Question: hello! please help me with questions 1-5. we're dealing with piecewise tax functions and finding a slope with graphs. thanks in advance! Individual Taxpayers If

hello! please help me with questions 1-5. we're dealing with piecewise tax functions and finding a slope with graphs. thanks in advance!

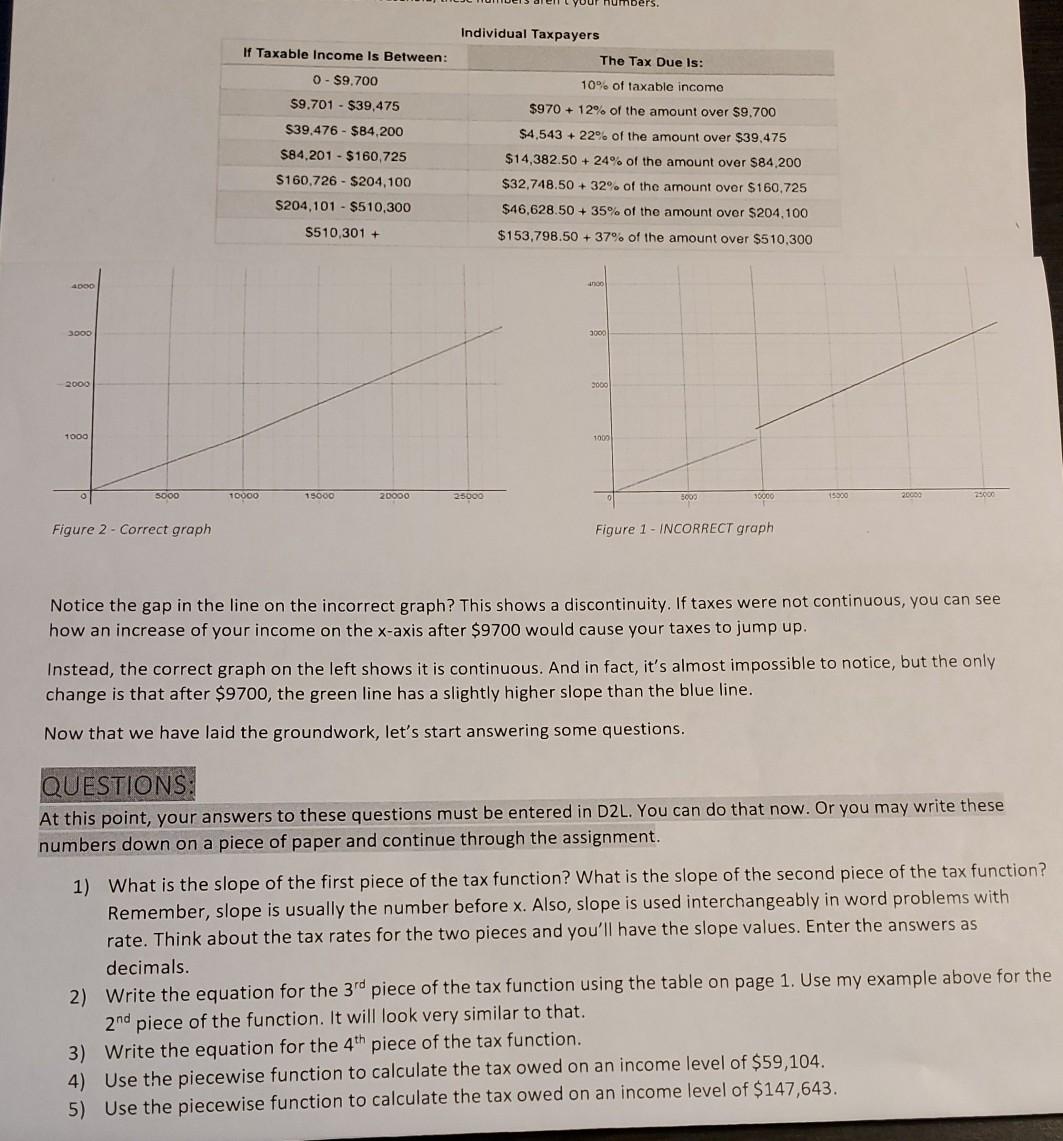

Individual Taxpayers If Taxable Income Is Between: The Tax Due ls: 10% of taxable incomo 0 - $9.700 $9.701 - $39,475 $39,476 - $84.200 $84.201 - $160,725 S160.726 - $204,100 $970 + 12% of the amount over $9.700 $4,543 +22% of the amount over $39.475 $14,382.50 +24% of the amount over $84.200 $32.748.50 +32% of the amount over $160.725 $46,628.50 + 35% of the amount over $204,100 S204,101 - $510,300 S510,301 + $153,798.50 +37% of the amount over $510,300 apod ned JOOD 3000 2000 3000 1000 1002 SOOO 10000 19000 20000 25000 30000 13500 2006 2000 Figure 2 - Correct graph Figure 1 - INCORRECT graph Notice the gap in the line on the incorrect graph? This shows a discontinuity. If taxes were not continuous, you can see how an increase of your income on the x-axis after $9700 would cause your taxes to jump up. Instead, the correct graph on the left shows it is continuous. And in fact, it's almost impossible to notice, but the only change is that after $9700, the green line has a slightly higher slope than the blue line. Now that we have laid the groundwork, let's start answering some questions. QUESTIONS: At this point, your answers to these questions must be entered in D2L. You can do that now. Or you may write these numbers down on a piece of paper and continue through the assignment. 1) What is the slope of the first piece of the tax function? What is the slope of the second piece of the tax function? Remember, slope is usually the number before x. Also, slope is used interchangeably in word problems with rate. Think about the tax rates for the two pieces and you'll have the slope values. Enter the answers as decimals. 2) Write the equation for the 3rd piece of the tax function using the table on page 1. Use my example above for the 2nd piece of the function. It will look very similar to that. 3) Write the equation for the 4th piece of the tax function. 4) Use the piecewise function to calculate the tax owed on an income level of $59,104. 5) Use the piecewise function to calculate the tax owed on an income level of $147,643

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts