Question: HELLO, Please I need help with these questions. Can you please so working so I can do this on my own. I get confused to

HELLO, Please I need help with these questions. Can you please so working so I can do this on my own. I get confused to know either to do a negative when writing them down.

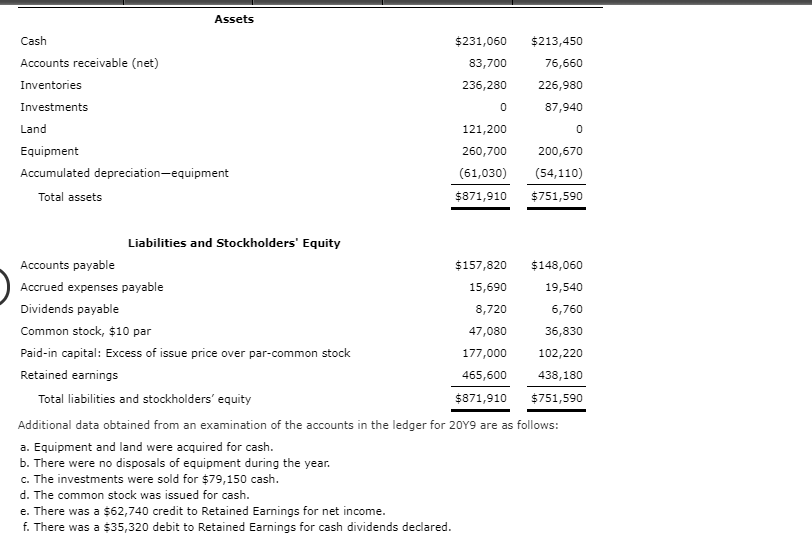

#1 The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows:

_____________________________________________________________________________________________________________________________________________________

#2

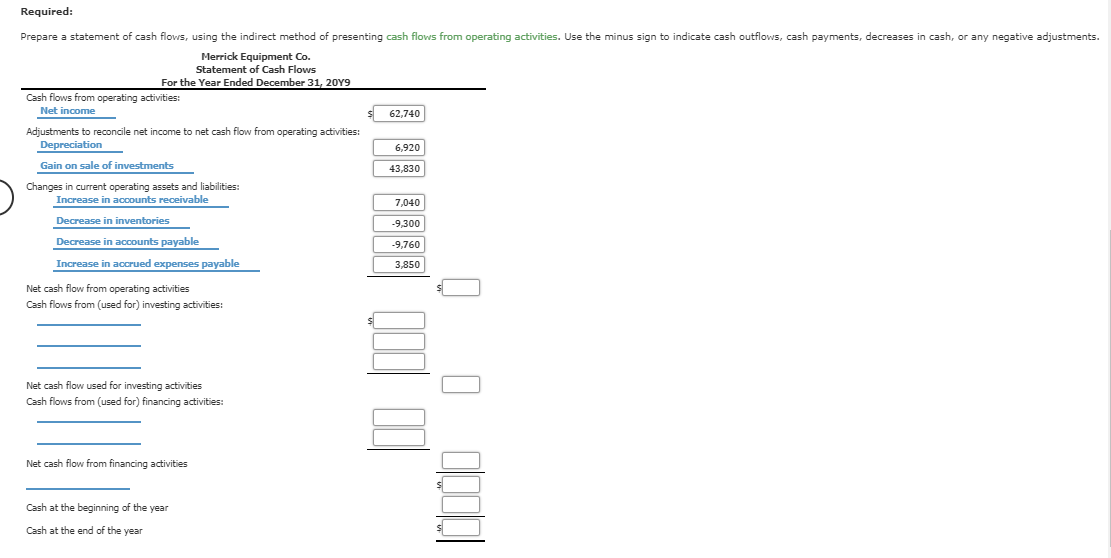

Statement of Cash FlowsIndirect Method

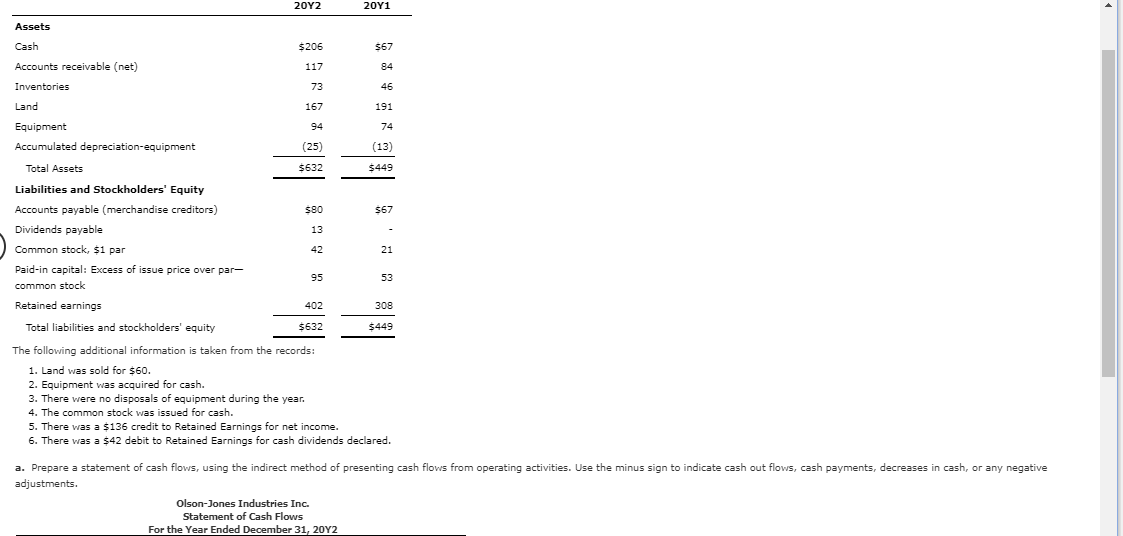

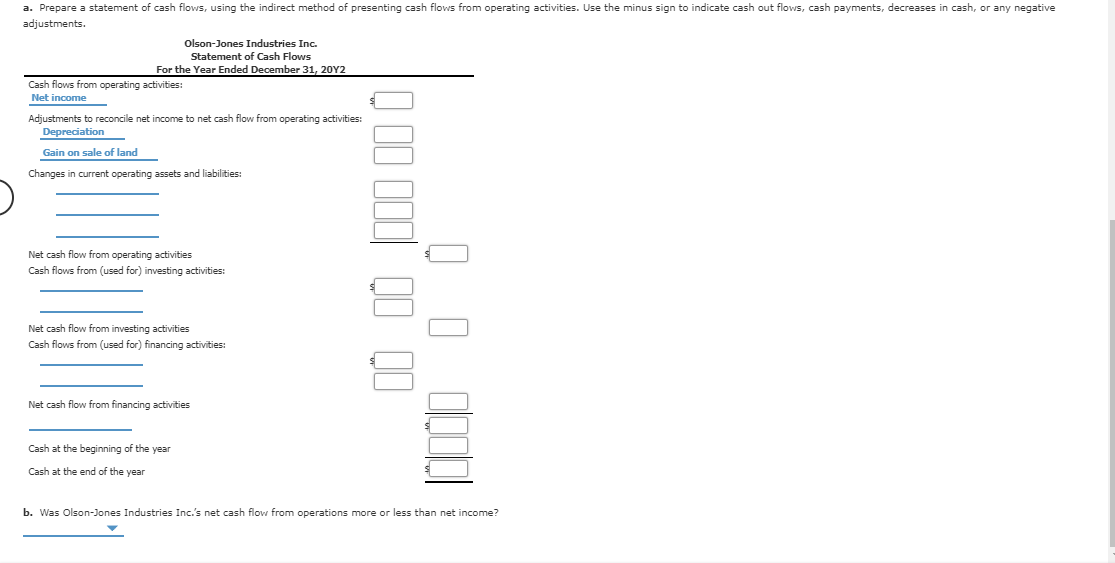

The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 20Y1, is as follows:

Assets Cash Accounts receivable (net) Inventories $231,060 83,700 236,280 $213,450 76,660 226,980 87,940 Investments Land Equipment Accumulated depreciation-equipment 121,200 260,700 (61,030) $871,910 200,670 (54,110) $751,590 Total assets Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Dividends payable Common stock, $10 par Paid-in capital: Excess of issue price over par-common stock Retained earnings Total liabilities and stockholders' equity $157,820 15,690 8,720 47,080 177,000 465,600 $871,910 $148,060 19,540 6,760 36,830 102,220 438,180 $751,590 Additional data obtained from an examination of the accounts in the ledger for 2049 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $79,150 cash. d. The common stock was issued for cash. e. There was a $62,740 credit to Retained Earnings for net income. f. There was a $35,320 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Merrick Equipment Co. Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from operating activities: Net income $ 62,740 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation 6,920 Gain on sale of investments 43,830 Changes in current operating assets and liabilities: Increase in accounts receivable 7,040 Decrease in inventories -9,300 Decrease in accounts payable -9,760 Increase in accrued expenses payable 3,850 Net cash flow from operating activities Cash flows from (used for) investing activities: Net cash flow used for investing activities Cash flows from (used for) financing activities: Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year 2012 20Y1 Assets Cash Accounts receivable (net) Inventories Land Equipment Accumulated depreciation equipment Total Assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Dividends payable Common stock, $1 par Paid-in capital: Excess of issue price over par- common stock Retained earnings Total liabilities and stockholders' equity $632 $449 The following additional information is taken from the records: 1. Land was sold for $60. 2. Equipment was acquired for cash. 3. There were no disposals of equipment during the year. 4. The common stock was issued for cash. 5. There was a $136 credit to Retained Earnings for net income. 6. There was a $42 debit to Retained Earnings for cash dividends declared. a. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Olson-Jones Industries Inc. Statement of Cash Flows For the Year Ended December 31, 2012 a. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Olson-Jones Industries Inc. Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Gain on sale of land Changes in current operating assets and liabilities: Net cash flow from operating activities Cash flows from (used for) investing activities: Net cash flow from investing activities Cash flows from (used for) financing activities: Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year b. Was Olson-Jones Industries Inc.'s net cash flow from operations more or less than net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts