Question: Hello Please Help me answer this Question. Thanks! Problem 1 You have the following projects available: Note: For simplicity, we measure payback period in full

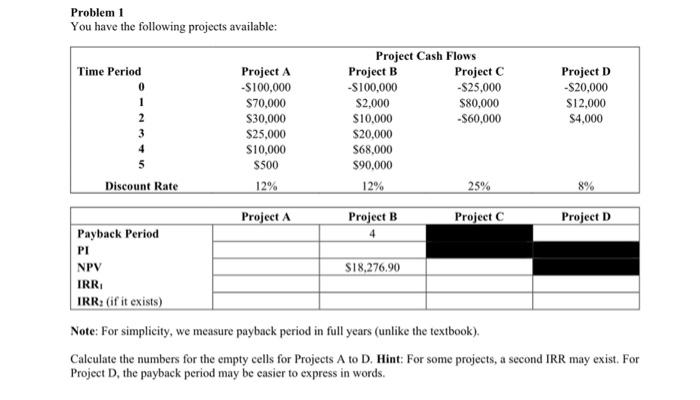

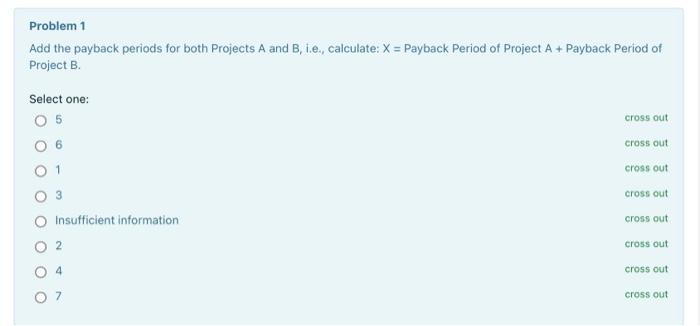

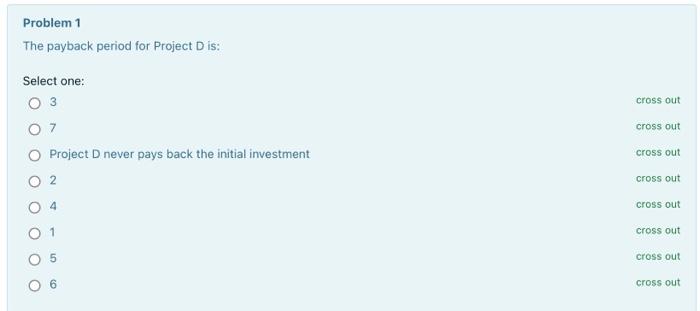

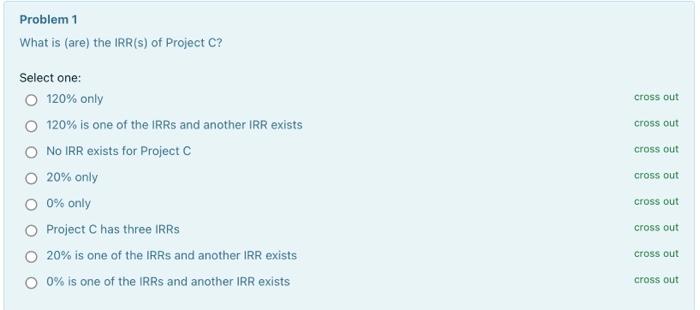

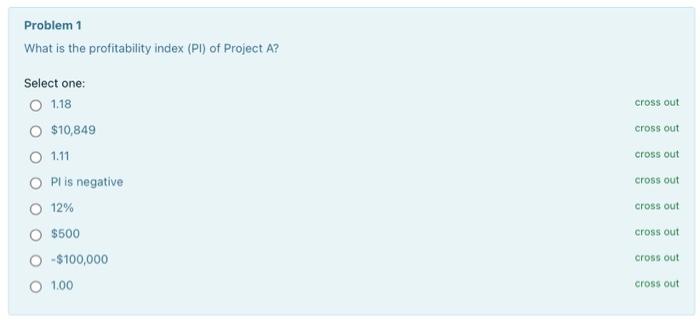

Problem 1 You have the following projects available: Note: For simplicity, we measure payback period in full years (unlike the textbook). Calculate the numbers for the empty cells for Projects A to D. Hint: For some projects, a second IRR may exist. For Project D, the payback period may be easier to express in words. Add the payback periods for both Projects A and B, i.e., calculate: X= Payback Period of Project A+ Payback Period of Project B. Select one: 5 cross out 6 cross out 1 cross out 3 cross out Insufficient information cross out 2 cross out 4 cross out 7 cross out Problem 1 The payback period for Project D is: Select one: 3 7 Project D never pays back the initial investment 2 4 1 5 6 Problem 1 What is (are) the IRR(s) of Project C? Select one: 120% only cross out 120% is one of the IRRs and another IRR exists cross out No IRR exists for Project C cross out 20% only cross out 0% only cross out Project C has three IRRs cross out 20% is one of the IRRs and another IRR exists cross out 0% is one of the IRRs and another IRR exists cross out Problem 1 What is the IRR of Project B? Select one: 19.03% 4.67% IRR doesn't exist 12.00% 100.00% IRR is negative Project B has multiple IRRs 16.67% Problem 1 What is the NPV of Project C? Select one: $5,000$600$27,437$25,000$55,000$100TheNPVcannotbecalculatedbecausethelastcashoutflowisnegative$0crossoutcrossoutcrossoutcrossoutcrossoutcrossoutcrosscrossout What is the profitability index (PI) of Project A? Select one: 1,18 $10,849 1.11 PI is negative 12% $500 $100,000 1.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts