Question: Hello, please help me with both I will appreciate it. I don't have any more options. 1) CAPM, PORTFOLIO RISK, AND RETURN Consider the following

Hello, please help me with both I will appreciate it. I don't have any more options.

1)

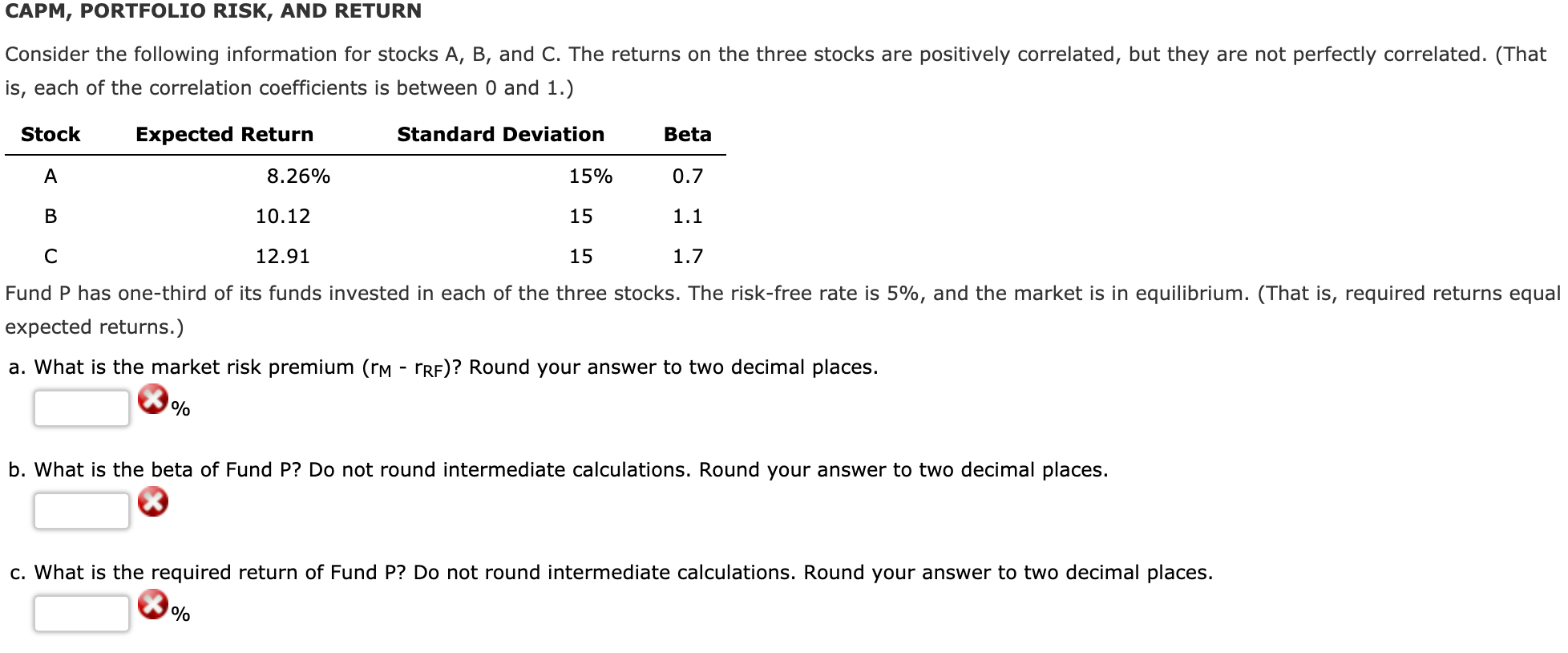

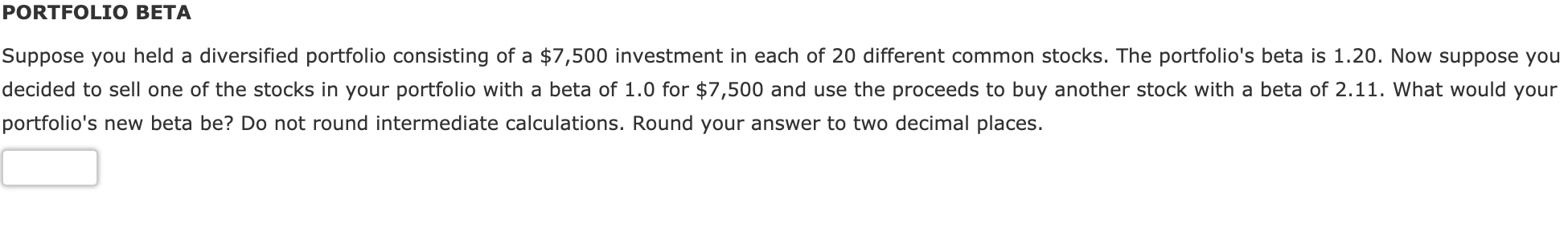

CAPM, PORTFOLIO RISK, AND RETURN Consider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation Beta A 8.26% 15% 0.7 B 10.12 15 1.1 C 12.91 15 1.7 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium. (That is, required returns equal expected returns.) a. What is the market risk premium (rM - PRF)? Round your answer to two decimal places. % b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. c. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. % PORTFOLIO BETA Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio's beta is 1.20. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 2.11. What would your portfolio's new beta be? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts