Question: HELLO PLEASE SHOW ALL STEPS, FORMULAS, CALCULATIONS SO I CAN FOLLOW AND UNDERSTAND, THANK YOU. I WILL GIVE THUMBS UP. You are investing in RST

HELLO PLEASE SHOW ALL STEPS, FORMULAS, CALCULATIONS SO I CAN FOLLOW AND UNDERSTAND, THANK YOU. I WILL GIVE THUMBS UP.

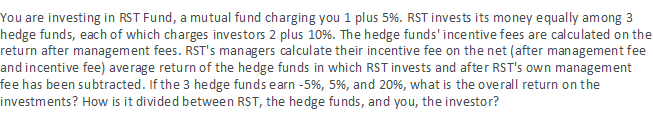

You are investing in RST Fund, a mutual fund charging you 1 plus 5%. RST invests its money equally among 3 hedge funds, each of which charges investors 2 plus 10%. The hedge funds'incentive fees are calculated on the return after management fees. RST's managers calculate their incentive fee on the net (after management fee and incentive fee) average return of the hedge funds in which RST invests and after RST's own management fee has been subtracted. If the 3 hedge funds earn -5%, 5%, and 20%, what is the overall return on the investments? How is it divided between RST, the hedge funds, and you, the investor? You are investing in RST Fund, a mutual fund charging you 1 plus 5%. RST invests its money equally among 3 hedge funds, each of which charges investors 2 plus 10%. The hedge funds'incentive fees are calculated on the return after management fees. RST's managers calculate their incentive fee on the net (after management fee and incentive fee) average return of the hedge funds in which RST invests and after RST's own management fee has been subtracted. If the 3 hedge funds earn -5%, 5%, and 20%, what is the overall return on the investments? How is it divided between RST, the hedge funds, and you, the investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts