Question: Hello . Please solve detailed. I will upvote you lifetime. PART: B) Mini Case Study [3 x 2 = 6 marks] (Answer from google is

Hello . Please solve detailed. I will upvote you lifetime.

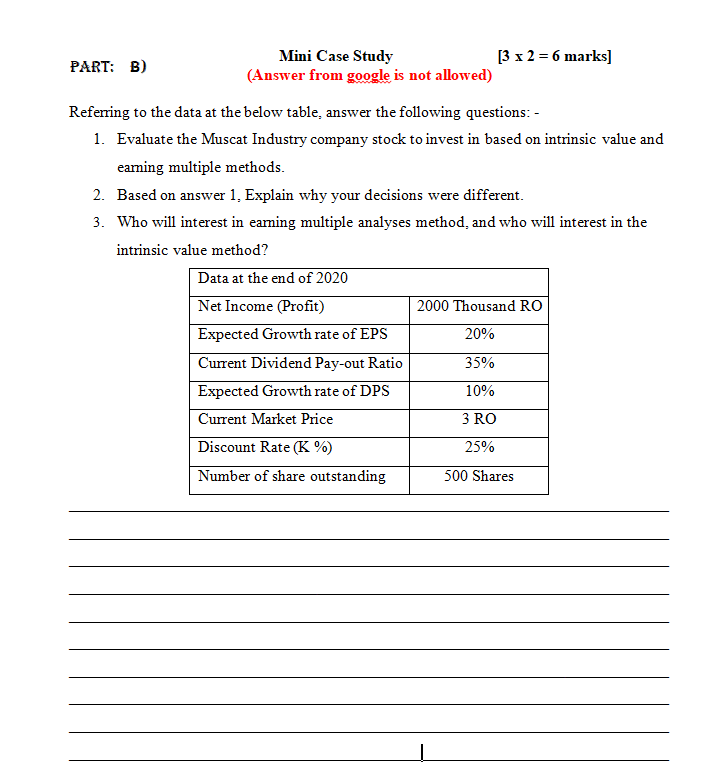

PART: B) Mini Case Study [3 x 2 = 6 marks] (Answer from google is not allowed) Referring to the data at the below table, answer the following questions: - 1. Evaluate the Muscat Industry company stock to invest in based on intrinsic value and eaming multiple methods. 2. Based on answer 1. Explain why your decisions were different. 3. Who will interest in eaming multiple analyses method, and who will interest in the intrinsic value method? Data at the end of 2020 Net Income (Profit) 2000 Thousand RO Expected Growth rate of EPS 20% Current Dividend Pay-out Ratio 35% Expected Growth rate of DPS 10% Current Market Price 3 RO Discount Rate (K %) 25% Number of share outstanding 500 Shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts