Question: hello, please find out how to do it, I've used various methods and I can't find the numbersThe Correct answer is 994,898 but i cant

hello, please find out how to do it, I've used various methods and I can't find the numbersThe Correct answer is 994,898 but i cant find how to do it

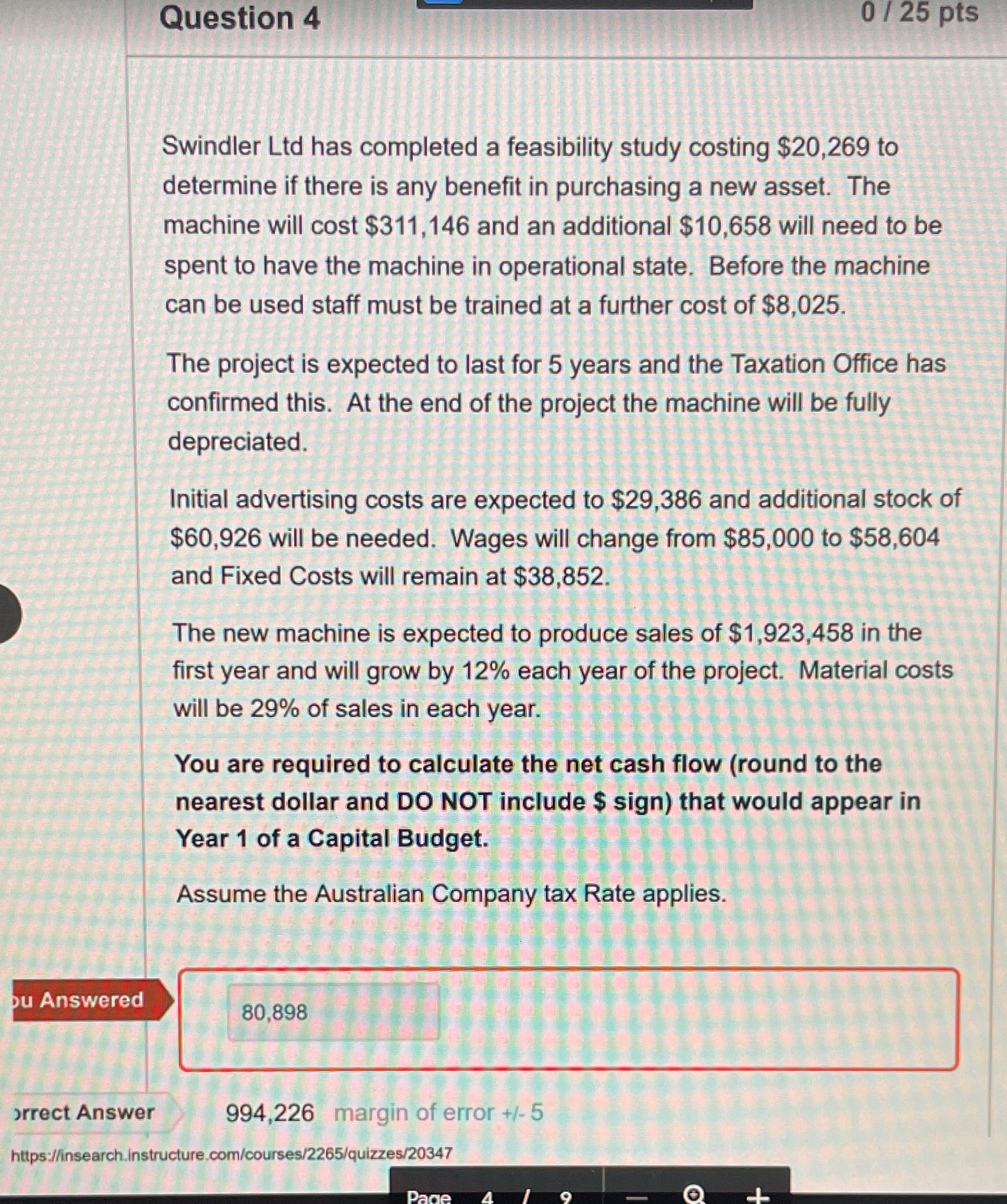

Question 4 0 / 25 pts Swindler Lid has completed a feasibility study costing $20,269 to determine if there is any benefit in purchasing a new asset. The machine will cost $311, 146 and an additional $10,658 will need to be spent to have the machine in operational state. Before the machine can be used staff must be trained at a further cost of $8,025. The project is expected to last for 5 years and the Taxation Office has confirmed this. At the end of the project the machine will be fully depreciated. Initial advertising costs are expected to $29,386 and additional stock of $60,926 will be needed. Wages will change from $85,000 to $58,604 and Fixed Costs will remain at $38,852. The new machine is expected to produce sales of $1,923,458 in the first year and will grow by 12% each year of the project." Material costs will be 29% of sales in each year. You are required to calculate the net cash flow (round to the nearest dollar and DO NOT include $ sign) that would appear in Year 1 of a Capital Budget. Assume the Australian Company tax Rate applies. pu Answered 80,898 prrect Answer 994,226 margin of error +/- 5 https://insearch.instructure.com/courses/2265/quizzes/20347