Question: Hello please hell me answer my questions Your business plan for your proposed start-up firm envisions first-year revenues of $120,000, fixed costs of $61,000, and

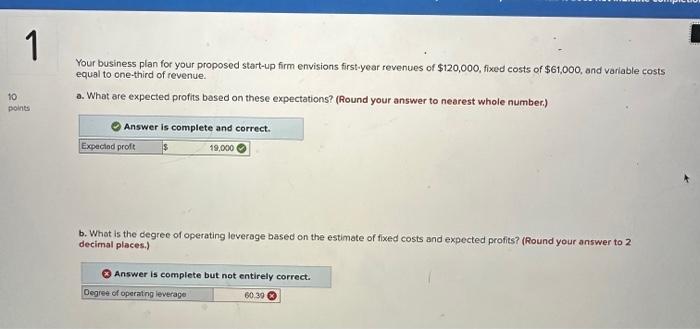

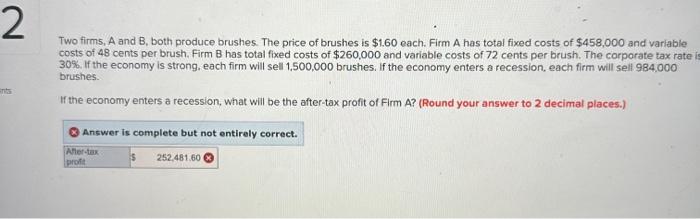

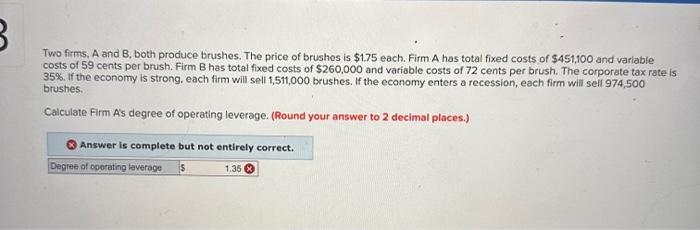

Your business plan for your proposed start-up firm envisions first-year revenues of $120,000, fixed costs of $61,000, and variable costs equal to one-third of revernue. a. What are expected profits based on these expectations? (Round your answer to nearest whole number.) b. What is the degree of operating leverage based on the estimate of fixed costs and expected profits? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Two firm5, A and B, both produce brushes. The price of brushes is $1,60 each. Firm A has total fixed costs of $458,000 and varlable costs of 48 cents per brush. Firm B has total fixed costs of $260,000 and variable costs of 72 cents per brush. The corporate tax rate 30%. If the economy is strong, each firm will sell 1,500,000 brushes. If the economy enters a recession, each firm will sell 984,000 brushes. If the economy enters a recession, what will be the after-tax profit of Firm A? (Round your answer to 2 decimal places.) Two firms, A and B, both produce brushes. The price of brushes is $1.75 each. Firm A has total fixed costs of $451,100 and variable costs of 59 cents per brush. Firm B has total fixed costs of $260,000 and variable costs of 72 cents per brush. The corporate tax rate is 35%. If the economy is strong. each firm will sell 1,511,000 brushes. If the economy enters a recession, each firm will sell 974,500 brushes. Calculate Firm As degree of operating leverage. (Round your answer to 2 decimal places.) Your business plan for your proposed start-up firm envisions first-year revenues of $120,000, fixed costs of $61,000, and variable costs equal to one-third of revernue. a. What are expected profits based on these expectations? (Round your answer to nearest whole number.) b. What is the degree of operating leverage based on the estimate of fixed costs and expected profits? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Two firm5, A and B, both produce brushes. The price of brushes is $1,60 each. Firm A has total fixed costs of $458,000 and varlable costs of 48 cents per brush. Firm B has total fixed costs of $260,000 and variable costs of 72 cents per brush. The corporate tax rate 30%. If the economy is strong, each firm will sell 1,500,000 brushes. If the economy enters a recession, each firm will sell 984,000 brushes. If the economy enters a recession, what will be the after-tax profit of Firm A? (Round your answer to 2 decimal places.) Two firms, A and B, both produce brushes. The price of brushes is $1.75 each. Firm A has total fixed costs of $451,100 and variable costs of 59 cents per brush. Firm B has total fixed costs of $260,000 and variable costs of 72 cents per brush. The corporate tax rate is 35%. If the economy is strong. each firm will sell 1,511,000 brushes. If the economy enters a recession, each firm will sell 974,500 brushes. Calculate Firm As degree of operating leverage. (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts