Question: Hello please show all steps and calculations and explanations so I can understand, print clearly please! Estimate the interest rate paid by Procter & Gamble

Hello please show all steps and calculations and explanations so I can understand, print clearly please!

Estimate the interest rate paid by Procter & Gamble on the 5/30 swap in Business Snapshot 5.4 if (a) the CP rate is 6.5% and the Treasury yield curve is at at 6%, and (b) the CP rate is 7.5% and the Treasury yield curve is at at 7% with semiannual compounding.

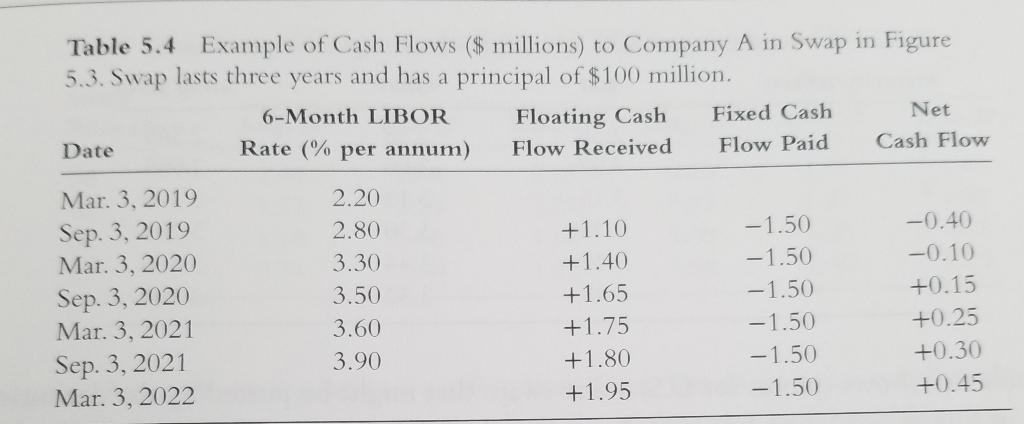

Table 5.4 Example of Cash Flows ($ millions) to Company A in Swap in Figure 5.3. Swap lasts three years and has a principal of $100 million. 6-Month LIBOR Floating Cash Fixed Cash Net Date Rate (% per annum) Flow Received Flow Paid Cash Flow Mar. 3, 2019 Sep. 3, 2019 Mar. 3, 2020 Sep. 3, 2020 Mar. 3, 2021 Sep. 3, 2021 Mar. 3, 2022 2.20 2.80 3.30 3.50 3.60 3.90 +1.10 +1.40 +1.65 +1.75 +1.80 +1.95 -1.50 -1.50 -1.50 -1.50 -1.50 -1.50 -0.40 -0.10 +0.15 +0.25 +0.30 +0.45 Table 5.4 Example of Cash Flows ($ millions) to Company A in Swap in Figure 5.3. Swap lasts three years and has a principal of $100 million. 6-Month LIBOR Floating Cash Fixed Cash Net Date Rate (% per annum) Flow Received Flow Paid Cash Flow Mar. 3, 2019 Sep. 3, 2019 Mar. 3, 2020 Sep. 3, 2020 Mar. 3, 2021 Sep. 3, 2021 Mar. 3, 2022 2.20 2.80 3.30 3.50 3.60 3.90 +1.10 +1.40 +1.65 +1.75 +1.80 +1.95 -1.50 -1.50 -1.50 -1.50 -1.50 -1.50 -0.40 -0.10 +0.15 +0.25 +0.30 +0.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts