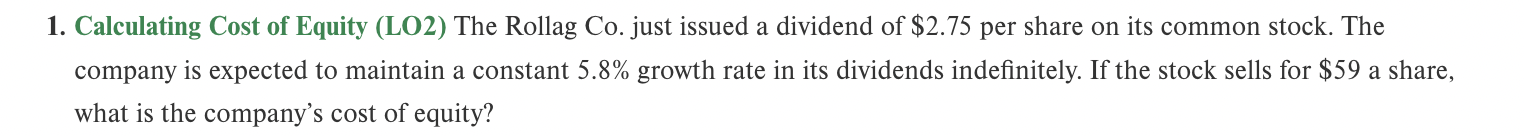

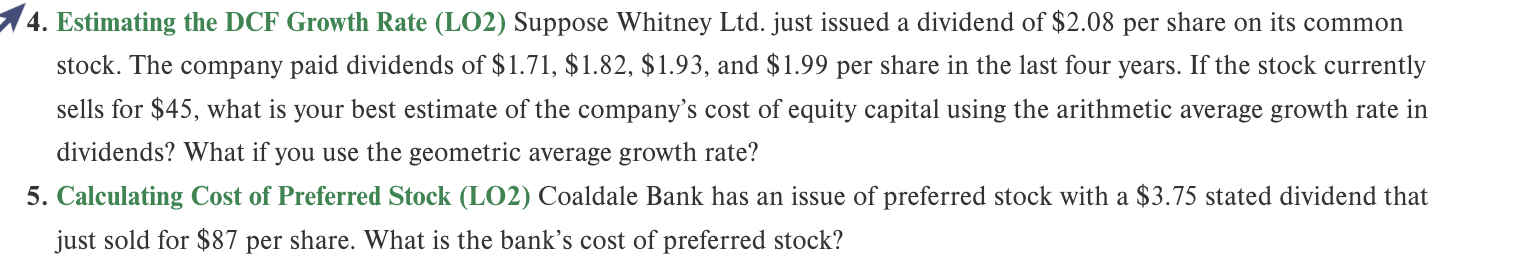

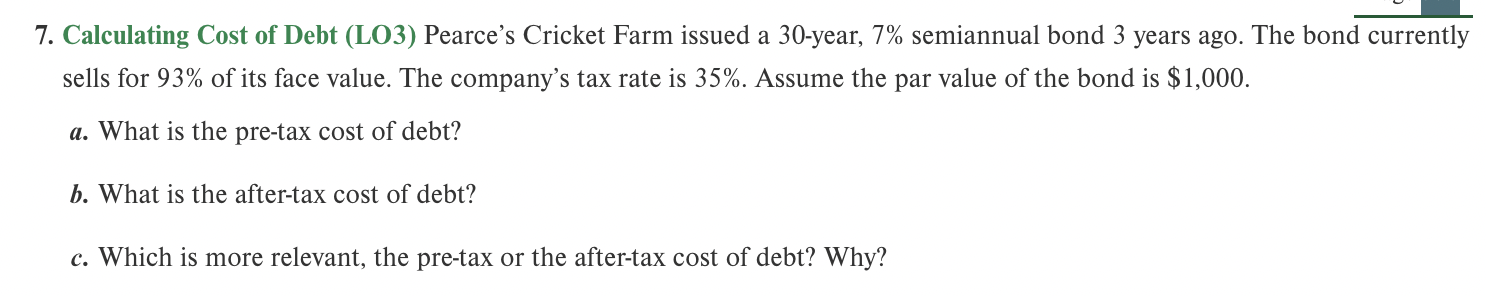

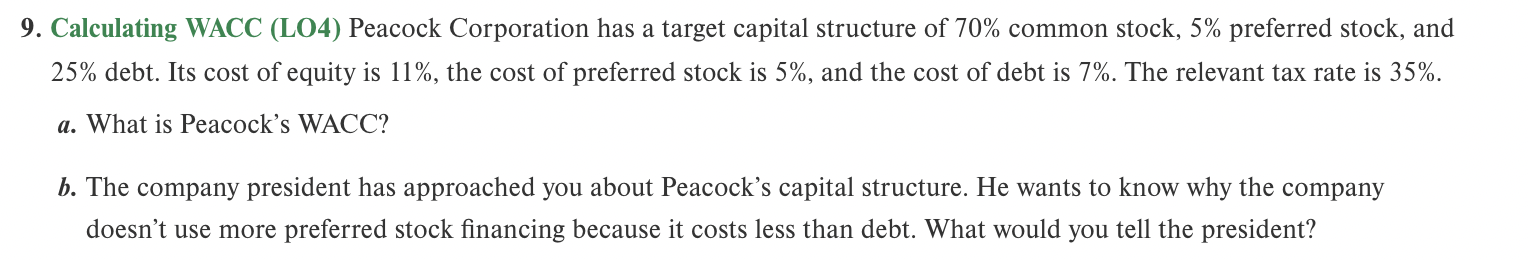

Question: Hello please suggest how to answer these questions. 1. Calculating Cost of Equity (LO2) The Rollag Co. just issued a dividend of $2.75 per share

Hello please suggest how to answer these questions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock