Question: hello please I need this question as soon as posible its 1 question but has 3 part to answer and this is all the picture

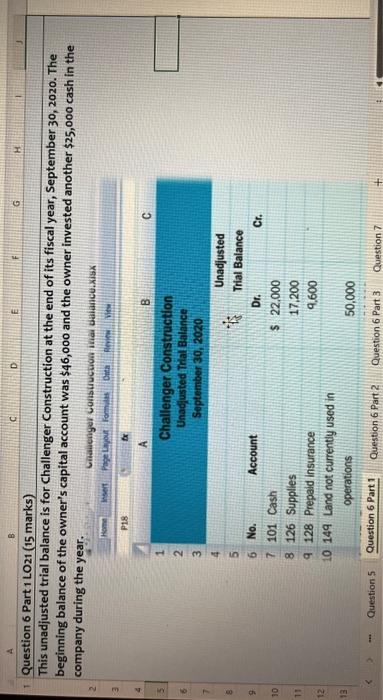

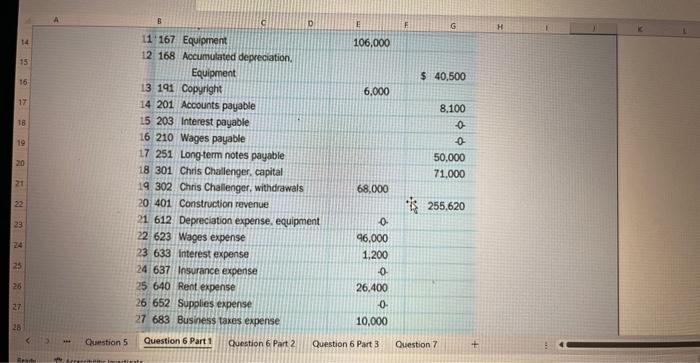

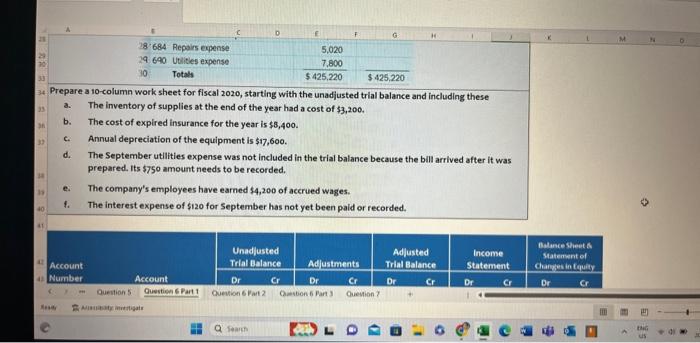

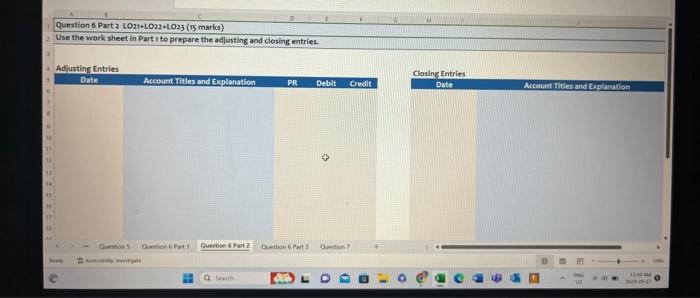

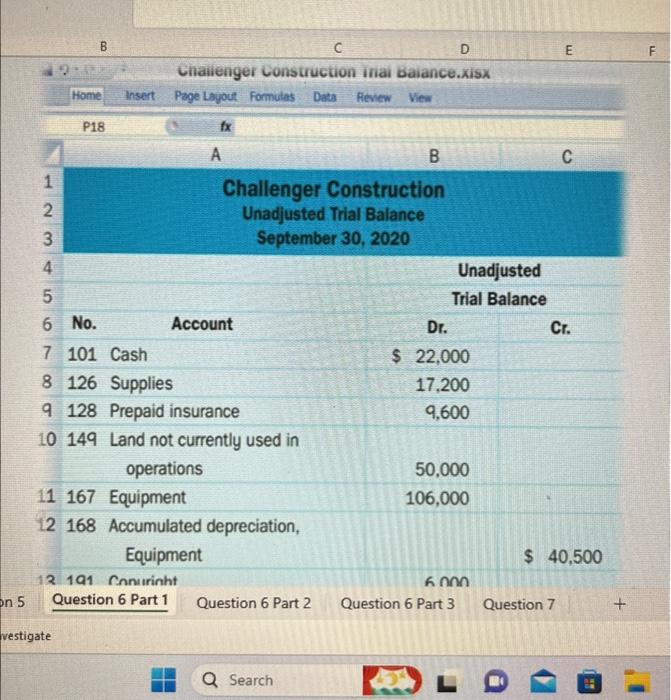

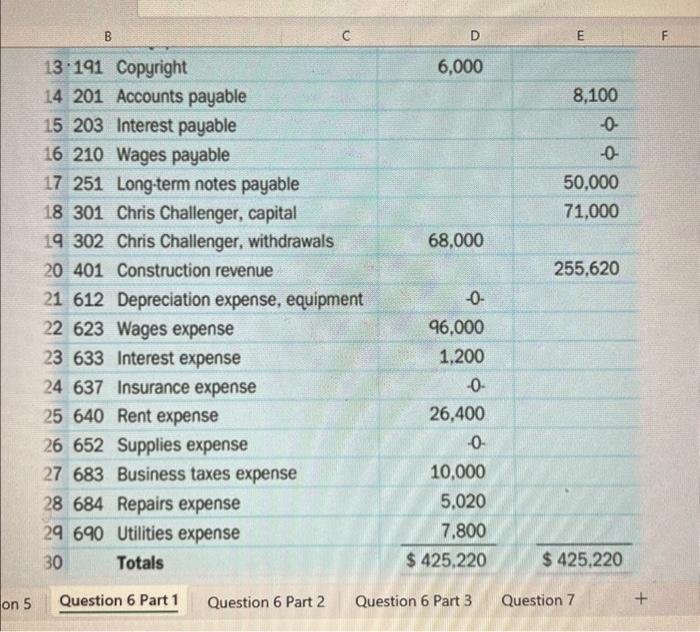

This unadjusted trial balance is for Challenger Construction at the end of its fiscal year, September 30,2020 . The beginning balance of the owner's capital account was $46,000 and the owner invested another $25,000 cash in the $3,200. b. The cost of expired insurance for the year is $8,400. c. Annual depreciation of the equipment is $17,600. d. The September utilities expense was not included in the trial balance because the bill arrived after it was prepared. Its $750 amount needs to be recorded. e. The company's employees have earned $4,200 of accrued wages. 1. The interest expense of \$120 for September has not yet been paid or recorded. Question 6 Part 2 LO21+LO22+LO23 (15 marks) Use the work sheet in Part 1 to prepare the adjusting and closing entries. Ad, usting Entries Bate Aceount Titles and Explanation PR Debit Credit Closing Entries Dete Acceunt Fites and Explanation Ix Prepare an income tatement, astatement of changes in equity, and a clasulied balance shev1. $16,000 of the long-term note payable is to be paid by September 30, 2021. Question 6 Part 3 LO22+LO25 (20 marks) Prepare an income statement, a statement of changes in equity, and a classified balance sheet. $16,000 of the long-term note payable is to be paid by September 30,2021. B CDChailengerConstructioniniaibaiance.xisx Home insert Page Layout formulas Dats Revew View Prepare an income statement, a statement of changes in equity, and a classified balance sheet. $16,000 of the long-term note payable is to be paid by September 30,2021 . \begin{tabular}{l} P 9. \\ \hline \end{tabular} A2 : X fx Prepare an income statement, a statement of changes in equity, and a classified balance sheet. $16,000 of the long-term note payable is to be paid by September 30,2021. Question 6 Part 3 LO22+LO25 (20 marks) Prepare an income statement, a statement of changes in equity, and a classified balance sheet. This unadjusted trial balance is for Challenger Construction at the end of its fiscal year, September 30,2020 . The beginning balance of the owner's capital account was $46,000 and the owner invested another $25,000 cash in the $3,200. b. The cost of expired insurance for the year is $8,400. c. Annual depreciation of the equipment is $17,600. d. The September utilities expense was not included in the trial balance because the bill arrived after it was prepared. Its $750 amount needs to be recorded. e. The company's employees have earned $4,200 of accrued wages. 1. The interest expense of \$120 for September has not yet been paid or recorded. Question 6 Part 2 LO21+LO22+LO23 (15 marks) Use the work sheet in Part 1 to prepare the adjusting and closing entries. Ad, usting Entries Bate Aceount Titles and Explanation PR Debit Credit Closing Entries Dete Acceunt Fites and Explanation Ix Prepare an income tatement, astatement of changes in equity, and a clasulied balance shev1. $16,000 of the long-term note payable is to be paid by September 30, 2021. Question 6 Part 3 LO22+LO25 (20 marks) Prepare an income statement, a statement of changes in equity, and a classified balance sheet. $16,000 of the long-term note payable is to be paid by September 30,2021. B CDChailengerConstructioniniaibaiance.xisx Home insert Page Layout formulas Dats Revew View Prepare an income statement, a statement of changes in equity, and a classified balance sheet. $16,000 of the long-term note payable is to be paid by September 30,2021 . \begin{tabular}{l} P 9. \\ \hline \end{tabular} A2 : X fx Prepare an income statement, a statement of changes in equity, and a classified balance sheet. $16,000 of the long-term note payable is to be paid by September 30,2021. Question 6 Part 3 LO22+LO25 (20 marks) Prepare an income statement, a statement of changes in equity, and a classified balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts