Question: hello! Please help me pick the right answer for questions A to E, only one answer on each is correct. also, motivate your answer in

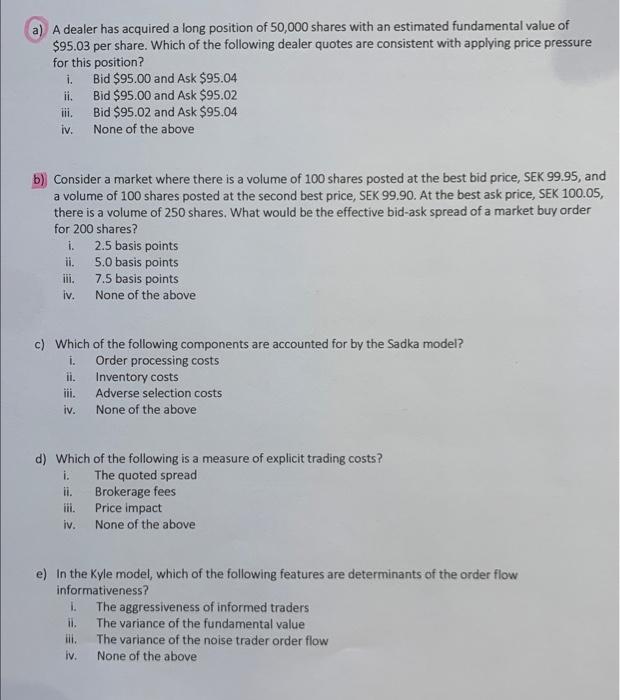

a) A dealer has acquired a long position of 50,000 shares with an estimated fundamental value of $95.03 per share. Which of the following dealer quotes are consistent with applying price pressure for this position? i. Bid $95.00 and Ask $95.04 ii. Bid $95.00 and Ask $95.02 iii. Bid $95.02 and Ask $95.04 iv. None of the above b) Consider a market where there is a volume of 100 shares posted at the best bid price, SEK 99.95, and a volume of 100 shares posted at the second best price, SEK 99.90. At the best ask price, SEK 100.05, there is a volume of 250 shares. What would be the effective bid-ask spread of a market buy order for 200 shares? i. 2.5 basis points ii. 5.0 basis points iii. 7.5 basis points iv. None of the above c) Which of the following components are accounted for by the Sadka model? i. Order processing costs ii. Inventory costs iii. Adverse selection costs iv. None of the above d) Which of the following is a measure of explicit trading costs? i. The quoted spread ii. Brokerage fees iii. Price impact iv. None of the above e) In the Kyle model, which of the following features are determinants of the order flow informativeness? i. The aggressiveness of informed traders ii. The variance of the fundamental value iii. The variance of the noise trader order flow iv. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts