Question: hello! Please I need details of this problem Expert Q&A XYZ company is considering a new project. The project involves introducing a new product and

hello! Please I need details of this problem

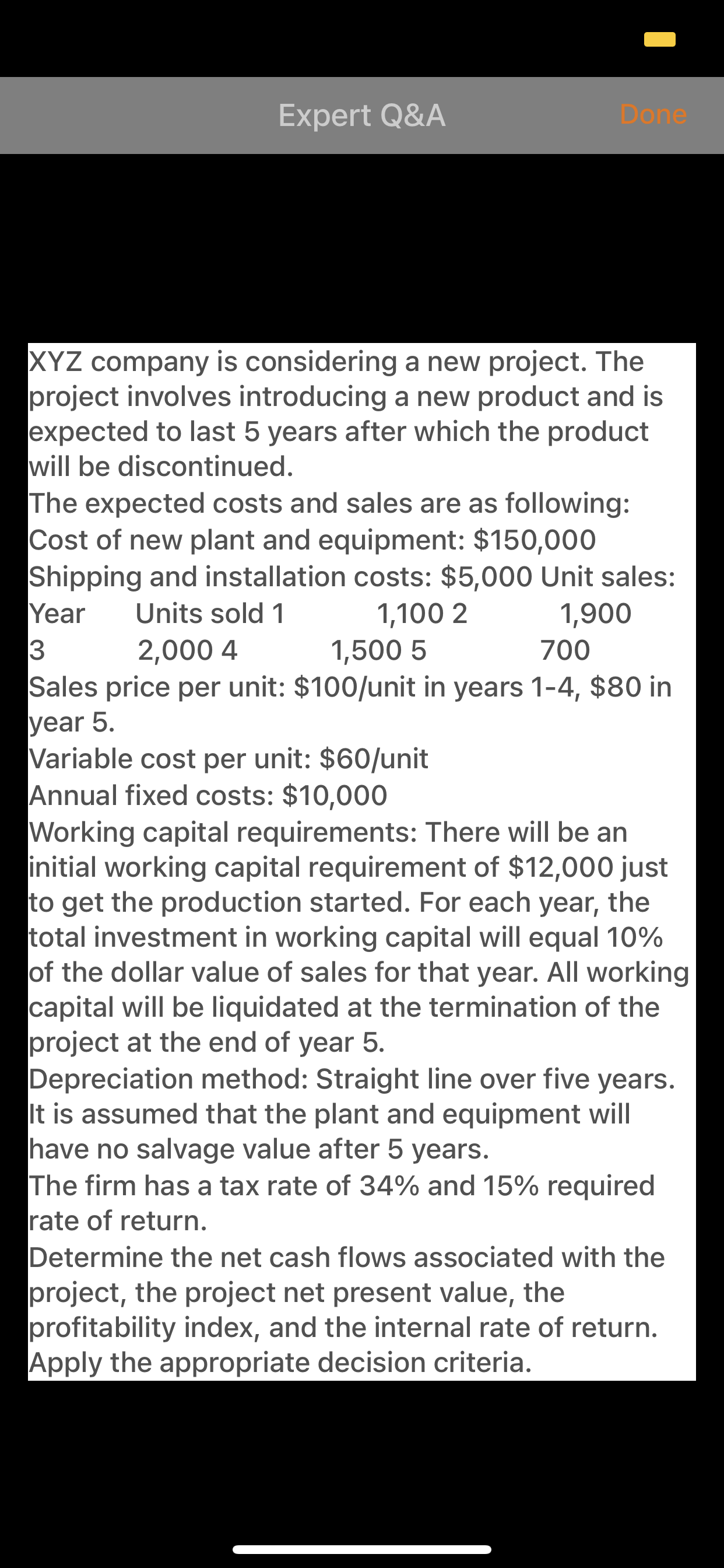

Expert Q&A XYZ company is considering a new project. The project involves introducing a new product and is expected to last 5 years after which the product will be discontinued. The expected costs and sales are as following: Cost of new plant and equipment: $150,000 Shipping and installation costs: $5,000 Unit sales: Year Units sold 1 1,100 2 1,900 3 2,000 4 1,500 5 700 Sales price per unit: $100/unit in years 14, $80 in year 5. Variable cost per unit: $60/unit Annual fixed costs: $10,000 Working capital requirements: There will be an initial working capital requirement of $12,000 just to get the production started. For each year, the total investment in working capital will equal 10% of the dollar value of sales for that year. All working capital will be liquidated at the termination of the project at the end of year 5. Depreciation method: Straight line over five years. It is assumed that the plant and equipment will have no salvage value after 5 years. The firm has a tax rate of 34% and 15% required rate of return. Determine the net cash flows associated with the project, the project net present value, the profitability index, and the internal rate of return. Apply the appropriate decision criteria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts