Question: Hello, Please your help solving it and explainning theory. I get confuse choosing between PUT or CALL. Kind of regards, S/SE 5 C3300 Index OMON

Hello,

Please your help solving it and explainning theory. I get confuse choosing between PUT or CALL.

Kind of regards,

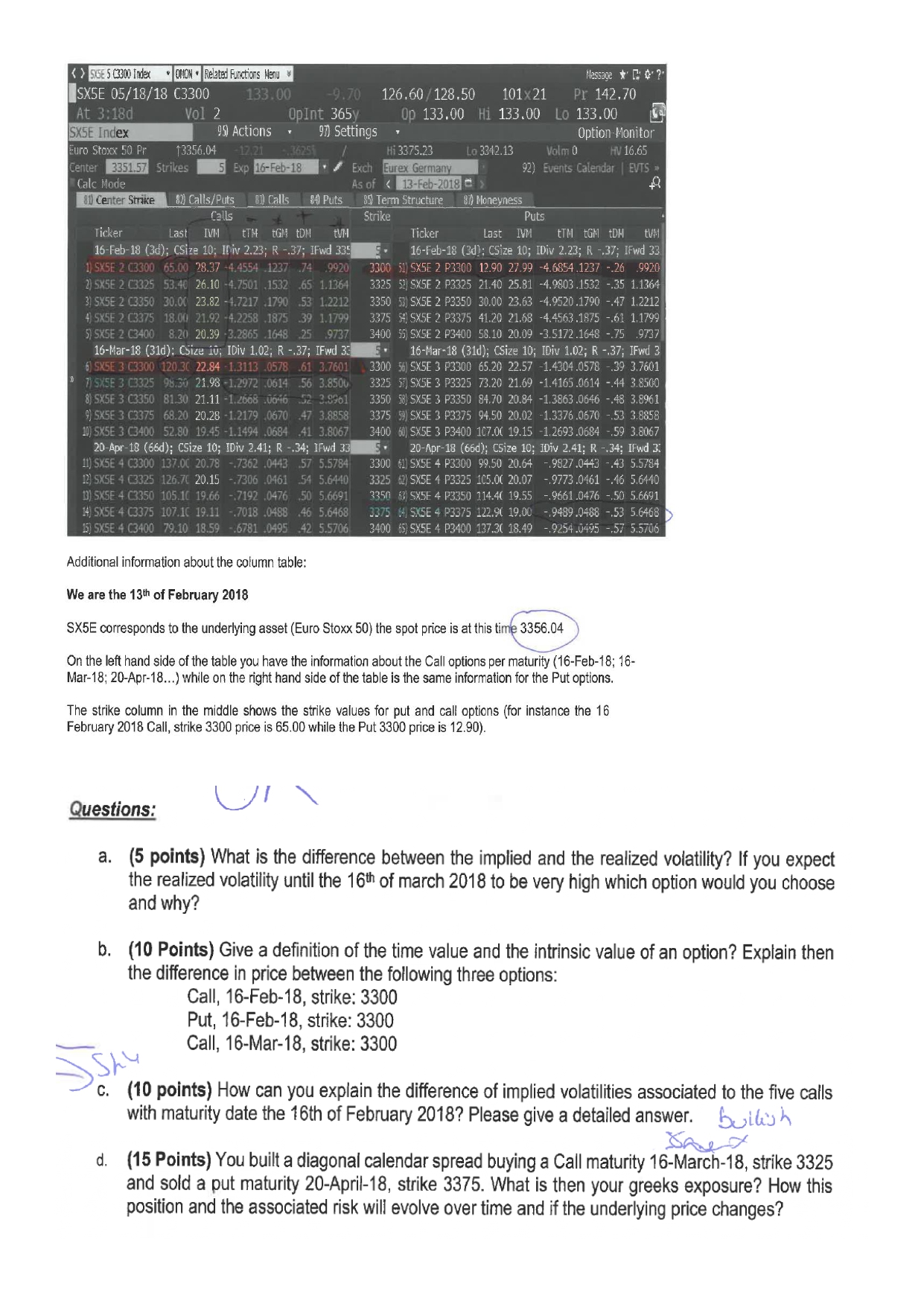

S/SE 5 C3300 Index OMON Related Functions Menu Nessage to SXSE 05/18/18 (3300 133.00 -9.70 126.60 128.50 101x21 Pr 142.70 At 3:18d Vol 2 Opint 365 Op 133.00 Hi 133.00 LO 133.00 SX5E Index 99 Actions 97) Settings Option Monitor Euro Stoxx 50 PM 13356.04 -12,21 36251 Hi 3375.23 Lo 3342.13 Volm 0 HV 16.65 Center 3351.57 Strikes Exp 16-Feb-18 Exch Eurex Germany 92) Events Calendar EVTS Calc Mode As of 13-Feb-2018 - 3 81 Center Strike 82) Calls/Puts 83) Calls 94 Puts 85) Term Structure 87) Moneyness Calls Strike Puts Ticker Last IVM THEGN EDN TVM Ticker Last IVN tTM TGM DH TVM 16-Feb-18 (3d); CSize 10: If iv 2.23; R -.37; IFwd 335 16-Feb-18 (3d): Csize 10; IDiv 2.23; R --37; IFwd 33 1) SXSE 2 03300 65.00 28.37 -4.4554 1237 74 9920 3300 51) SXSE 2 P3300 12.90 27.99 -4.6854.1237 - 26 9920 2) SXSE 2 C3325 53.40 26.10 -4.7501 1532 65 1.1364 3325 21 SX5E 2 P3325 21.40 25.81 -4.9803.1532 -.35 1.1364 3) SXSE 2 C3350 30.00 23.82 -4.7217 1790.53 1,2212 3350 53) SXSE 2 P3350 30.00 23.63 -4.9520.1790 -.47 1.2212 4 SXSE 2 C3375 18.00 21.92 -4.2258 .1875 39 1.1799 3375 SX5E 2 P3375 41.20 21.68 -4.4563.1875 -61 1.1799 5) SXSE 2 C3400 8.20 20.39 -3.2865 1648 25 9737 3400 55 SXSE 2 P3400 58.10 20.09 -3.5172.1648 - 75 9737 16-Mar-18 (310): CSize iv; IDiv 1.02; R - 37; IFwd 33 16-Mar-18 (310); CSize 10; IDiv 1.02; R - 37; IFwd 3 6) SXSE 3 C3300 120.30 22.84 1.3113 .0578 61 3.7601 3300 56) SX5E 3 P3300 65.20 22.57 1.4304.0578-39 3.7601 7) SXSE 3 03325 98.30 21.98 -1.2972 0614.56 3.8500 3325 5i) SXSE 3 P3325 73.20 21.69 -1.4165.0614 - 44 3.8500 8) SXSE 3 C3350 81.30 21.11 -1.2608 U6-6.52 3.9961 3350 58) SX5E 3 P3350 84.70 20.84 -1.3863.0646 - 48 3.8961 9) SX5E 3 C3375 68.20 20.28 -1.2179 0670.47 3.8858 3375_59) SX5E 3 P3375 94.50 20.02 -1.3376.0670 -.53 3.8858 10) SX5E 3 C3400 52.80 19.45 -1.1494 .0684 .41 3.8067 3400 60) SX5E 3 P3400 107.0( 19.15 -1.2693.0684 - 59 3.8067 20-Apr-18 (66d); CSize 10; IDiv 2.41; R - 34; IFwd 33 20-Apr-18 (66d); CSize 10; IDiV 2.41; R - 34; IFwd 3: 11) SX5E 4 C3300 137.00 20.78 -.7362 .0443.57 5.5784 3300 61) SXSE 4 P3300 99.50 20.64 -9827.0443 - 43 5.5784 12) SXSE 4 C3325 126.71 20.15 -.7306 0461 54 5.6440 332562) SX5E 4 P3325 105.00 20.07 -9773.0461 -.46 5.6440 13) SXSE 4 C3350 105.16 19.66 -.7192 0476.50 5.6691 3350 SX5E 4 P3350 114.4( 19.55 - 9661.0476 -.50 5.6691 14) SXSE 4 (3375 107.16 19.11 -.7018 .048846 5.6468 3375 64 SXSE 4 P3375 122.96 19.00 -9439.0488 - 53 5.6468 15) SXSE 4 C3400 79.10 18.59 -6781 .0495 42 5.5706 340065) SXSE 4 P3400 137.30 18.49 -9254.0445 - 57 5.5706 Additional information about the column table: We are the 13th of February 2018 SX5E corresponds to the underlying asset (Euro Stoxx 50) the spot price is at this time 3356.04 On the left hand side of the table you have the information about the Call options per maturity (16-Feb-18; 16- Mar-18; 20-Apr-18...) while on the right hand side of the table is the same information for the Put options. The strike column in the middle shows the strike values for put and call options (for instance the 16 February 2018 Call, strike 3300 price is 65.00 while the Put 3300 price is 12.90). Questions: a. (5 points) What is the difference between the implied and the realized volatility? If you expect the realized volatility until the 16th of march 2018 to be very high which option would you choose and why? b. (10 Points) Give a definition of the time value and the intrinsic value of an option? Explain then the difference in price between the following three options: Call, 16-Feb-18, strike: 3300 Put, 16-Feb-18, strike: 3300 Call, 16-Mar-18, strike: 3300 JS C. (10 points) How can you explain the difference of implied volatilities associated to the five calls with maturity date the 16th of February 2018? Please give a detailed answer. bullish d. (15 Points) You built a diagonal calendar spread buying a Call maturity 16-March-18, strike 3325 and sold a put maturity 20-April-18, strike 3375. What is then your greeks exposure? How this position and the associated risk will evolve over time and if the underlying price changes? S/SE 5 C3300 Index OMON Related Functions Menu Nessage to SXSE 05/18/18 (3300 133.00 -9.70 126.60 128.50 101x21 Pr 142.70 At 3:18d Vol 2 Opint 365 Op 133.00 Hi 133.00 LO 133.00 SX5E Index 99 Actions 97) Settings Option Monitor Euro Stoxx 50 PM 13356.04 -12,21 36251 Hi 3375.23 Lo 3342.13 Volm 0 HV 16.65 Center 3351.57 Strikes Exp 16-Feb-18 Exch Eurex Germany 92) Events Calendar EVTS Calc Mode As of 13-Feb-2018 - 3 81 Center Strike 82) Calls/Puts 83) Calls 94 Puts 85) Term Structure 87) Moneyness Calls Strike Puts Ticker Last IVM THEGN EDN TVM Ticker Last IVN tTM TGM DH TVM 16-Feb-18 (3d); CSize 10: If iv 2.23; R -.37; IFwd 335 16-Feb-18 (3d): Csize 10; IDiv 2.23; R --37; IFwd 33 1) SXSE 2 03300 65.00 28.37 -4.4554 1237 74 9920 3300 51) SXSE 2 P3300 12.90 27.99 -4.6854.1237 - 26 9920 2) SXSE 2 C3325 53.40 26.10 -4.7501 1532 65 1.1364 3325 21 SX5E 2 P3325 21.40 25.81 -4.9803.1532 -.35 1.1364 3) SXSE 2 C3350 30.00 23.82 -4.7217 1790.53 1,2212 3350 53) SXSE 2 P3350 30.00 23.63 -4.9520.1790 -.47 1.2212 4 SXSE 2 C3375 18.00 21.92 -4.2258 .1875 39 1.1799 3375 SX5E 2 P3375 41.20 21.68 -4.4563.1875 -61 1.1799 5) SXSE 2 C3400 8.20 20.39 -3.2865 1648 25 9737 3400 55 SXSE 2 P3400 58.10 20.09 -3.5172.1648 - 75 9737 16-Mar-18 (310): CSize iv; IDiv 1.02; R - 37; IFwd 33 16-Mar-18 (310); CSize 10; IDiv 1.02; R - 37; IFwd 3 6) SXSE 3 C3300 120.30 22.84 1.3113 .0578 61 3.7601 3300 56) SX5E 3 P3300 65.20 22.57 1.4304.0578-39 3.7601 7) SXSE 3 03325 98.30 21.98 -1.2972 0614.56 3.8500 3325 5i) SXSE 3 P3325 73.20 21.69 -1.4165.0614 - 44 3.8500 8) SXSE 3 C3350 81.30 21.11 -1.2608 U6-6.52 3.9961 3350 58) SX5E 3 P3350 84.70 20.84 -1.3863.0646 - 48 3.8961 9) SX5E 3 C3375 68.20 20.28 -1.2179 0670.47 3.8858 3375_59) SX5E 3 P3375 94.50 20.02 -1.3376.0670 -.53 3.8858 10) SX5E 3 C3400 52.80 19.45 -1.1494 .0684 .41 3.8067 3400 60) SX5E 3 P3400 107.0( 19.15 -1.2693.0684 - 59 3.8067 20-Apr-18 (66d); CSize 10; IDiv 2.41; R - 34; IFwd 33 20-Apr-18 (66d); CSize 10; IDiV 2.41; R - 34; IFwd 3: 11) SX5E 4 C3300 137.00 20.78 -.7362 .0443.57 5.5784 3300 61) SXSE 4 P3300 99.50 20.64 -9827.0443 - 43 5.5784 12) SXSE 4 C3325 126.71 20.15 -.7306 0461 54 5.6440 332562) SX5E 4 P3325 105.00 20.07 -9773.0461 -.46 5.6440 13) SXSE 4 C3350 105.16 19.66 -.7192 0476.50 5.6691 3350 SX5E 4 P3350 114.4( 19.55 - 9661.0476 -.50 5.6691 14) SXSE 4 (3375 107.16 19.11 -.7018 .048846 5.6468 3375 64 SXSE 4 P3375 122.96 19.00 -9439.0488 - 53 5.6468 15) SXSE 4 C3400 79.10 18.59 -6781 .0495 42 5.5706 340065) SXSE 4 P3400 137.30 18.49 -9254.0445 - 57 5.5706 Additional information about the column table: We are the 13th of February 2018 SX5E corresponds to the underlying asset (Euro Stoxx 50) the spot price is at this time 3356.04 On the left hand side of the table you have the information about the Call options per maturity (16-Feb-18; 16- Mar-18; 20-Apr-18...) while on the right hand side of the table is the same information for the Put options. The strike column in the middle shows the strike values for put and call options (for instance the 16 February 2018 Call, strike 3300 price is 65.00 while the Put 3300 price is 12.90). Questions: a. (5 points) What is the difference between the implied and the realized volatility? If you expect the realized volatility until the 16th of march 2018 to be very high which option would you choose and why? b. (10 Points) Give a definition of the time value and the intrinsic value of an option? Explain then the difference in price between the following three options: Call, 16-Feb-18, strike: 3300 Put, 16-Feb-18, strike: 3300 Call, 16-Mar-18, strike: 3300 JS C. (10 points) How can you explain the difference of implied volatilities associated to the five calls with maturity date the 16th of February 2018? Please give a detailed answer. bullish d. (15 Points) You built a diagonal calendar spread buying a Call maturity 16-March-18, strike 3325 and sold a put maturity 20-April-18, strike 3375. What is then your greeks exposure? How this position and the associated risk will evolve over time and if the underlying price changes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts