Question: Hello please help me to answer this please thank you 1. Philippine Turtle, Inc., is a domestic corporation engaged in the transport of passengers to

Hello please help me to answer this please thank you

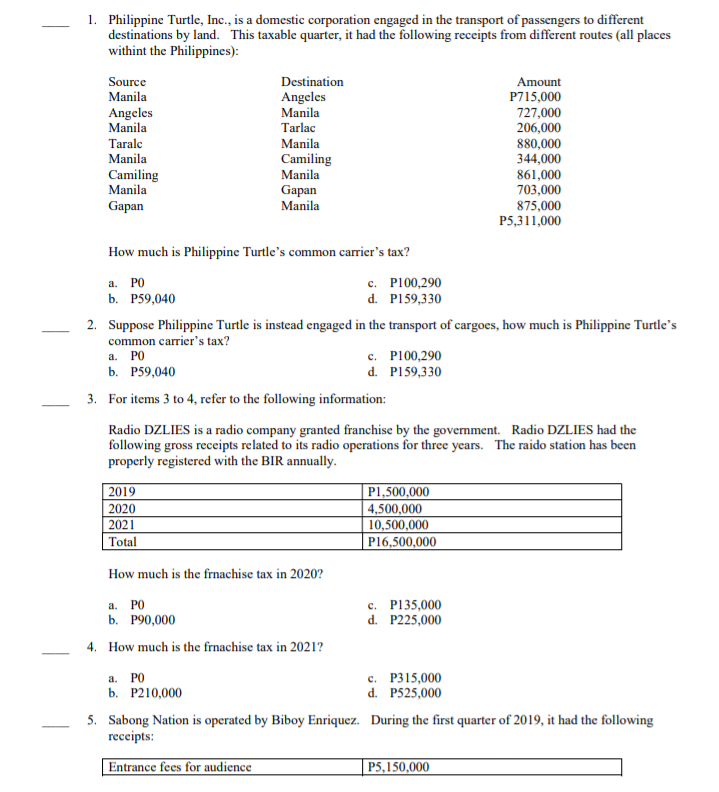

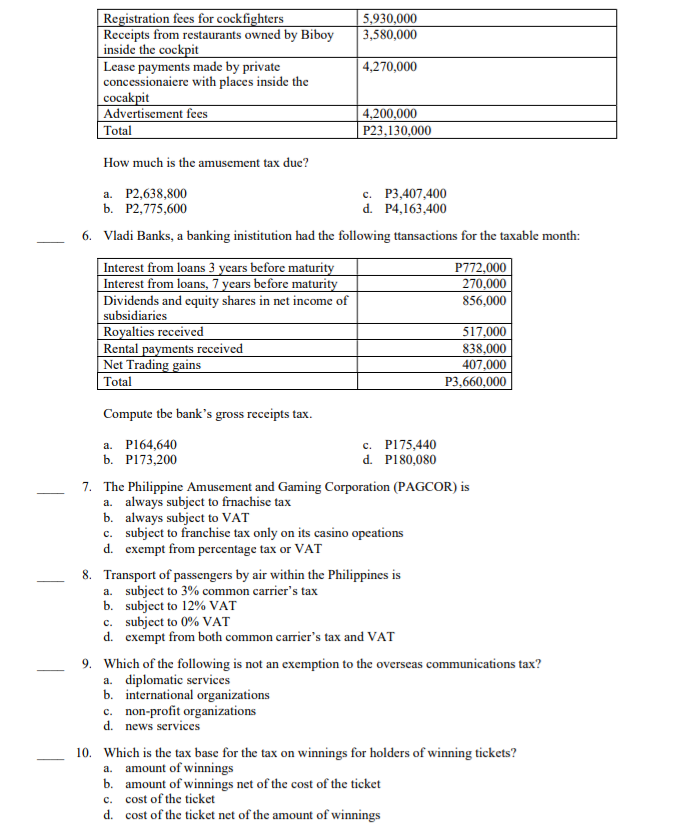

1. Philippine Turtle, Inc., is a domestic corporation engaged in the transport of passengers to different destinations by land. This taxable quarter, it had the following receipts from different routes (all places withint the Philippines): Source Destination Amount Manila Angeles P715,000 Angeles Manila 727,000 Manila Tarlac 206,000 Taralc Manila 880,000 Manila Camiling 344,000 Camiling Manila 861,000 Manila Gapan 703,000 Gapan Manila 875,000 P5,311,000 How much is Philippine Turtle's common carrier's tax? a. PO c. P100,290 b. P59,040 d. P159,330 2. Suppose Philippine Turtle is instead engaged in the transport of cargoes, how much is Philippine Turtle's common carrier's tax? a. PO C. P100,290 b. P59,040 d. P159,330 3. For items 3 to 4, refer to the following information: Radio DZLIES is a radio company granted franchise by the government. Radio DZLIES had the following gross receipts related to its radio operations for three years. The raido station has been properly registered with the BIR annually. 2019 P1,500,000 2020 4,500,000 2021 10,500,000 Total P16,500,000 How much is the frnachise tax in 2020? a. PO c. P135,000 b. P90,000 d. P225,000 How much is the frnachise tax in 2021? PO c. P315,000 b. P210,000 d. P525,000 5. Sabong Nation is operated by Biboy Enriquez. During the first quarter of 2019, it had the following receipts: Entrance fees for audience P5,150,000Registration fees for cockfighters 5,930,000 Receipts from restaurants owned by Biboy 3,580,000 inside the cockpit Lease payments made by private 4,270,000 concessionaire with places inside the cocakpit Advertisement fees 4,200,000 Total P23,130,000 How much is the amusement tax due? a. P2,638,800 C. P3,407,400 b. P2,775,600 d. P4,163,400 6. Vladi Banks, a banking inistitution had the following transactions for the taxable month: Interest from loans 3 years before maturity P772,000 Interest from loans, 7 years before maturity 270,000 Dividends and equity shares in net income of 856,000 subsidiaries Royalties received 517,000 Rental payments received 838.000 Net Trading gains 407,000 Tota P3.660,000 Compute the bank's gross receipts tax. a. P164,640 C. P175,440 b. P173,200 d. P180,080 7. The Philippine Amusement and Gaming Corporation (PAGCOR) is a. always subject to frnachise tax b. always subject to VAT C. subject to franchise tax only on its casino opcations d. exempt from percentage tax or VAT 8. Transport of passengers by air within the Philippines is a. subject to 3% common carrier's tax b. subject to 12% VAT c. subject to 0% VAT d. exempt from both common carrier's tax and VAT 9. Which of the following is not an exemption to the overseas communications tax? a. diplomatic services b. international organizations C. non-profit organizations d. news services 10. Which is the tax base for the tax on winnings for holders of winning tickets? a. amount of winnings amount of winnings net of the cost of the ticket C. cost of the ticket d. cost of the ticket net of the amount of winnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts