Question: Hello please dont chatgpt this it is getting it wrong Mason Phillips, age 4 5 , and his wife, Alyssa, live at 2 3 0

Hello please dont chatgpt this it is getting it wrong

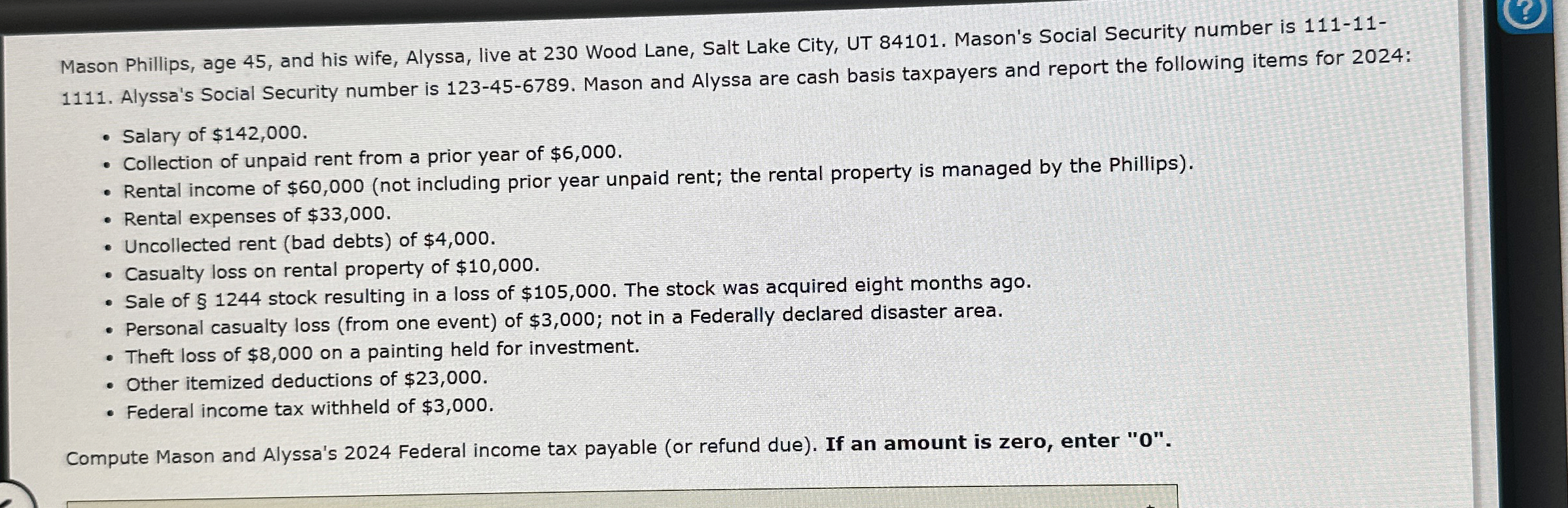

Mason Phillips, age and his wife, Alyssa, live at Wood Lane, Salt Lake City, UT Mason's Social Security number is

Alyssa's Social Security number is Mason and Alyssa are cash basis taxpayers and report the following items for :

Salary of $

Collection of unpaid rent from a prior year of $

Rental income of $not including prior year unpaid rent; the rental property is managed by the Phillips

Rental expenses of $

Uncollected rent bad debts of $

Casualty loss on rental property of $

Sale of stock resulting in a loss of $ The stock was acquired eight months ago.

Personal casualty loss from one event of $; not in a Federally declared disaster area.

Theft loss of $ on a painting held for investment.

Other itemized deductions of $

Federal income tax withheld of $

Compute Mason and Alyssa's Federal income tax payable or refund due If an amount is zero, enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock