Question: Hello, please provide detailed proof and analysis. Thank you! Problem 5. (10 Points) European call and put options with strike price X and exercise date

Hello, please provide detailed proof and analysis. Thank you!

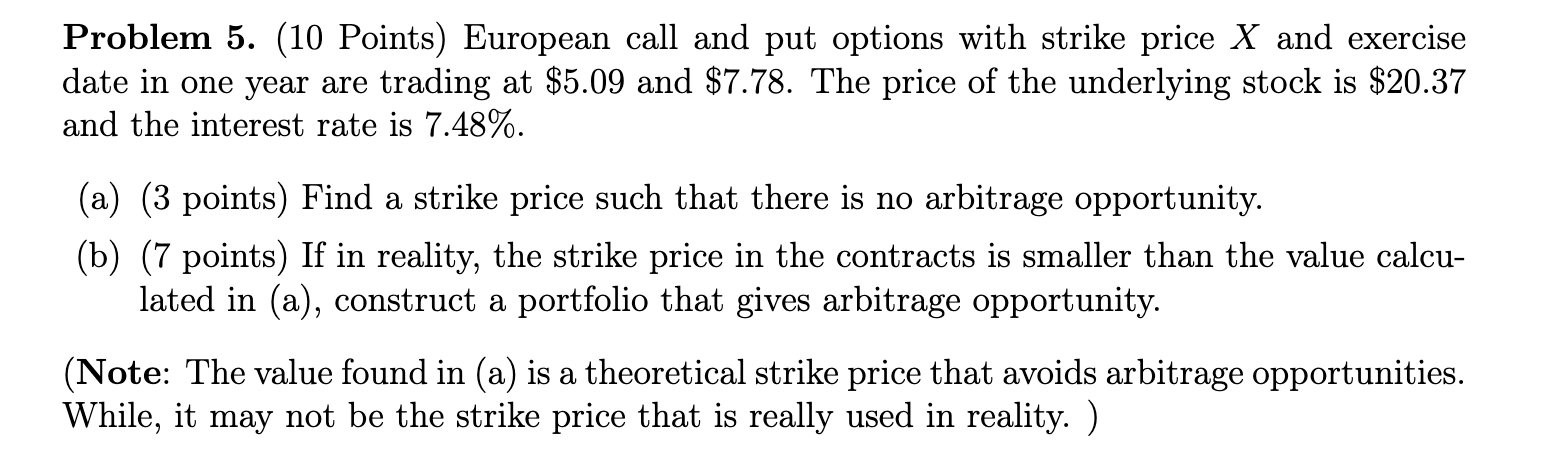

Problem 5. (10 Points) European call and put options with strike price X and exercise date in one year are trading at $5.09 and $7.78. The price of the underlying stock is $20.37 and the interest rate is 7.48%. (a) (3 points) Find a strike price such that there is no arbitrage opportunity. (b) (7 points) If in reality, the strike price in the contracts is smaller than the value calcu- lated in (a), construct a portfolio that gives arbitrage opportunity. (Note: The value found in (a) is a theoretical strike price that avoids arbitrage opportunities. While, it may not be the strike price that is really used in reality. )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts