Question: Hello, Please need assistance on attached Multiple Choice Questions. Question 1 Not yet answered Marked out of 0.5 5? Flag question Question 2 Not yet

Hello,

Please need assistance on attached Multiple Choice Questions.

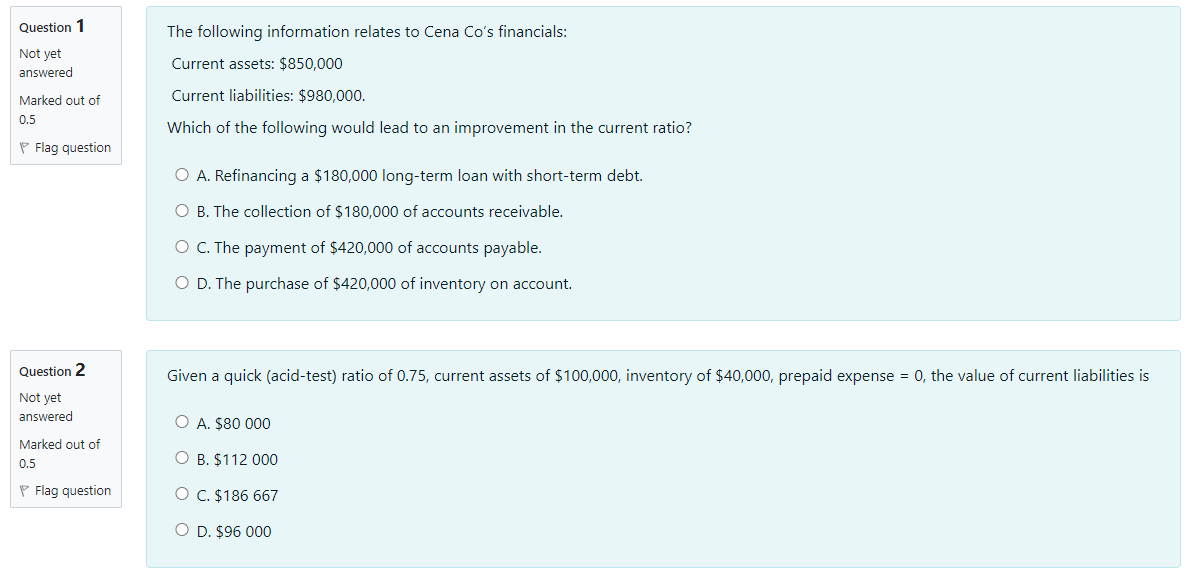

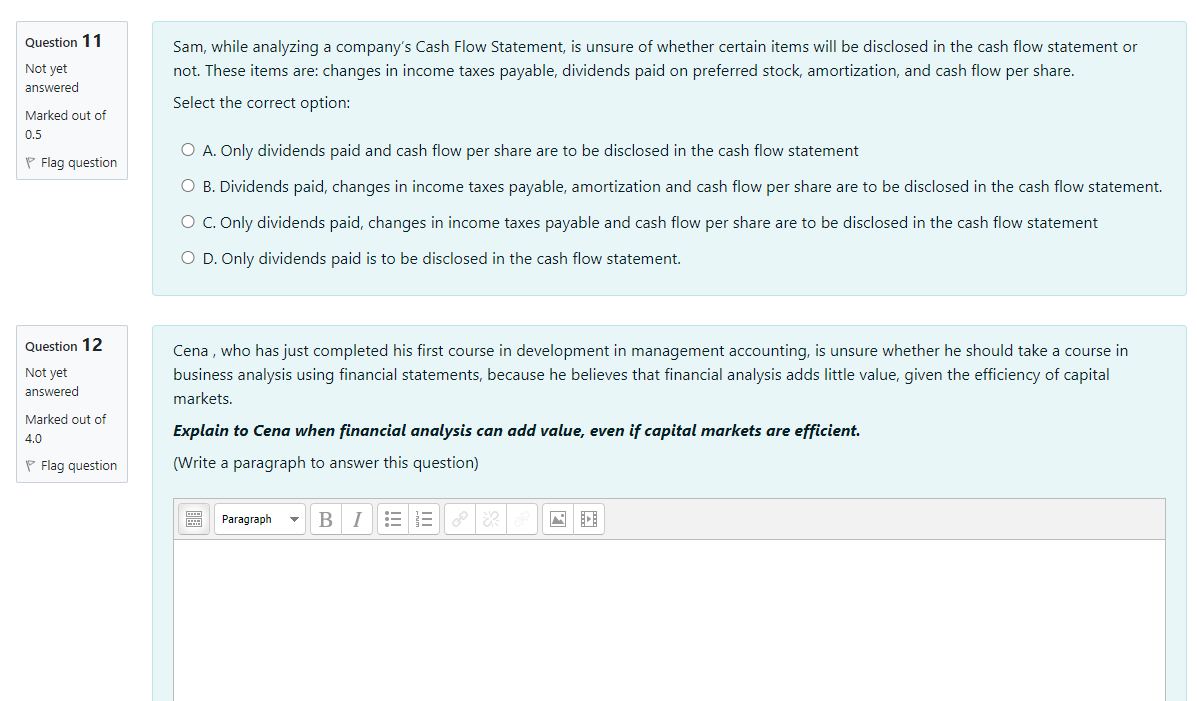

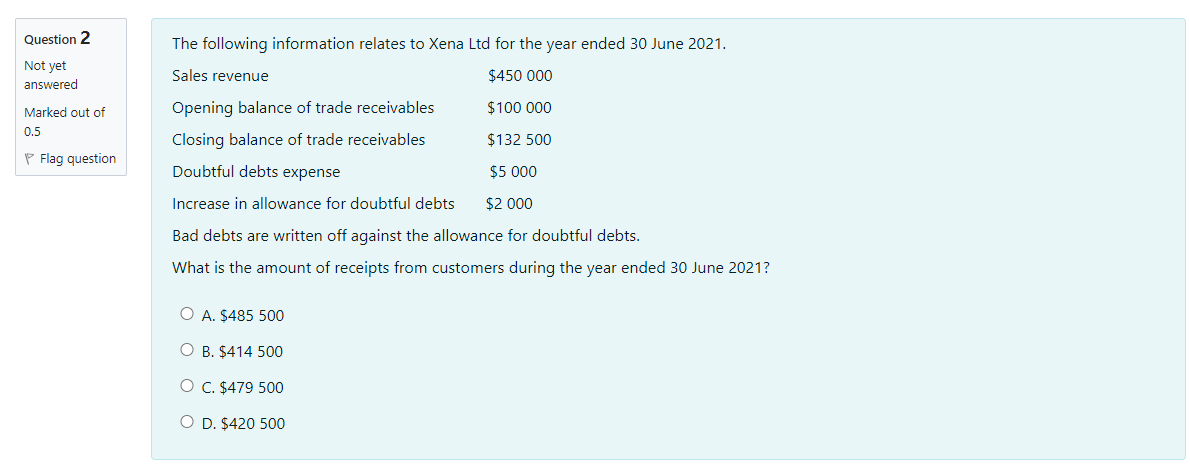

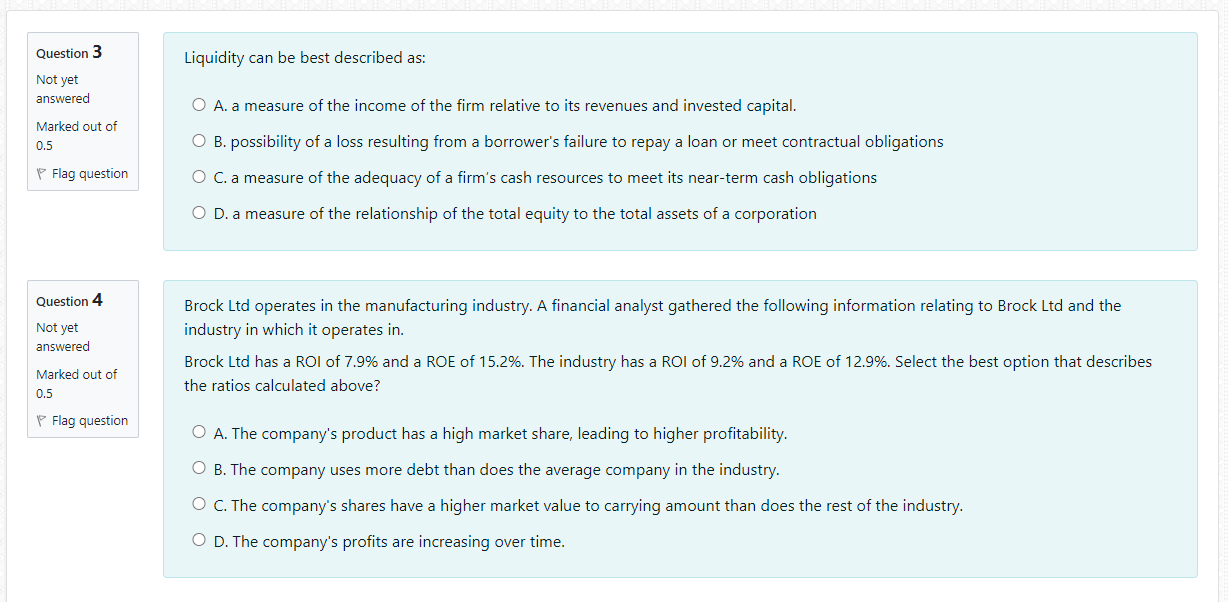

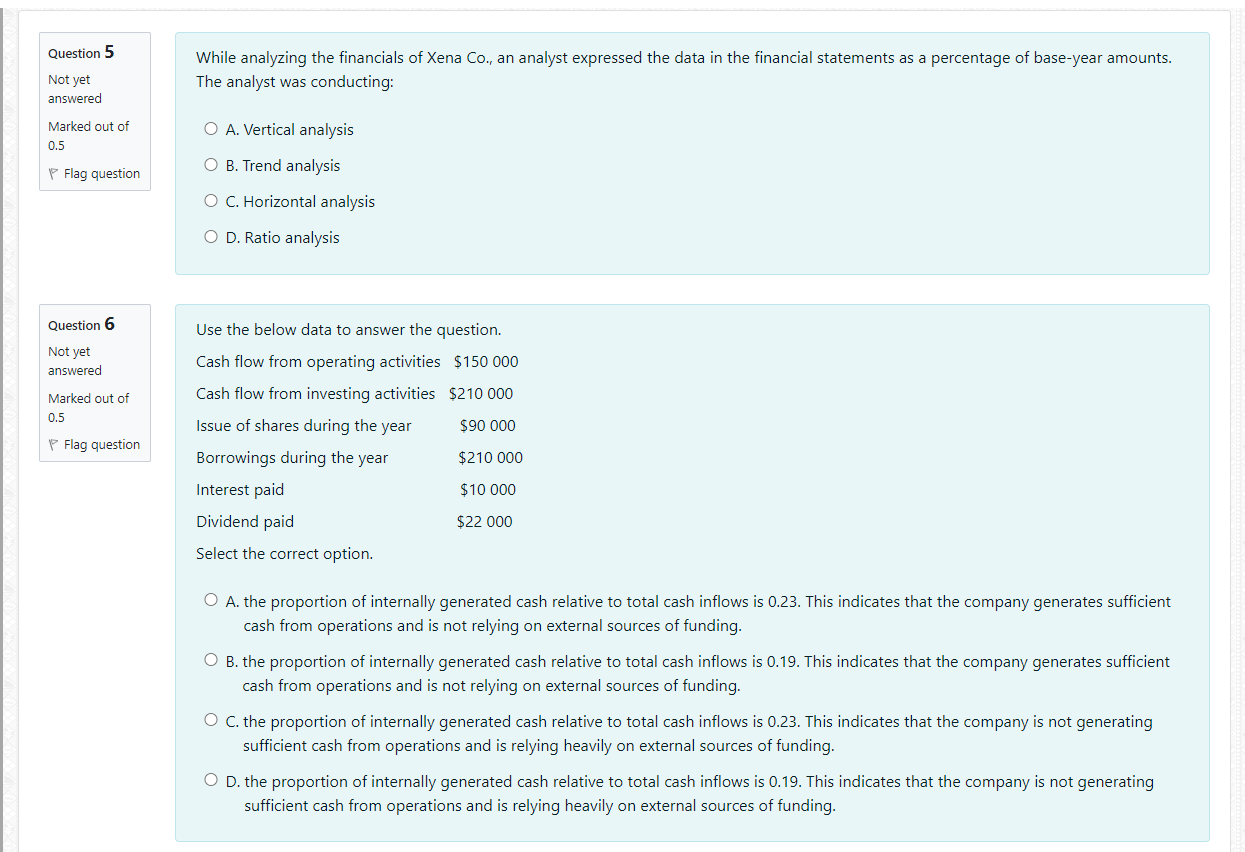

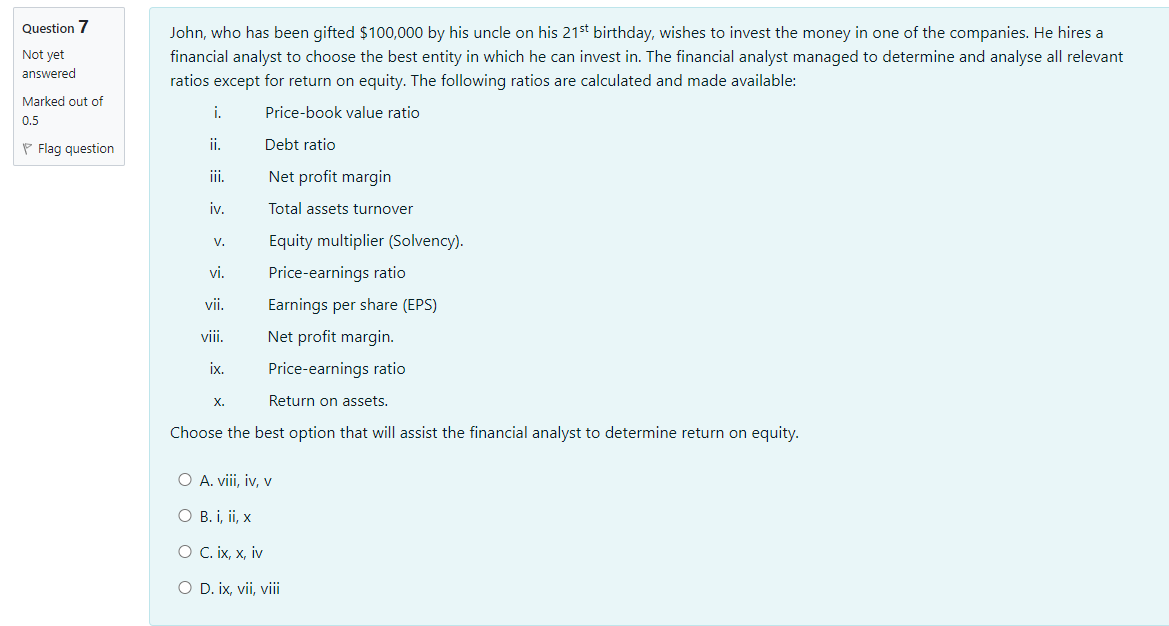

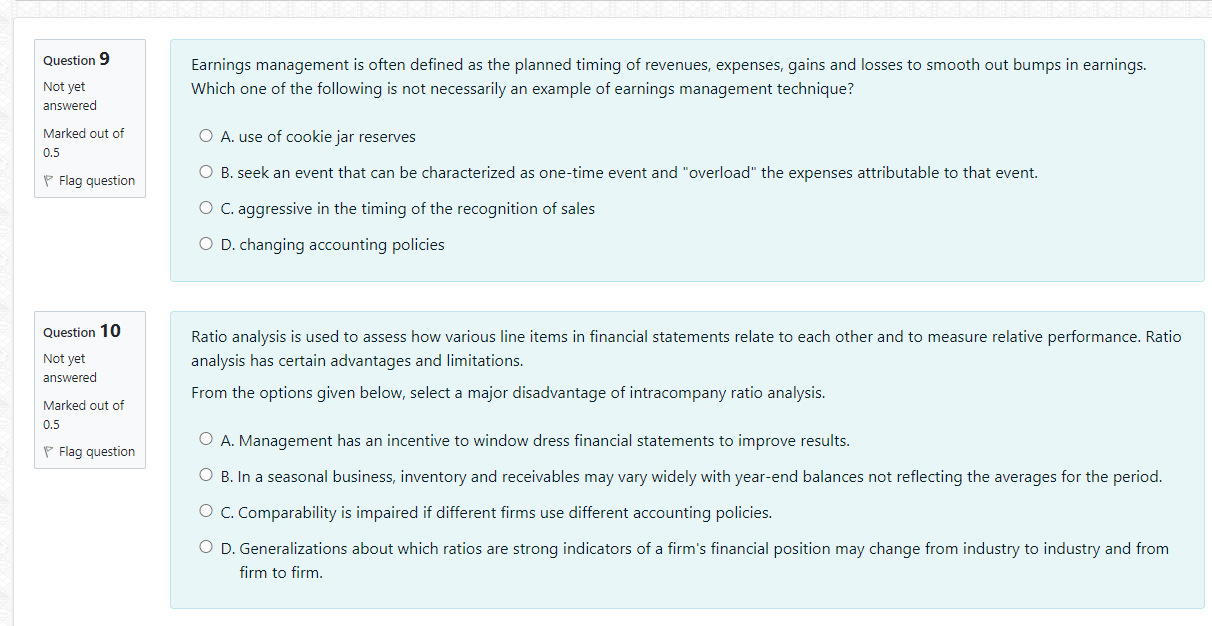

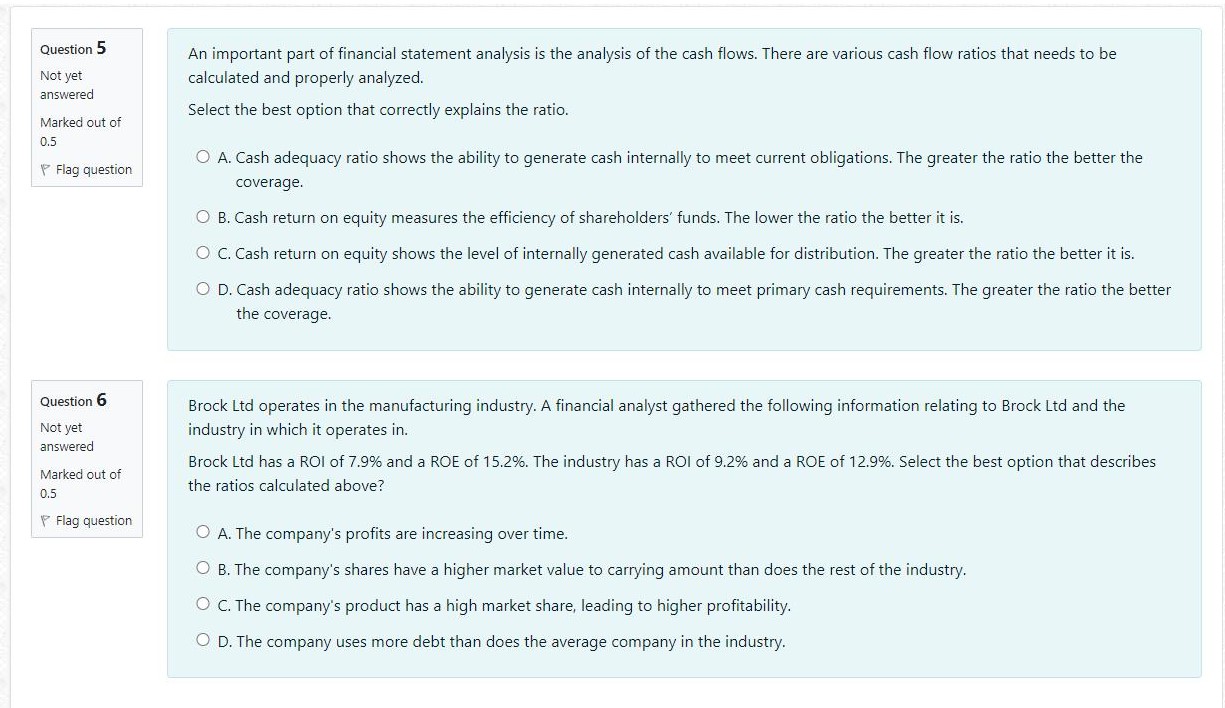

Question 1 Not yet answered Marked out of 0.5 5? Flag question Question 2 Not yet answered Marked out of 0.5 '5" Flag question The following information relates to Cena Co's financials: Current assets: $850,000 Current liabilities: $980,000. Which of the following would lead to an improvement in the current ratio? O A. Refinancing a $180,000 longterm loan with shortterm debt. O B. The collection of $180,000 of accounts receivable. O C. The payment of $420,000 of accounts payable. O D. The purchase of $420,000 of inventory on account. Given a quick (aciditest) ratio of 0.75, current assets of $100,000, inventory of $40,000, prepaid expense = 0, the value of current liabilities is O A. $80 000 O B. $112 000 O C. $186 56? O D. $96 000 Question 1 1 Sam, while analyzing a company's Cash Flow Statement, is unsure of whether certain items will be disclosed in the cash flow statement or Not yet not. These items are: changes in income taxes payable, dividends paid on preferred stock, amortization, and cash flow per share. answered Select the correct option: Marked out of 0.5 O A. Only dividends paid and cash flow per share are to be disclosed in the cash flow statement Flag question O B. Dividends paid, changes in income taxes payable, amortization and cash flow per share are to be disclosed in the cash flow statement. O C. Only dividends paid, changes in income taxes payable and cash flow per share are to be disclosed in the cash flow statement O D. Only dividends paid is to be disclosed in the cash flow statement. Question 12 Cena , who has just completed his first course in development in management accounting, is unsure whether he should take a course in Not yet business analysis using financial statements, because he believes that financial analysis adds little value, given the efficiency of capital answered markets. Marked out of 4.0 Explain to Cena when financial analysis can add value, even if capital markets are efficient. Flag question (Write a paragraph to answer this question) Paragraph BQuestion 2 Not yet answered Marked out of 0.5 F Flag question The following information relates to Xena Ltd for the year ended 30 June 2021. Sales revenue $450 000 Opening balance of trade receivables $100 000 Closing balance of trade receivables $132 500 Doubtful debts expense $5 000 Increase in allowance for doubtful debts $2 000 Bad debts are written off against the allowance for doubtful debts. What is the amount of receipts from customers during the year ended 30 June 2021? O A. $485 500 O E. $414 500 O C. $4?9 500 O D. $420 500 Question 3 Not yet answered Marked out of 0.5 F Flag question Question 4 Not yet answered Marked out of 0.5 F Flag question Liquidity can be best described as: O A. a measure of the income of the firm relative to its revenues and invested capital. 0 B. possibility ofa loss resulting from a borrower's failure to repay a loan or meet contractual obligations O C. a measure of the adequacy ofa firm's cash resources to meet its near-term cash obligations O D. a measure of the relationship of the total equity to the total assets ofa corporation Brock Ltd operates in the manufacturing industry. A financial analyst gathered the following information relating to Brock Ltd and the industry in which it operates in. Brock Ltd has a ROI of 19% and a ROE of 'l 5.2%. The industry has a ROI of 9.2% and a ROE of H.996. Select the best option that describes the ratios calculated above? 0 A. The company's product has a high market share, leading to higher profitability. O B. The company uses more debt than does the average company in the industry. 0 C. The company's shares have a higher market value to carrying amount than does the rest of the industry. 0 D. The company's profits are increasing over time. Question 5 While analyzing the financials of Xena Co., an analyst expressed the data in the financial statements as a percentage of base-year amounts. Not yet The analyst was conducting: answered Marked out of O A. Vertical analysis 0.5 Flag question O B. Trend analysis O C. Horizontal analysis O D. Ratio analysis Question 6 Use the below data to answer the question. Not yet answered Cash flow from operating activities $150 000 Marked out of Cash flow from investing activities $210 000 Issue of shares during the year $90 000 F Flag question Borrowings during the year $210 000 Interest paid $10 000 Dividend paid $22 000 Select the correct option. O A. the proportion of internally generated cash relative to total cash inflows is 0.23. This indicates that the company generates sufficient cash from operations and is not relying on external sources of funding O B. the proportion of internally generated cash relative to total cash inflows is 0.19. This indicates that the company generates sufficient cash from operations and is not relying on external sources of funding. O C. the proportion of internally generated cash relative to total cash inflows is 0.23. This indicates that the company is not generating sufficient cash from operations and is relying heavily on external sources of funding. D. the proportion of internally generated cash relative to total cash inflows is 0.19. This indicates that the company is not generating sufficient cash from operations and is relying heavily on external sources of funding.Question 7 Not yet answered Marked out of 0.5 5? Flag question Johnr who has been gifted $100,000 by his uncle on his 21St birthday, wishes to invest the money in one of the companies. He hires a nancial analyst to choose the best entity in which he can invest in. The nancial analyst managed to determlne and analyse all relevant ratios except for return on equity. The following ratios are calculated and made available: i. Pricebook value ratio ii. Debt ratio iii. Net profit margin iv. Total assets turnover v. Equity multiplier (Solvency). vi. Priceearnings ratio vii. Earnings per share (EPS) viii. Net profit margin. ix. Priceearnings ratio x. Return on assets. Choose the best option that will assist the financial analyst to determine return on equity. O A. viii, iv,v O B. i, ii, x O C. ix, x, iv O D. ix, vii, viii Question 9 Earnings management is often defined as the planned timing of revenues, expenses, gains and losses to smooth out bumps in earnings. Not yet Which one of the following is not necessarily an example of earnings management technique? answered Marked out of O A. use of cookie jar reserves 0.5 Flag question O B. seek an event that can be characterized as one-time event and "overload" the expenses attributable to that event. O C. aggressive in the timing of the recognition of sales O D. changing accounting policies Question 10 Ratio analysis is used to assess how various line items in financial statements relate to each other and to measure relative performance. Ratio Not yet analysis has certain advantages and limitations. answered From the options given below, select a major disadvantage of intracompany ratio analysis. Marked out of 0.5 O A. Management has an incentive to window dress financial statements to improve results. P Flag question O B. In a seasonal business, inventory and receivables may vary widely with year-end balances not reflecting the averages for the period. O C. Comparability is impaired if different firms use different accounting policies. O D. Generalizations about which ratios are strong indicators of a firm's financial position may change from industry to industry and from firm to firm.Question 5 Not yet answered Marked out of 0.5 t' Flag question Question 6 Not yet answered Marked out of 0.5 Y' Flag question An important part of financial statement analysis is the analysis of the cash flows. There are various cash flow tatios that needs to be calculated and properly analyzed. Select the best option that correctly explains the ratio. 0 A. Cash adequacy ratio shows the ability to generate cash internally to meet current obligations. The greater the ratio the better the coverage. 0 E. Cash return on equity measures the efficiency of shareholders funds. The lower the ratio the better it is. O C. Cash return on equity shows the level of internally generated cash available for distribution. The greater the ratio the better it is. O D. Cash adequacy ratio shows the ability to generate cash internally to meet primary cash requirements. The greater the ratio the better the coverage. Brock Ltd operates in the manufacturing industry. A financial analyst gathered the following information relating to Brock Ltd and the industry in which it operates in. Brock Ltd has a ROI of 19% and a ROE of 15.2%. The industry has a ROI of 9.2% and a ROE of 12.9%. Select the best option that describes the ratios calculated above? 0 A. The company's profits are increasing overtime. O B. The company's shares have a higher market value to carrying amount than does the rest of the industry. 0 C. The company's product has a high market share. leading to higher protability. O D. The company uses more debt than does the average company in the industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts