Question: Hello, Please resolve this problem by explaining it step by step and how the numbers come together. This ACCY250 course. App-Exercise 7-107 Mullen Construction contracted

Hello,

Please resolve this problem by explaining it step by step and how the numbers come together. This ACCY250 course.

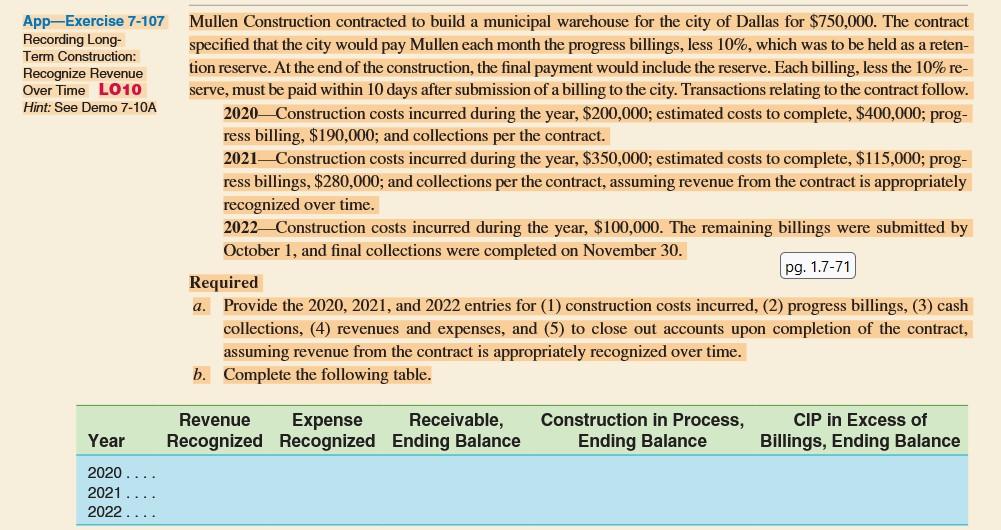

App-Exercise 7-107 Mullen Construction contracted to build a municipal warehouse for the city of Dallas for $750,000. The contract Recording Long- specified that the city would pay Mullen each month the progress billings, less 10%, which was to be held as a retenTerm Construction: Recognize Revenue tion reserve. At the end of the construction, the final payment would include the reserve. Each billing, less the 10% reOver Time LO10 serve, must be paid within 10 days after submission of a billing to the city. Transactions relating to the contract follow. Hint: See Demo 7-10A 2020 - Construction costs incurred during the year, $200,000; estimated costs to complete, $400,000; progress billing, $190,000; and collections per the contract. 2021 - Construction costs incurred during the year, $350,000; estimated costs to complete, $115,000; progress billings, $280,000; and collections per the contract, assuming revenue from the contract is appropriately recognized over time. 2022 - Construction costs incurred during the year, $100,000. The remaining billings were submitted by October 1, and final collections were completed on November 30. Required a. Provide the 2020, 2021, and 2022 entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, (4) revenues and expenses, and (5) to close out accounts upon completion of the contract, assuming revenue from the contract is appropriately recognized over time. b. Complete the following table. App-Exercise 7-107 Mullen Construction contracted to build a municipal warehouse for the city of Dallas for $750,000. The contract Recording Long- specified that the city would pay Mullen each month the progress billings, less 10%, which was to be held as a retenTerm Construction: Recognize Revenue tion reserve. At the end of the construction, the final payment would include the reserve. Each billing, less the 10% reOver Time LO10 serve, must be paid within 10 days after submission of a billing to the city. Transactions relating to the contract follow. Hint: See Demo 7-10A 2020 - Construction costs incurred during the year, $200,000; estimated costs to complete, $400,000; progress billing, $190,000; and collections per the contract. 2021 - Construction costs incurred during the year, $350,000; estimated costs to complete, $115,000; progress billings, $280,000; and collections per the contract, assuming revenue from the contract is appropriately recognized over time. 2022 - Construction costs incurred during the year, $100,000. The remaining billings were submitted by October 1, and final collections were completed on November 30. Required a. Provide the 2020, 2021, and 2022 entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, (4) revenues and expenses, and (5) to close out accounts upon completion of the contract, assuming revenue from the contract is appropriately recognized over time. b. Complete the following table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts