Question: Hello, question 4 please. Please show the excel formulas. Thank You!!! You are about to price a call option that has a strike price of

Hello, question 4 please. Please show the excel formulas. Thank You!!!

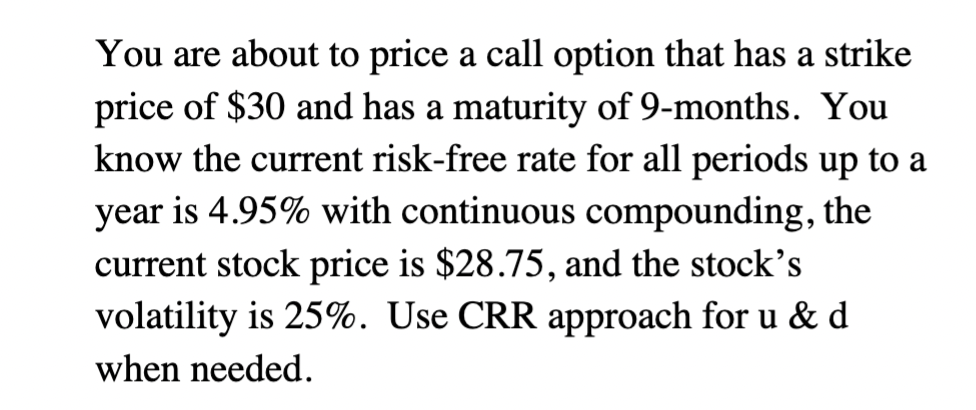

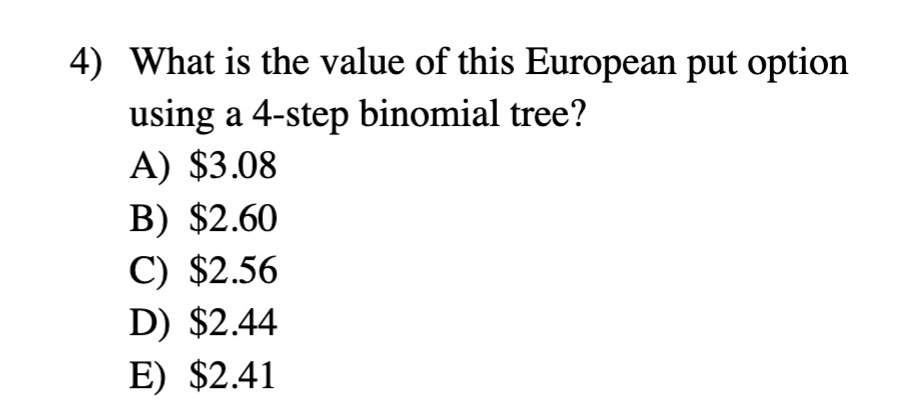

You are about to price a call option that has a strike price of $30 and has a maturity of 9-months. You know the current risk-free rate for all periods up to a year is 4.95% with continuous compounding, the current stock price is $28.75, and the stock's volatility is 25%. Use CRR approach for u & d when needed. 4) What is the value of this European put option using a 4-step binomial tree? A) $3.08 B) $2.60 C) $2.56 D) $2.44 E) $2.41 You are about to price a call option that has a strike price of $30 and has a maturity of 9-months. You know the current risk-free rate for all periods up to a year is 4.95% with continuous compounding, the current stock price is $28.75, and the stock's volatility is 25%. Use CRR approach for u & d when needed. 4) What is the value of this European put option using a 4-step binomial tree? A) $3.08 B) $2.60 C) $2.56 D) $2.44 E) $2.41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts