Question: hello please help me, this is my second time doing this question. I got the first one wrong, please explain it. But here are my

hello please help me, this is my second time doing this question. I got the first one wrong, please explain it. But here are my answers.

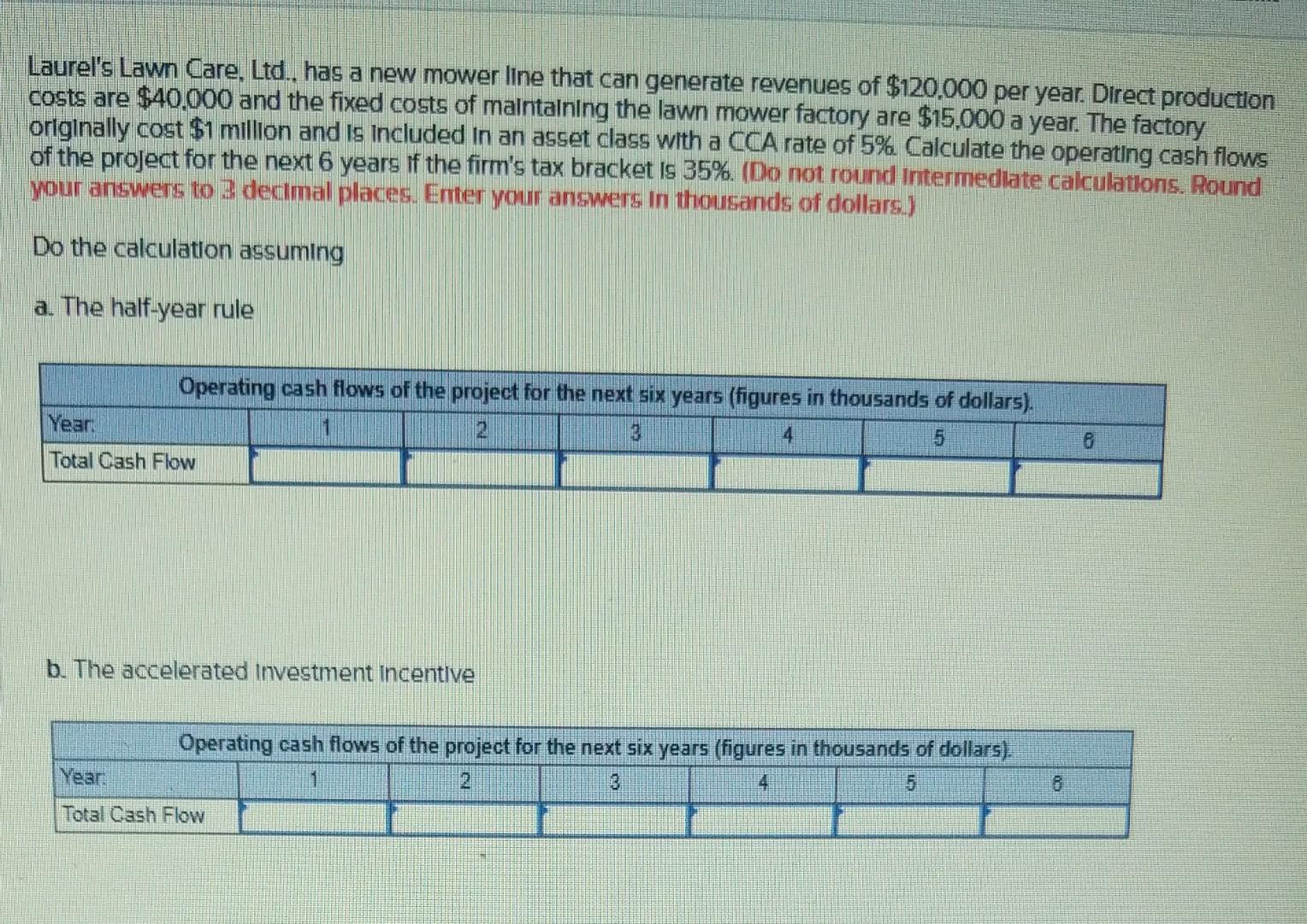

a. 12000 12900 9050 8736 10500 30600 b. 80020 12700 87000 13000 14000 20000

Laurel's Lawn Care, Ltd., has a new mower line that can generate revenues of $120,000 per year. Direct productlon costs are $40.000 and the fixed costs of maintaining the lawn mower factory are $15,000 a year. The factory originally cost $1 million and is included in an asset class with a CCA rate of 5% Calculate the operating cash flows of the project for the next 6 years if the firm's tax bracket is 35%. (Do not round Intermedlate calculatlons. Round your answers to 3 decimal places. Enter yourr answers in thousands of dollars.) Do the calculation assuming a. The half-year rule b. The accelerated investment incentive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts