Question: Hello, Please help me to solve it. Do not post other Chegg solution of this question. I am posting model which I received to do

Hello, Please help me to solve it. Do not post other Chegg solution of this question. I am posting model which I received to do this question. Follow the method given in image. No other things. Image is just a model or like hint how to solve. If u do not anything stay away. Dont comment un-necessary.

Sam wants to start a small commercial bakery to supply gourmet deserts to local restaurants. He believes that with his product line and his connections in the restaurant business, he can grow the business over the next five years into a profitable niche player in the pre-made food supply business. Sam projects the following cash flows (after any necessary reinvestment in the business): Year 1 $200,000 Year 2 $500,000 Year 3 $8000,000 Year 4 $1,050,000 Year 5 $1,250,000 Sam thinks the increase in profits will peak in about year six at $1.5 million, and that after that, they will grow at about 6% per year. Sam is going to put up half the money and an investor associate is putting up the other half. This investor puts money into a lot of early stage companies, and he usually expects to make about 40% return. Sam figures that once the business matures, he and the investor should only expect to make about 15% on the business, as that is similar to what some small publicly traded commercial bakeries make. Using discounted cash flows (including the terminal value), what is the net present value of Sams business?

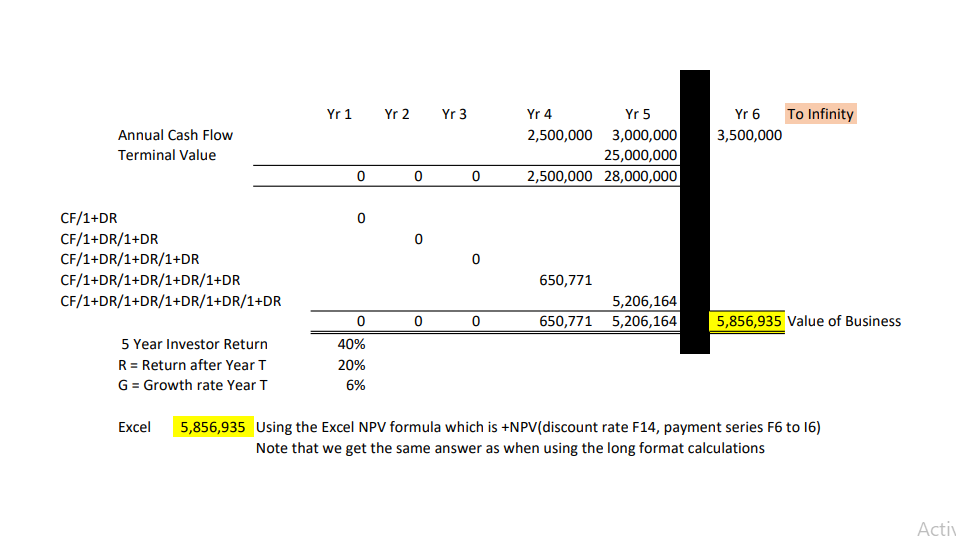

Yr 1 Yr 2 Yr 3 To Infinity Yr 6 3,500,000 Annual Cash Flow Terminal Value Yr 4 Yr 5 2,500,000 3,000,000 25,000,000 2,500,000 28,000,000 0 0 0 0 CF/1+DR CF/1+DR/1+DR CF/1+DR/1+DR/1+DR CF/1+DR/1+DR/1+DR/1+DR CF/1+DR/1+DR/1+DR/1+DR/1+DR 650,771 5,206,164 650,771 5,206,164 0 0 5,856,935 Value of Business 5 Year Investor Return R = Return after Year T G = Growth rate Year T 0 40% 20% 6% Excel 5,856,935 Using the Excel NPV formula which is +NPV(discount rate F14, payment series F6 to 16) Note that we get the same answer as when using the long format calculations Asti Yr 1 Yr 2 Yr 3 To Infinity Yr 6 3,500,000 Annual Cash Flow Terminal Value Yr 4 Yr 5 2,500,000 3,000,000 25,000,000 2,500,000 28,000,000 0 0 0 0 CF/1+DR CF/1+DR/1+DR CF/1+DR/1+DR/1+DR CF/1+DR/1+DR/1+DR/1+DR CF/1+DR/1+DR/1+DR/1+DR/1+DR 650,771 5,206,164 650,771 5,206,164 0 0 5,856,935 Value of Business 5 Year Investor Return R = Return after Year T G = Growth rate Year T 0 40% 20% 6% Excel 5,856,935 Using the Excel NPV formula which is +NPV(discount rate F14, payment series F6 to 16) Note that we get the same answer as when using the long format calculations Asti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts