Question: Hello, please help with this homework assignment. Thank you in advance. An investor wants to invest $300,000 in a portfolio of three mutual funds. The

Hello, please help with this homework assignment. Thank you in advance.

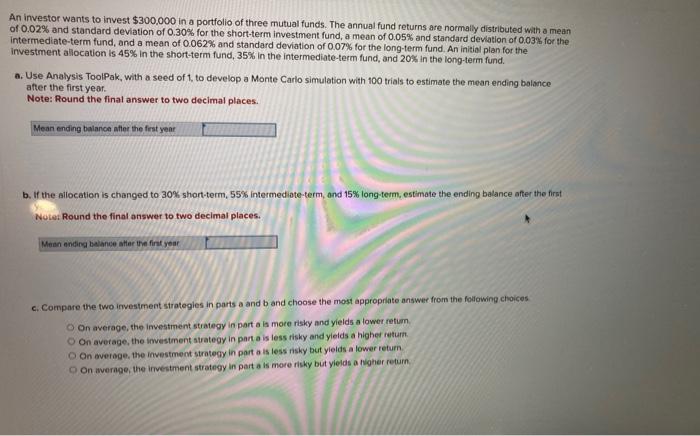

An investor wants to invest $300,000 in a portfolio of three mutual funds. The annual fund returns are normally distributed wath a mean 0.02% and standard deviation of 0.30% for the short-term investment fund, a mean of 0.05% and standard devation of 0.03% for the intermediate-term fund, and a mean of 0.062% and standard deviation of 0.07% for the long-term fund. An initial plan for the investment allocation is 45% in the short-term fund, 35% in the intermediate-term fund, and 20% in the lang-term fund. a. Use Analysis ToolPak, with a seed of 1, to develop a Monte Carlo simulation with 100 trials to estimate the mean ending balance after the first year. Note: Round the final answer to two decimal places. b. If the allocation is changed to 30% short-term, 55% intermediate-term, and 15% long-term, estimate the ending balance after the first Note: Round the final answer to two decimal places. c. Compare the two irvestment strategies in parts a and b and choose the most appropriate answer from the following choices On average, the investment strategy in part a is moce risky and yields a lower retian. On average, the imvestment strategy in part a is less risky and yields a highed return. On everoge. the investment stratecy in part a is less risky but yleids a lower return. On werage, the investment strategy in part a is more risky but ylelds a figher return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock