Question: Hello, please help with this one question, please. I am missing the value of the land. Thank you. Ramona and Hermione formed Wiley Corporation on

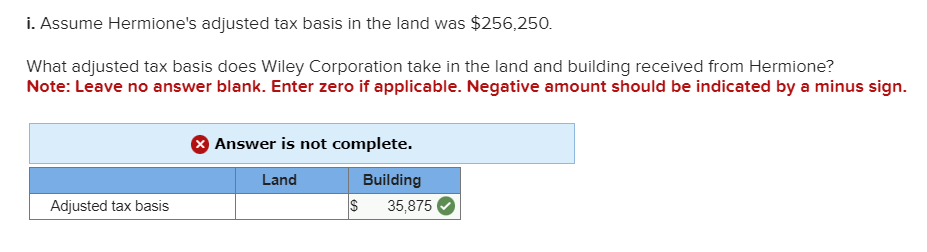

Hello, please help with this one question, please. I am missing the value of the land. Thank you.

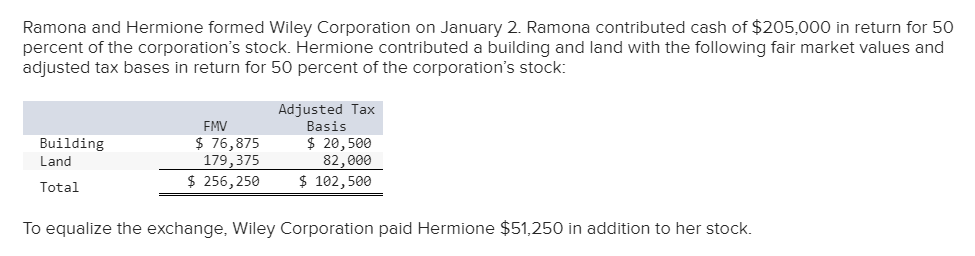

Ramona and Hermione formed Wiley Corporation on January 2. Ramona contributed cash of $205,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: To equalize the exchange, Wiley Corporation paid Hermione $51,250 in addition to her stock. i. Assume Hermione's adjusted tax basis in the land was $256,250. What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts