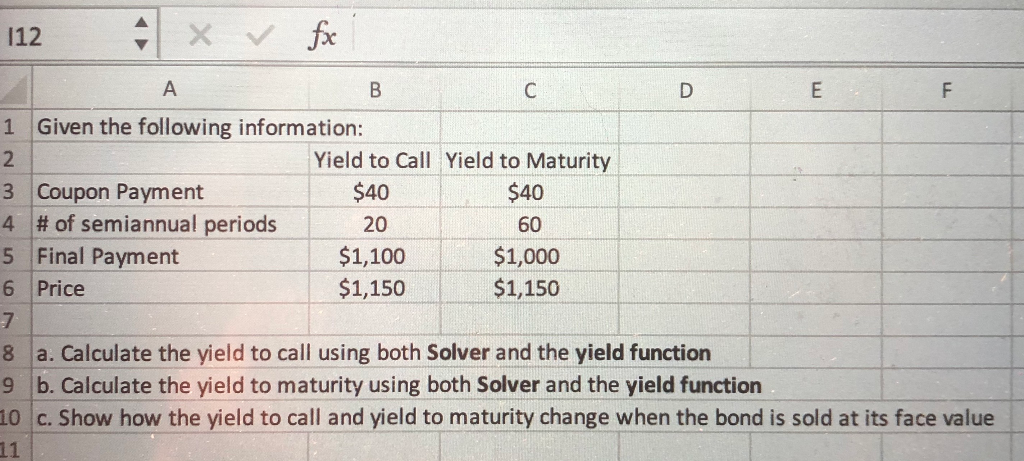

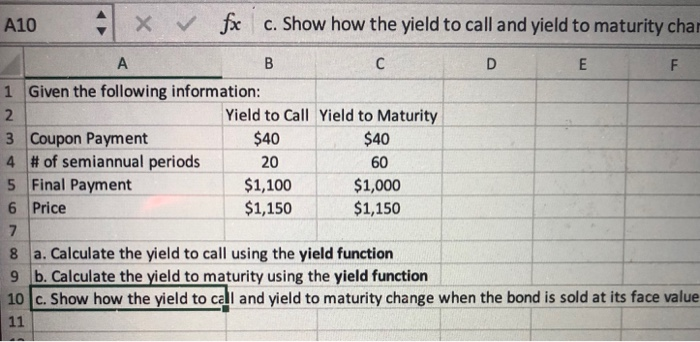

Question: Hello, please help me to solve this question: Given the following information: Yield to Call: coupon payment = $40, 20 semiannual periods, final payment =

112 + x fx 1 Given the following information: Yield to Call Yield to Maturity 3 Coupon Payment $40 $40 4 # of semiannual periods 20 60 5 Final Payment $1,100 $1,000 6 Price $1,150 $1,150 8 a. Calculate the yield to call using both Solver and the yield function 9 b. Calculate the yield to maturity using both Solver and the yield function 10 c. Show how the yield to call and yield to maturity change when the bond is sold at its face value A10 fx c. Show how the yield to call and yield to maturity char AB DE F 1 Given the following information: Yield to Call Yield to Maturity 3 Coupon Payment 4 # of semiannual periods 20 60 5 Final Payment $1,100 $1,000 6 Price $1,150 $1,150 $40 $40 7 8 a. Calculate the yield to call using the yield function 9 b. Calculate the yield to maturity using the yield function 10 c. Show how the yield to call and yield to maturity change when the bond is sold at its face value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts