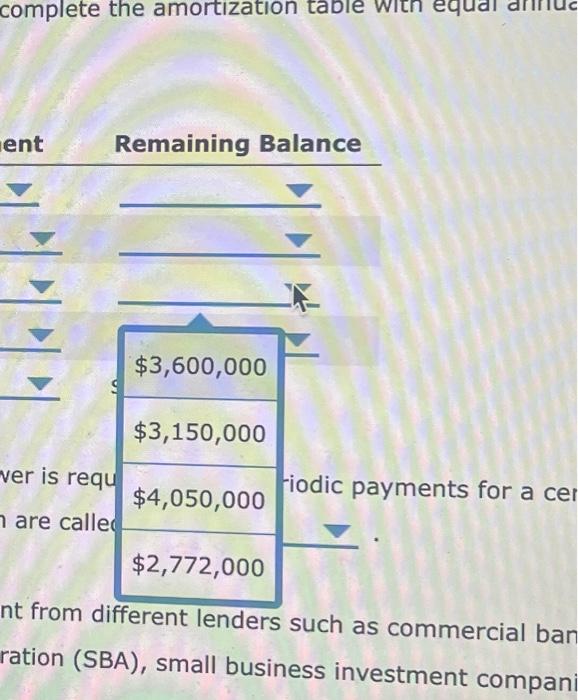

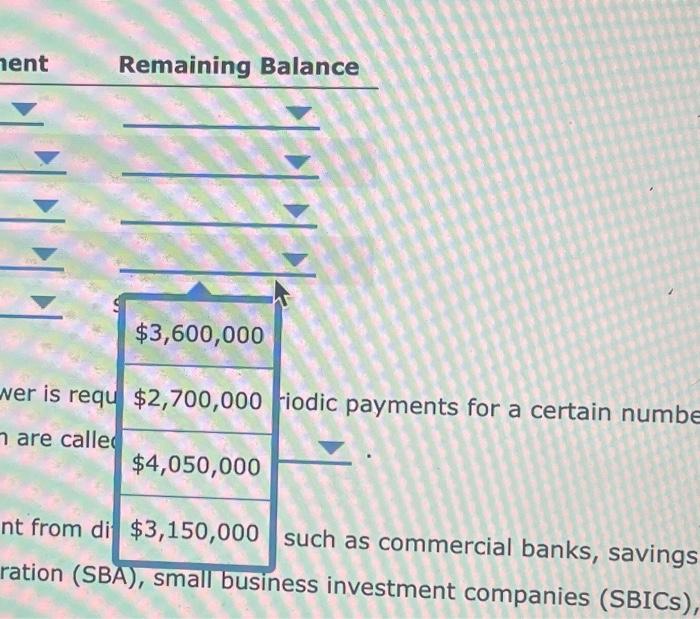

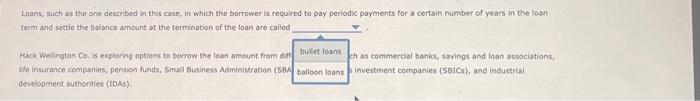

Loan contracts are set for different time periods. Contracts that mature between 1 to ip years are calied intermediate-term credit, or term loans. When firms need capital, they resort to different financing options. One method of raising capital is through the use of term loans. Terrn loans are most likely to be used because term loans are stocks and bonds. Hack Wellington Co. (HWC) plans to take out a five-yeas term loan from a commercial bank for $4,500,000 at a stated interest rate of 10%. The contrack of the term loan requires that the borrower makes payments toward the principal of $450,000 every year for four years, along with the interest on the balance remaining each year. The contract requires HWC to pay off the balance at the end of the fourth year. Calculate the total payments that HWc will make each year and complete the amortization table with equat annual reductions in principal. Loans, such as the one described in this case, in which the borrower is required to pay periodic payments for a certain number of years in the loan term and settle the balance amount at the termination of the loan are called Hack Wellington Co, is exploring options to borrow the loan amount from different lenders such as commercial banks, sayings and loan associations, life insurance companies, pension funds, Small Business Administration (SBA), small business investment companies (SBICs), and industrial development authorities (10As). Which of the following lenders tend to state higher interest rates for the term loans they make? Commercial banks and savings and loan associations Ufe insurance companies and pension funds Loan contracts are set for different time periods. Contracts that mature between 1 to 10 years are called intermedlato-term creqit, or term loans. When firms need copital, they resort to different financing options. One method of raising capital is through the use of term loans. Term loans are mose likely to be used because term losns are stocks and bonds. Hack Wellingten Co. (HWC) plans to take out e commercial bank for $4,500,000 at a stated interest rate of 10%. The contract of the term loan requires that the bor ird the principal of $450,000 every year for four years, along with the interest on the balance remaining each year. T pay off the balance at the end of the fourth year. Calculate the total payments that HWC will make each year and complete the amortization fable with equal annual reductions in principal. Loans, sue $3,600,000 escribed in this case, in which the borrower is required to pay periodic payments for a certain number of y term and s$2,700,000 ce amount at the termination of the loan are called Hack Welli $4,050,000 ploring options to borrow the loan amount from different lenders such as commercial banks, savings and lo life insurar $3,150,000 pension funds, Small Business Administration (SBA), small business investment companies (SBICs), and in developmentsuthortes (IDAs). term and settle the balance amntant at thatron Year12PrincipalPaid$450,000$450,000InterestPaid Loans, such as the one described term and settle the balance amoi in which the borrower is required to pay periodic payments for nination of the loan are called Loans, such as the one describel term and settle the balance amo in which the borrower is required to pay periodic payments for mination of the loan are called Hack Wellington Co. is exploring life insurance companies, pensior rrow the loan amount from different lenders such as commercia development authorities (IDAs). II Business Administration (SBA), small business investment com semu and secte the balance amount at the termination of the loan are called ts for term and settle the balance amount at the terminatio $765,000 re called ts for a Loans, such as the one described in this case, in whi term and settle the balance amount at the terminatii is required to pay periodic payments for a e called Hack Wellington Co. Is exploring options to borrow tr life insurance companies, pension funds, Small Busins Loans, such as the one described in this case, in term and settle the balance amount at the termir equired to pay periodic payments for a certain alled Hack Wellington Co. is exploring options to borroi Ilfe insurance companies, pension funds, Small BC development authorities (IDAs). I different lenders such as commercial banks, (SBA), small business investment companies 'ments for a certain numb WC will make each year and complete the amortization table with equal annual reduc ments for a certain nu ns to borrow the loan amount from different lenders such as commercial banks, sav ds, Small Business Administration (SBA), small business investment companies (SBI Remaining Balance ver is requ iodic payments for a cer are calle nt from different lenders such as commercial ban ration (SBA), small business investment compani rodic payments for a certain numbe are calles such as commercial banks, savings ration (SBA), small business investment companies (SBICs) Loans, such as the one described in this case, in which the borrower as required to pay periodic payments for a certain number of years in the toan teren and settie the balance amount at the termination of the loan are called Hack welington Co. is exploring options ta borrow the loan amount from diff th as commercial banks, savings and loan associations, If insurance companies, pension funds, 5mal Eusiness Administration (SEA i investment companies (SBICs), and industrial development suthonties (IDAs) Loan contracts are set for different time periods. Contracts that mature between 1 to ip years are calied intermediate-term credit, or term loans. When firms need capital, they resort to different financing options. One method of raising capital is through the use of term loans. Terrn loans are most likely to be used because term loans are stocks and bonds. Hack Wellington Co. (HWC) plans to take out a five-yeas term loan from a commercial bank for $4,500,000 at a stated interest rate of 10%. The contrack of the term loan requires that the borrower makes payments toward the principal of $450,000 every year for four years, along with the interest on the balance remaining each year. The contract requires HWC to pay off the balance at the end of the fourth year. Calculate the total payments that HWc will make each year and complete the amortization table with equat annual reductions in principal. Loans, such as the one described in this case, in which the borrower is required to pay periodic payments for a certain number of years in the loan term and settle the balance amount at the termination of the loan are called Hack Wellington Co, is exploring options to borrow the loan amount from different lenders such as commercial banks, sayings and loan associations, life insurance companies, pension funds, Small Business Administration (SBA), small business investment companies (SBICs), and industrial development authorities (10As). Which of the following lenders tend to state higher interest rates for the term loans they make? Commercial banks and savings and loan associations Ufe insurance companies and pension funds Loan contracts are set for different time periods. Contracts that mature between 1 to 10 years are called intermedlato-term creqit, or term loans. When firms need copital, they resort to different financing options. One method of raising capital is through the use of term loans. Term loans are mose likely to be used because term losns are stocks and bonds. Hack Wellingten Co. (HWC) plans to take out e commercial bank for $4,500,000 at a stated interest rate of 10%. The contract of the term loan requires that the bor ird the principal of $450,000 every year for four years, along with the interest on the balance remaining each year. T pay off the balance at the end of the fourth year. Calculate the total payments that HWC will make each year and complete the amortization fable with equal annual reductions in principal. Loans, sue $3,600,000 escribed in this case, in which the borrower is required to pay periodic payments for a certain number of y term and s$2,700,000 ce amount at the termination of the loan are called Hack Welli $4,050,000 ploring options to borrow the loan amount from different lenders such as commercial banks, savings and lo life insurar $3,150,000 pension funds, Small Business Administration (SBA), small business investment companies (SBICs), and in developmentsuthortes (IDAs). term and settle the balance amntant at thatron Year12PrincipalPaid$450,000$450,000InterestPaid Loans, such as the one described term and settle the balance amoi in which the borrower is required to pay periodic payments for nination of the loan are called Loans, such as the one describel term and settle the balance amo in which the borrower is required to pay periodic payments for mination of the loan are called Hack Wellington Co. is exploring life insurance companies, pensior rrow the loan amount from different lenders such as commercia development authorities (IDAs). II Business Administration (SBA), small business investment com semu and secte the balance amount at the termination of the loan are called ts for term and settle the balance amount at the terminatio $765,000 re called ts for a Loans, such as the one described in this case, in whi term and settle the balance amount at the terminatii is required to pay periodic payments for a e called Hack Wellington Co. Is exploring options to borrow tr life insurance companies, pension funds, Small Busins Loans, such as the one described in this case, in term and settle the balance amount at the termir equired to pay periodic payments for a certain alled Hack Wellington Co. is exploring options to borroi Ilfe insurance companies, pension funds, Small BC development authorities (IDAs). I different lenders such as commercial banks, (SBA), small business investment companies 'ments for a certain numb WC will make each year and complete the amortization table with equal annual reduc ments for a certain nu ns to borrow the loan amount from different lenders such as commercial banks, sav ds, Small Business Administration (SBA), small business investment companies (SBI Remaining Balance ver is requ iodic payments for a cer are calle nt from different lenders such as commercial ban ration (SBA), small business investment compani rodic payments for a certain numbe are calles such as commercial banks, savings ration (SBA), small business investment companies (SBICs) Loans, such as the one described in this case, in which the borrower as required to pay periodic payments for a certain number of years in the toan teren and settie the balance amount at the termination of the loan are called Hack welington Co. is exploring options ta borrow the loan amount from diff th as commercial banks, savings and loan associations, If insurance companies, pension funds, 5mal Eusiness Administration (SEA i investment companies (SBICs), and industrial development suthonties (IDAs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts