Question: Hello, please show work step by step for this problem. The answer is not zero for sure. Thank you Chris recently took out a loan

Hello, please show work step by step for this problem. The answer is not zero for sure. Thank you

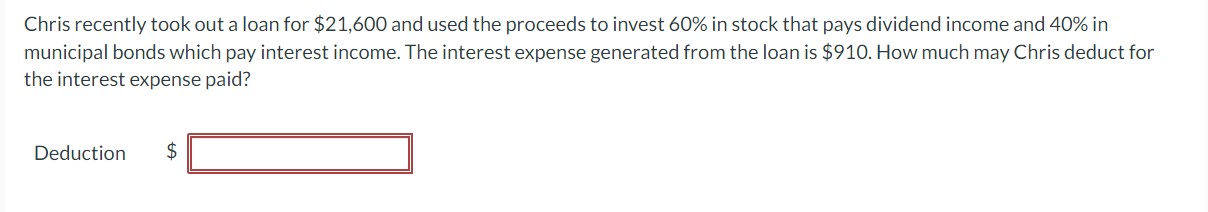

Chris recently took out a loan for $21,600 and used the proceeds to invest 60% in stock that pays dividend income and 40% in municipal bonds which pay interest income. The interest expense generated from the loan is $910. How much may Chris deduct for the interest expense paid? Deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts