Question: hello, please I really need help with this assignment as it's graded. please if someone could solve this I would be so grateful. AGBU 292:

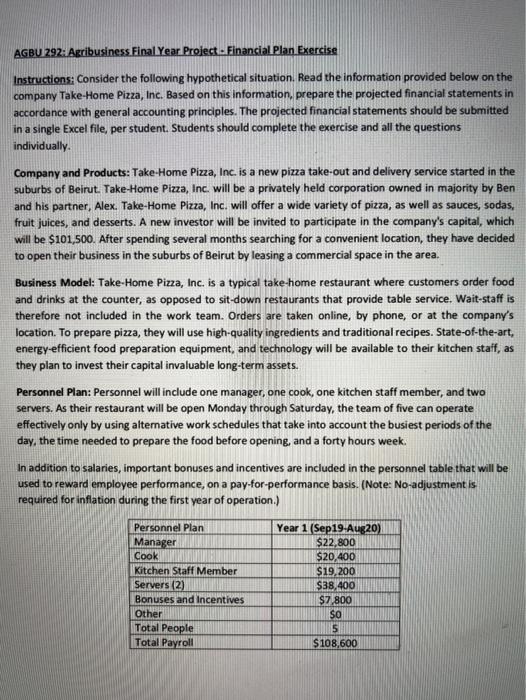

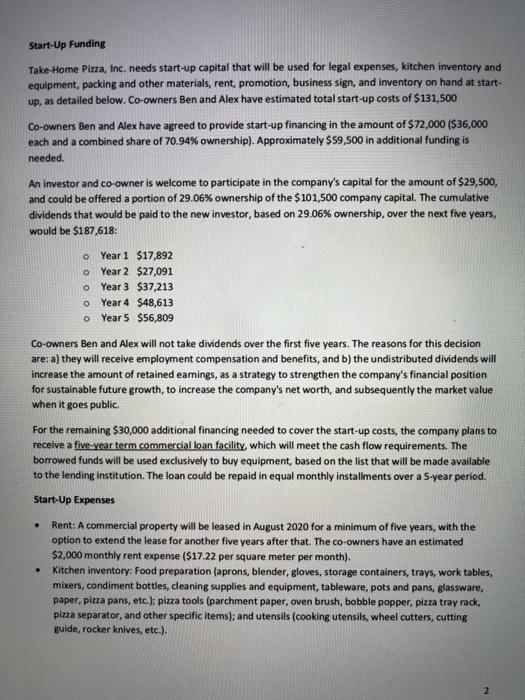

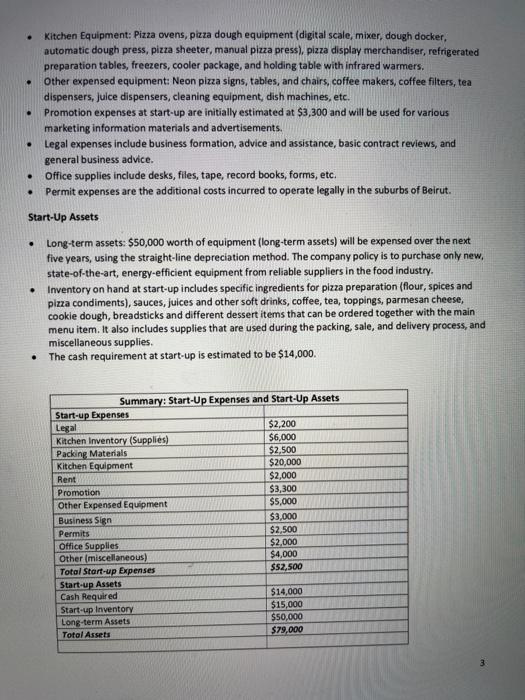

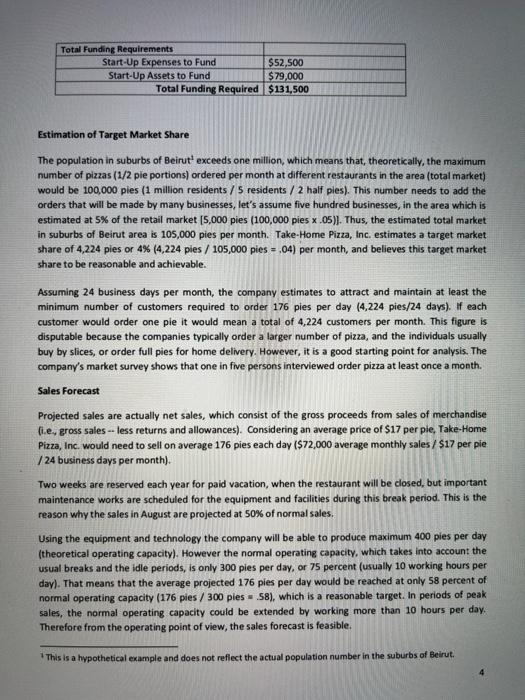

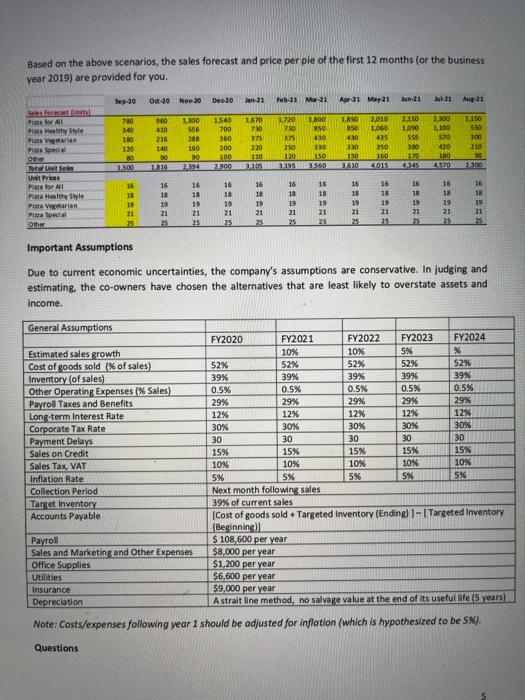

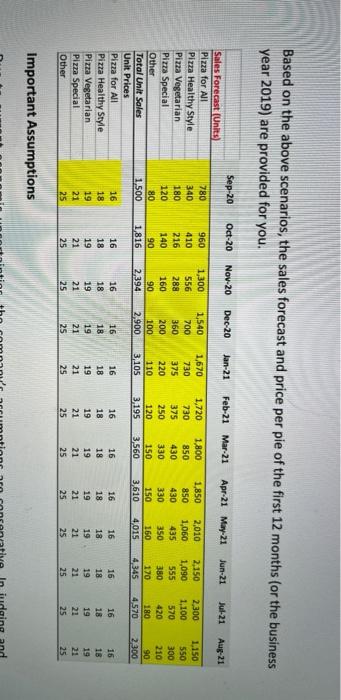

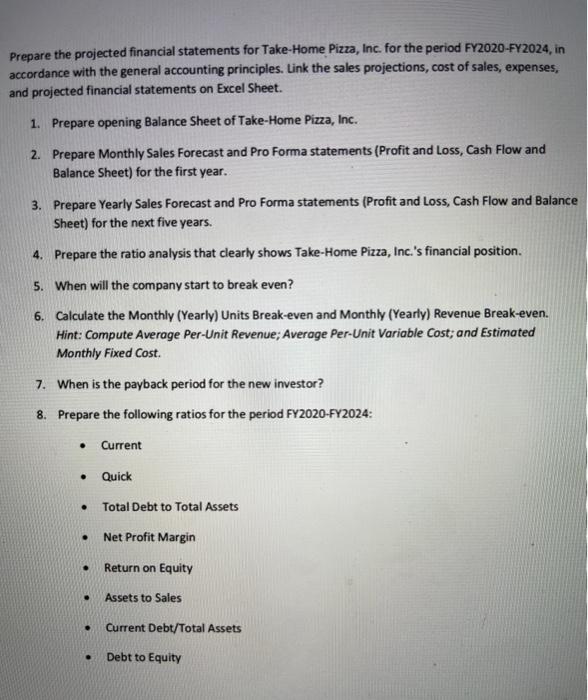

AGBU 292: Agribusiness Final Year Project. Financial Plan Exercise Instructions: Consider the following hypothetical situation. Read the information provided below on the company Take-Home Pizza, Inc. Based on this information, prepare the projected financial statements in accordance with general accounting principles. The projected financial statements should be submitted in a single Excel file, per student. Students should complete the exercise and all the questions individually Company and Products: Take-Home Pizza, Inc. is a new pizza take-out and delivery service started in the suburbs of Beirut. Take-Home Pizza, Inc. will be a privately held corporation owned in majority by Ben and his partner, Alex. Take-Home Pizza, Inc. will offer a wide variety of pizza, as well as sauces, sodas, fruit juices, and desserts. A new investor will be invited to participate in the company's capital, which will be $101,500. After spending several months searching for a convenient location, they have decided to open their business in the suburbs of Beirut by leasing a commercial space in the area. Business Model: Take-Home Pizza, Inc. is a typical take-home restaurant where customers order food and drinks at the counter, as opposed to sit-down restaurants that provide table service. Wait-staff is therefore not included in the work team. Orders are taken online, by phone, or at the company's location. To prepare pizza, they will use high-quality ingredients and traditional recipes. State-of-the-art, energy-efficient food preparation equipment, and technology will be available to their kitchen staff, as they plan to invest their capital invaluable long-term assets. Personnel Plan: Personnel will include one manager, one cook, one kitchen staff member, and two servers. As their restaurant will be open Monday through Saturday, the team of five can operate effectively only by using alternative work schedules that take into account the busiest periods of the day, the time needed to prepare the food before opening, and a forty hours week. In addition to salaries, important bonuses and incentives are included in the personnel table that will be used to reward employee performance, on a pay-for-performance basis. (Note: No-adjustment is required for inflation during the first year of operation.) Personnel Plan Manager Cook Kitchen Staff Member Servers (2) Bonuses and Incentives Other Total People Total Payroll Year 1 (Sep19-Aug20) $22,800 $20,400 $19,200 $38,400 $7.800 SO 5 $108,60 Start-Up Funding Take-Home Pizza, Inc. needs start-up capital that will be used for legal expenses, kitchen inventory and equipment, packing and other materials, rent, promotion, business sign, and inventory on hand at start- up, as detailed below. Co-owners Ben and Alex have estimated total start-up costs of $131,500 Co-owners Ben and Alex have agreed to provide start-up financing in the amount of $72,000 ($36,000 each and a combined share of 70.94% ownership). Approximately $59,500 in additional funding is needed. An investor and co-owner is welcome to participate in the company's capital for the amount of $29,500, and could be offered a portion of 29.06% ownership of the $101,500 company capital. The cumulative dividends that would be paid to the new investor, based on 29.06% ownership, over the next five years, would be $187,618: O o Year 1 $17,892 o Year 2 $27,091 Year 3 $37,213 0 Year 4 $48,613 o Year 5 $56,809 Co-owners Ben and Alex will not take dividends over the first five years. The reasons for this decision are: a) they will receive employment compensation and benefits, and b) the undistributed dividends will increase the amount of retained earnings, as a strategy to strengthen the company's financial position for sustainable future growth, to increase the company's net worth, and subsequently the market value when it goes public For the remaining $30,000 additional financing needed to cover the start-up costs, the company plans to receive a five-year term commercial loan facility, which will meet the cash flow requirements. The borrowed funds will be used exclusively to buy equipment, based on the list that will be made available to the lending institution. The loan could be repaid in equal monthly installments over a S-year period. Start-Up Expenses . Rent: A commercial property will be leased in August 2020 for a minimum of five years, with the option to extend the lease for another five years after that. The co-owners have an estimated $2,000 monthly rent expense ($17.22 per square meter per month). Kitchen inventory: Food preparation (aprons, blender, gloves, storage containers, trays, work tables, mixers, condiment bottles, cleaning supplies and equipment, tableware, pots and pans, glassware, paper, pizza pans, etc.); pizza tools (parchment paper, oven brush, bobble popper, pizza tray rack, pizza separator, and other specific items); and utensils (cooking utensils, wheel cutters, cutting guide, rocker knives, etc.). . . . Kitchen Equipment: Pizza ovens, pizza dough equipment (digital scale, mixer, dough docker, automatic dough press, pizza sheeter, manual pizza press), pizza display merchandiser, refrigerated preparation tables, freezers, cooler package, and holding table with infrared warmers. Other expensed equipment: Neon pizza signs, tables, and chairs, coffee makers, coffee filters, tea dispensers, juice dispensers, cleaning equipment, dish machines, etc. Promotion expenses at start-up are initially estimated at $3,300 and will be used for various marketing information materials and advertisements. Legal expenses include business formation, advice and assistance, basic contract reviews, and general business advice. Office supplies include desks, files, tape, record books, forms, etc. Permit expenses are the additional costs incurred to operate legally in the suburbs of Beirut. . Start-Up Assets Long-term assets: $50,000 worth of equipment (long-term assets) will be expensed over the next five years, using the straight-line depreciation method. The company policy is to purchase only new, state-of-the-art, energy-efficient equipment from reliable suppliers in the food industry, Inventory on hand at start-up includes specific ingredients for pizza preparation (flour, spices and pizza condiments), sauces, juices and other soft drinks, coffee, tea, toppings, parmesan cheese, cookie dough, breadsticks and different dessert items that can be ordered together with the main menu item. It also includes supplies that are used during the packing, sale, and delivery process, and miscellaneous supplies. The cash requirement at start-up is estimated to be $14,000. Summary: Start-Up Expenses and Start-Up Assets Start-up Expenses Legal $2,200 Kitchen Inventory (Supplies) $6,000 Packing Materials $2,500 Kitchen Equipment $20,000 Rent $2,000 Promotion $3,300 Other Expensed Equipment $5,000 Business Sign $3,000 Permits $2.500 Office Supplies $2.000 Other (miscellaneous) $4,000 Total Start-up Expenses $$2,500 Start-up Assets Cash Required $14,000 Start-up Inventory $15,000 Long-term Assets $50,000 Total Assets $79,000 Total Funding Requirements Start-Up Expenses to Fund $52,500 Start-Up Assets to Fund $79,000 Total Funding Required $131,500 Estimation of Target Market Share The population in suburbs of Beirut' exceeds one million, which means that, theoretically, the maximum number of pizzas (1/2 ple portions) ordered per month at different restaurants in the area (total market) would be 100,000 ples (1 million residents / 5 residents / 2 half ples). This number needs to add the orders that will be made by many businesses, let's assume five hundred businesses, in the area which is estimated at 5% of the retail market [5,000 pies (100,000 pies x .05)). Thus, the estimated total market in suburbs of Beirut area is 105,000 pies per month. Take-Home Pizza, Inc. estimates a target market share of 4,224 pies or 4% (4,224 pies / 105,000 pies = ,04) per month, and believes this target market share to be reasonable and achievable. Assuming 24 business days per month, the company estimates to attract and maintain at least the minimum number of customers required to order 176 pies per day (4,224 pies/24 days). If each customer would order one pie it would mean a total of 4,224 customers per month. This figure is disputable because the companies typically order a larger number of pizza, and the individuals usually buy by slices, or order full pies for home delivery. However, it is a good starting point for analysis. The company's market survey shows that one in five persons interviewed order pizza at least once a month. Sales Forecast Projected sales are actually net sales, which consist of the gross proceeds from sales of merchandise fi.e, gross sales -- less returns and allowances). Considering an average price of S17 per ple, Take-Home Pizza, Inc. would need to sell on average 176 pies each day ($72,000 average monthly sales / $17 per pie /24 business days per month). Two weeks are reserved each year for paid vacation, when the restaurant will be closed, but important maintenance works are scheduled for the equipment and facilities during this break period. This is the reason why the sales in August are projected at 50% of normal sales. Using the equipment and technology the company will be able to produce maximum 400 pies per day (theoretical operating capacity). However the normal operating capacity, which takes into account the usual breaks and the idle periods, is only 300 pies per day, or 75 percent (usually 10 working hours per day). That means that the average projected 176 pies per day would be reached at only 58 percent of normal operating capacity (176 pies / 300 pies - 58), which is a reasonable target. In periods of peak sales, the normal operating capacity could be extended by working more than 10 hours per day Therefore from the operating point of view, the sales forecast is feasible. This is a hypothetical example and does not reflect the actual population number in the suburbs of Beirut. Based on the above scenarios, the sales forecast and price per ple of the first 12 months (or the business year 2019) are provided for you. De 20 Now 20 De 10 Jan 21 Feb 21 Mw21 M21 Arai May21 un 21 2100 780 340 180 120 160 410 216 140 50 1.2016 2.150 1.000 555 1560 700 360 200 100 2.900 200 1520 1220 710 736 375 175 220 250 110130 1,105 3195 INS 250 410 130 1.00 aso 430 330 150 3560 2010 1.06 435 350 160 4015 2.500 1.100 70 420 180 1.150 550 300 210 90 2,194 1,500 3,510 22100 Piata for MI Healthy Style Pin an Pura for Other Total Unit Price Pin for NI Rue Healthy Style Pura Varian Para Special Other 16 16 16 18 15 21 16 16 19 21 16 16 16 18 10 12 19 19 19 21 21 21 25 25 16 18 19 21 25 19 21 16 18 19 21 25 16 11 19 21 16 18 19 23 19 21 16 18 19 21 25 Important Assumptions Due to current economic uncertainties, the company's assumptions are conservative. In judging and estimating, the co-owners have chosen the alternatives that are least likely to overstate assets and Income. 12% General Assumptions FY2020 FY2021 FY2022 FY2023 FY2024 Estimated sales growth 10% 10% 5% % Cost of goods sold (% of sales) 52% 52% 52% 52% 52% Inventory (of sales) 39% 39% 39% 39% 39% Other Operating Expenses (% Sales) 0.5% 0.5% 0.5% 0.5% 0.5% Payroll Taxes and Benefits 29% 29% 29% 29% 29% Long-term Interest Rate 12% 12% 12% 12% Corporate Tax Rate 30% 30% 30% 30% 30% Payment Delays 30 30 30 30 30 Sales on Credit 15% 15% 15% 15% 15% Sales Tax, VAT 10% 10% 10% 10% 10% Inflation Rate 5% 5% 5% 5% 5% Collection Period Next month following sales Target Inventory 39% of current sales Accounts Payable (Cost of goods sold + Targeted Inventory (Ending) 1-Targeted Inventory (Beginning) Payrol $ 108,600 per year Sales and Marketing and Other Expenses $8,000 per year Office Supplies $1,200 per year Utilities $6,600 per year Insurance $9,000 per year Depreciation A strait line method, no salvage value at the end of its useful life (5 years) Note: Costs/expenses following year I should be adjusted for inflation (which is hypothesized to be 5%). Questions Based on the above scenarios, the sales forecast and price per pie of the first 12 months (or the business year 2019) are provided for you. Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sales Forecast (Units) Pizza for All Pizza Healthy Style Pizza Vegetarian Pizza Special Other Total Unit Sales Unit Prices Pizza for All Pizza Healthy Style Pizza Vegetarian Pizza Special Other 780 340 180 120 80 1,500 960 410 216 140 90 1,816 1,300 556 288 160 90 2,394 1,540 700 360 200 100 2.900 1,670 730 375 220 110 3,105 1,720 730 375 250 120 3,195 1800 850 430 330 150 3.560 1,850 850 430 330 150 3610 2,010 1,060 435 350 160 4,015 2,150 1,090 555 380 170 4345 2,300 1.100 570 420 180 4,570 1.150 550 300 210 90 2300 16 18 16 18 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 19 21 25 19 23 25 16 18 19 21 25 16 18 19 21 25 Important Assumptions In and Prepare the projected financial statements for Take-Home Pizza, Inc. for the period FY2020-FY2024, in accordance with the general accounting principles. Link the sales projections, cost of sales, expenses, and projected financial statements on Excel Sheet. 1. Prepare opening Balance Sheet of Take-Home Pizza, Inc. 2. Prepare Monthly Sales Forecast and Pro Forma statements (Profit and Loss, Cash Flow and Balance Sheet) for the first year. 3. Prepare Yearly Sales Forecast and Pro Forma statements (Profit and Loss, Cash Flow and Balance Sheet) for the next five years. 4. Prepare the ratio analysis that clearly shows Take-Home Pizza, Inc.'s financial position. 5. When will the company start to break even? 6. Calculate the Monthly (Yearly) Units Break-even and Monthly (Yearly) Revenue Break-even. Hint: Compute Average Per-Unit Revenue; Average Per-Unit Variable Cost; and Estimated Monthly Fixed Cost. 7. When is the payback period for the new investor? 8. Prepare the following ratios for the period FY2020-FY2024: . Current Quick Total Debt to Total Assets Net Profit Margin Return on Equity Assets to Sales . Current Debt/Total Assets . Debt to Equity AGBU 292: Agribusiness Final Year Project. Financial Plan Exercise Instructions: Consider the following hypothetical situation. Read the information provided below on the company Take-Home Pizza, Inc. Based on this information, prepare the projected financial statements in accordance with general accounting principles. The projected financial statements should be submitted in a single Excel file, per student. Students should complete the exercise and all the questions individually Company and Products: Take-Home Pizza, Inc. is a new pizza take-out and delivery service started in the suburbs of Beirut. Take-Home Pizza, Inc. will be a privately held corporation owned in majority by Ben and his partner, Alex. Take-Home Pizza, Inc. will offer a wide variety of pizza, as well as sauces, sodas, fruit juices, and desserts. A new investor will be invited to participate in the company's capital, which will be $101,500. After spending several months searching for a convenient location, they have decided to open their business in the suburbs of Beirut by leasing a commercial space in the area. Business Model: Take-Home Pizza, Inc. is a typical take-home restaurant where customers order food and drinks at the counter, as opposed to sit-down restaurants that provide table service. Wait-staff is therefore not included in the work team. Orders are taken online, by phone, or at the company's location. To prepare pizza, they will use high-quality ingredients and traditional recipes. State-of-the-art, energy-efficient food preparation equipment, and technology will be available to their kitchen staff, as they plan to invest their capital invaluable long-term assets. Personnel Plan: Personnel will include one manager, one cook, one kitchen staff member, and two servers. As their restaurant will be open Monday through Saturday, the team of five can operate effectively only by using alternative work schedules that take into account the busiest periods of the day, the time needed to prepare the food before opening, and a forty hours week. In addition to salaries, important bonuses and incentives are included in the personnel table that will be used to reward employee performance, on a pay-for-performance basis. (Note: No-adjustment is required for inflation during the first year of operation.) Personnel Plan Manager Cook Kitchen Staff Member Servers (2) Bonuses and Incentives Other Total People Total Payroll Year 1 (Sep19-Aug20) $22,800 $20,400 $19,200 $38,400 $7.800 SO 5 $108,60 Start-Up Funding Take-Home Pizza, Inc. needs start-up capital that will be used for legal expenses, kitchen inventory and equipment, packing and other materials, rent, promotion, business sign, and inventory on hand at start- up, as detailed below. Co-owners Ben and Alex have estimated total start-up costs of $131,500 Co-owners Ben and Alex have agreed to provide start-up financing in the amount of $72,000 ($36,000 each and a combined share of 70.94% ownership). Approximately $59,500 in additional funding is needed. An investor and co-owner is welcome to participate in the company's capital for the amount of $29,500, and could be offered a portion of 29.06% ownership of the $101,500 company capital. The cumulative dividends that would be paid to the new investor, based on 29.06% ownership, over the next five years, would be $187,618: O o Year 1 $17,892 o Year 2 $27,091 Year 3 $37,213 0 Year 4 $48,613 o Year 5 $56,809 Co-owners Ben and Alex will not take dividends over the first five years. The reasons for this decision are: a) they will receive employment compensation and benefits, and b) the undistributed dividends will increase the amount of retained earnings, as a strategy to strengthen the company's financial position for sustainable future growth, to increase the company's net worth, and subsequently the market value when it goes public For the remaining $30,000 additional financing needed to cover the start-up costs, the company plans to receive a five-year term commercial loan facility, which will meet the cash flow requirements. The borrowed funds will be used exclusively to buy equipment, based on the list that will be made available to the lending institution. The loan could be repaid in equal monthly installments over a S-year period. Start-Up Expenses . Rent: A commercial property will be leased in August 2020 for a minimum of five years, with the option to extend the lease for another five years after that. The co-owners have an estimated $2,000 monthly rent expense ($17.22 per square meter per month). Kitchen inventory: Food preparation (aprons, blender, gloves, storage containers, trays, work tables, mixers, condiment bottles, cleaning supplies and equipment, tableware, pots and pans, glassware, paper, pizza pans, etc.); pizza tools (parchment paper, oven brush, bobble popper, pizza tray rack, pizza separator, and other specific items); and utensils (cooking utensils, wheel cutters, cutting guide, rocker knives, etc.). . . . Kitchen Equipment: Pizza ovens, pizza dough equipment (digital scale, mixer, dough docker, automatic dough press, pizza sheeter, manual pizza press), pizza display merchandiser, refrigerated preparation tables, freezers, cooler package, and holding table with infrared warmers. Other expensed equipment: Neon pizza signs, tables, and chairs, coffee makers, coffee filters, tea dispensers, juice dispensers, cleaning equipment, dish machines, etc. Promotion expenses at start-up are initially estimated at $3,300 and will be used for various marketing information materials and advertisements. Legal expenses include business formation, advice and assistance, basic contract reviews, and general business advice. Office supplies include desks, files, tape, record books, forms, etc. Permit expenses are the additional costs incurred to operate legally in the suburbs of Beirut. . Start-Up Assets Long-term assets: $50,000 worth of equipment (long-term assets) will be expensed over the next five years, using the straight-line depreciation method. The company policy is to purchase only new, state-of-the-art, energy-efficient equipment from reliable suppliers in the food industry, Inventory on hand at start-up includes specific ingredients for pizza preparation (flour, spices and pizza condiments), sauces, juices and other soft drinks, coffee, tea, toppings, parmesan cheese, cookie dough, breadsticks and different dessert items that can be ordered together with the main menu item. It also includes supplies that are used during the packing, sale, and delivery process, and miscellaneous supplies. The cash requirement at start-up is estimated to be $14,000. Summary: Start-Up Expenses and Start-Up Assets Start-up Expenses Legal $2,200 Kitchen Inventory (Supplies) $6,000 Packing Materials $2,500 Kitchen Equipment $20,000 Rent $2,000 Promotion $3,300 Other Expensed Equipment $5,000 Business Sign $3,000 Permits $2.500 Office Supplies $2.000 Other (miscellaneous) $4,000 Total Start-up Expenses $$2,500 Start-up Assets Cash Required $14,000 Start-up Inventory $15,000 Long-term Assets $50,000 Total Assets $79,000 Total Funding Requirements Start-Up Expenses to Fund $52,500 Start-Up Assets to Fund $79,000 Total Funding Required $131,500 Estimation of Target Market Share The population in suburbs of Beirut' exceeds one million, which means that, theoretically, the maximum number of pizzas (1/2 ple portions) ordered per month at different restaurants in the area (total market) would be 100,000 ples (1 million residents / 5 residents / 2 half ples). This number needs to add the orders that will be made by many businesses, let's assume five hundred businesses, in the area which is estimated at 5% of the retail market [5,000 pies (100,000 pies x .05)). Thus, the estimated total market in suburbs of Beirut area is 105,000 pies per month. Take-Home Pizza, Inc. estimates a target market share of 4,224 pies or 4% (4,224 pies / 105,000 pies = ,04) per month, and believes this target market share to be reasonable and achievable. Assuming 24 business days per month, the company estimates to attract and maintain at least the minimum number of customers required to order 176 pies per day (4,224 pies/24 days). If each customer would order one pie it would mean a total of 4,224 customers per month. This figure is disputable because the companies typically order a larger number of pizza, and the individuals usually buy by slices, or order full pies for home delivery. However, it is a good starting point for analysis. The company's market survey shows that one in five persons interviewed order pizza at least once a month. Sales Forecast Projected sales are actually net sales, which consist of the gross proceeds from sales of merchandise fi.e, gross sales -- less returns and allowances). Considering an average price of S17 per ple, Take-Home Pizza, Inc. would need to sell on average 176 pies each day ($72,000 average monthly sales / $17 per pie /24 business days per month). Two weeks are reserved each year for paid vacation, when the restaurant will be closed, but important maintenance works are scheduled for the equipment and facilities during this break period. This is the reason why the sales in August are projected at 50% of normal sales. Using the equipment and technology the company will be able to produce maximum 400 pies per day (theoretical operating capacity). However the normal operating capacity, which takes into account the usual breaks and the idle periods, is only 300 pies per day, or 75 percent (usually 10 working hours per day). That means that the average projected 176 pies per day would be reached at only 58 percent of normal operating capacity (176 pies / 300 pies - 58), which is a reasonable target. In periods of peak sales, the normal operating capacity could be extended by working more than 10 hours per day Therefore from the operating point of view, the sales forecast is feasible. This is a hypothetical example and does not reflect the actual population number in the suburbs of Beirut. Based on the above scenarios, the sales forecast and price per ple of the first 12 months (or the business year 2019) are provided for you. De 20 Now 20 De 10 Jan 21 Feb 21 Mw21 M21 Arai May21 un 21 2100 780 340 180 120 160 410 216 140 50 1.2016 2.150 1.000 555 1560 700 360 200 100 2.900 200 1520 1220 710 736 375 175 220 250 110130 1,105 3195 INS 250 410 130 1.00 aso 430 330 150 3560 2010 1.06 435 350 160 4015 2.500 1.100 70 420 180 1.150 550 300 210 90 2,194 1,500 3,510 22100 Piata for MI Healthy Style Pin an Pura for Other Total Unit Price Pin for NI Rue Healthy Style Pura Varian Para Special Other 16 16 16 18 15 21 16 16 19 21 16 16 16 18 10 12 19 19 19 21 21 21 25 25 16 18 19 21 25 19 21 16 18 19 21 25 16 11 19 21 16 18 19 23 19 21 16 18 19 21 25 Important Assumptions Due to current economic uncertainties, the company's assumptions are conservative. In judging and estimating, the co-owners have chosen the alternatives that are least likely to overstate assets and Income. 12% General Assumptions FY2020 FY2021 FY2022 FY2023 FY2024 Estimated sales growth 10% 10% 5% % Cost of goods sold (% of sales) 52% 52% 52% 52% 52% Inventory (of sales) 39% 39% 39% 39% 39% Other Operating Expenses (% Sales) 0.5% 0.5% 0.5% 0.5% 0.5% Payroll Taxes and Benefits 29% 29% 29% 29% 29% Long-term Interest Rate 12% 12% 12% 12% Corporate Tax Rate 30% 30% 30% 30% 30% Payment Delays 30 30 30 30 30 Sales on Credit 15% 15% 15% 15% 15% Sales Tax, VAT 10% 10% 10% 10% 10% Inflation Rate 5% 5% 5% 5% 5% Collection Period Next month following sales Target Inventory 39% of current sales Accounts Payable (Cost of goods sold + Targeted Inventory (Ending) 1-Targeted Inventory (Beginning) Payrol $ 108,600 per year Sales and Marketing and Other Expenses $8,000 per year Office Supplies $1,200 per year Utilities $6,600 per year Insurance $9,000 per year Depreciation A strait line method, no salvage value at the end of its useful life (5 years) Note: Costs/expenses following year I should be adjusted for inflation (which is hypothesized to be 5%). Questions Based on the above scenarios, the sales forecast and price per pie of the first 12 months (or the business year 2019) are provided for you. Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sales Forecast (Units) Pizza for All Pizza Healthy Style Pizza Vegetarian Pizza Special Other Total Unit Sales Unit Prices Pizza for All Pizza Healthy Style Pizza Vegetarian Pizza Special Other 780 340 180 120 80 1,500 960 410 216 140 90 1,816 1,300 556 288 160 90 2,394 1,540 700 360 200 100 2.900 1,670 730 375 220 110 3,105 1,720 730 375 250 120 3,195 1800 850 430 330 150 3.560 1,850 850 430 330 150 3610 2,010 1,060 435 350 160 4,015 2,150 1,090 555 380 170 4345 2,300 1.100 570 420 180 4,570 1.150 550 300 210 90 2300 16 18 16 18 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 16 18 19 21 25 19 21 25 19 23 25 16 18 19 21 25 16 18 19 21 25 Important Assumptions In and Prepare the projected financial statements for Take-Home Pizza, Inc. for the period FY2020-FY2024, in accordance with the general accounting principles. Link the sales projections, cost of sales, expenses, and projected financial statements on Excel Sheet. 1. Prepare opening Balance Sheet of Take-Home Pizza, Inc. 2. Prepare Monthly Sales Forecast and Pro Forma statements (Profit and Loss, Cash Flow and Balance Sheet) for the first year. 3. Prepare Yearly Sales Forecast and Pro Forma statements (Profit and Loss, Cash Flow and Balance Sheet) for the next five years. 4. Prepare the ratio analysis that clearly shows Take-Home Pizza, Inc.'s financial position. 5. When will the company start to break even? 6. Calculate the Monthly (Yearly) Units Break-even and Monthly (Yearly) Revenue Break-even. Hint: Compute Average Per-Unit Revenue; Average Per-Unit Variable Cost; and Estimated Monthly Fixed Cost. 7. When is the payback period for the new investor? 8. Prepare the following ratios for the period FY2020-FY2024: . Current Quick Total Debt to Total Assets Net Profit Margin Return on Equity Assets to Sales . Current Debt/Total Assets . Debt to Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts