Question: hello Question 17 (2 points) Kingston Utilities is evaluating two projects. The first project has net after-tax cash inflows of $62396 per year starting at

hello

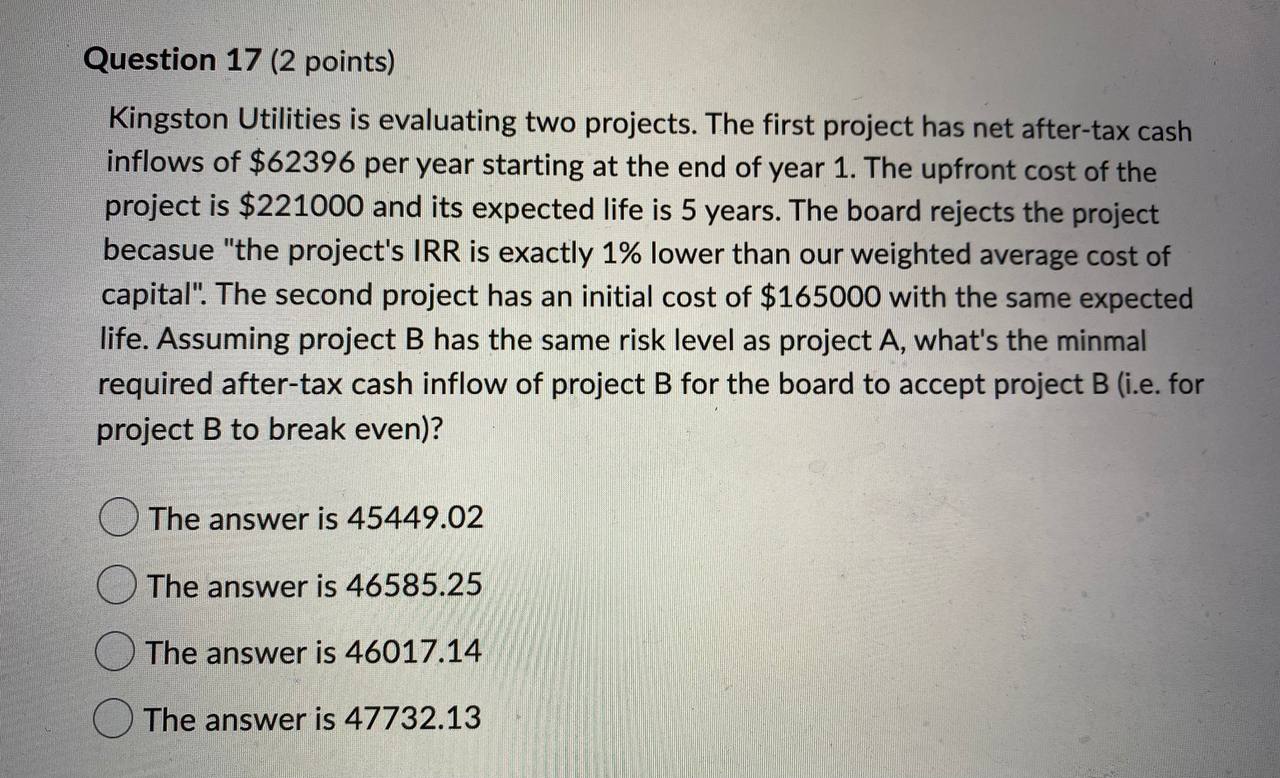

Question 17 (2 points) Kingston Utilities is evaluating two projects. The first project has net after-tax cash inflows of $62396 per year starting at the end of year 1. The upfront cost of the project is $221000 and its expected life is 5 years. The board rejects the project becasue "the project's IRR is exactly 1% lower than our weighted average cost of capital". The second project has an initial cost of $165000 with the same expected life. Assuming project B has the same risk level as project A, what's the minmal required after-tax cash inflow of project B for the board to accept project B (i.e. for project B to break even)? The answer is 45449.02 The answer is 46585.25 The answer is 46017.14 The answer is 47732.13

Step by Step Solution

There are 3 Steps involved in it

The correct answer is 4601714 To solve this problem we need to find the minimal required aftertax ca... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6642386289450_984326.pdf

180 KBs PDF File

6642386289450_984326.docx

120 KBs Word File