Question: Hello, Questions in below is all about in Chapter 8 in the textbook of Identity Theft Handbook What is medical identity theft and why is

Hello,

Questions in below is all about in Chapter 8 in the textbook of Identity Theft Handbook

-

What is medical identity theft and why is it becoming more prevalent?

-

Which of the prevention methods discussed on pages 107 110 is the most effective in preventing medical identity theft? Why?

-

Do you think that healthcare records should be placed on the Web? Why or Why not?

-

In your opinion, is the theft of medical records and/or medical information more important than other types of identity theft?

Thank you for your help,

Michele

(See below screenshot for Chapter 8 related to the questions number 2 and 3 and 4)

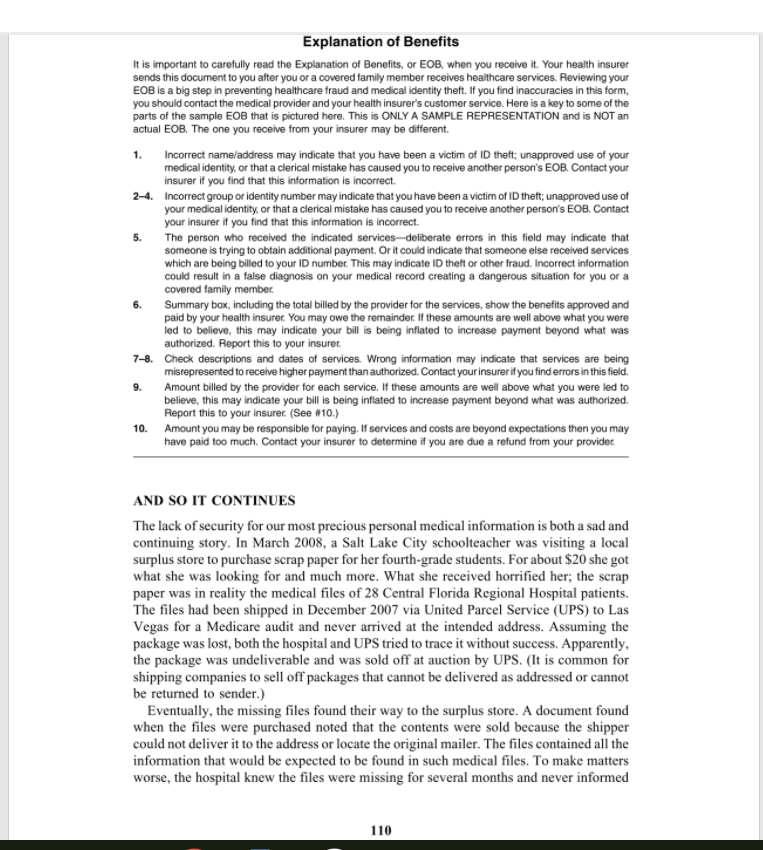

R Try the new Google Books Medical Identity Theft PREVENTION AND SECURITY Ben Franklin's wise adage of an ounce of prevention is worth a pound of cure" is just as true when applied to protecting against possible medical identity theft. Here are 14 best practices for prevention and protection for both the patient and healthcare providers to consider: 1. Guard your medical insurance card. In many ways it is just as valuable as your credit card. An insurance card is like a Visa card with a $1 million spending limit, warns Hollis. 22 Safeguard the card and the information contained on it. When you check in at your doctor's office, keep an eye on the card until you get it back. If it is lost, take the same steps you would if you lost your credit card. Instruct your family members to do the same. 2. If it sounds too good to be true, it usually is. Be skeptical when you receive calls from telemarketers offering "free" medical care, health screenings, or discounted medical plans. Con artists often use ruses to get unsuspecting victims to provide information. The data could be used in submitting phony medical claims and identity theft in your name. Never give your medical insurance number or any other personal information to anyone who calls, and that includes anyone coming to your door soliciting products or services. If you cannot easily say no, at least require them to mail you detailed information before you provide any information. Scammers usually will not follow-up; they will just move on to another potential victim. 3. Be Web savvy. There are innumerable collection points for your personal information. Many are found on the Web. While Web sites may simply be collecting marketing information, think about whether you want to provide information on yourself, including illnesses and medical conditions. Be extra careful when registering on health sites or dialing toll-free numbers to ask about new drugs, treatments, or an illness. 4. Opt out. Do not be your own worst enemy and disclose confidential information on product registration and warranty cards or marketing surveys. Send in opt-out forms to stop information from being shared with third parties. 5. Talk to your doctor and pharmacist about patient privacy. Ask them about their privacy and security procedures. I would venture to guess that you have never done that, and most people probably have not either. 6. Read your EOB statement, then read it again. Carefully read each and every explanation of benefits letter that you receive after medical treatment. Our No. 1 defense is the consumer himself," says Hollis. "We send our explanation-of- benefits notices, and people round-file those right off the bat. If people would look at those, a lot of theft would get caught. 23 Look for signs of unauthorized treatments performed under your name and insurance coverage. This may simply be a mistake, or it may be evidence of fraud that you will need to address immediately. Report any discrepancies to your insurance provider. Exhibit 8.1 is a resource that anyone can use in reviewing and understanding their EOB for possible identity theft Explanation of Benefits It is important to carefully read the Explanation of Benefits, or EOB, when you receive it. Your health insurer sends this document to you after you or a covered family member receives healthcare services. Reviewing your EOB is a big step in preventing healthcare fraud and medical identity theft. If you find inaccuracies in this form, you should contact the medical provider and your health insurer's customer service. Here is a key to some of the parts of the sample EOB that is pictured here. This is ONLY A SAMPLE REPRESENTATION and is NOT an actual EOB. The one you receive from your insurer may be different 1. Incorrect name/address may indicate that you have been a victim of ID theft; unapproved use of your medical identity, or that a clerical mistake has caused you to receive another person's EOB. Contact your insurer if you find that this information is incorrect. 2-4. Incorrect group or identity number may indicate that you have been a victim of ID theft; unapproved use of your medical identity, or that a clerical mistake has caused you to receive another person's EOB. Contact your insurer if you find that this information is incorrect. The person who received the indicated services-deliberate errors in this field may indicate that someone is trying to obtain additional payment. Or it could indicate that someone else received services which are being billed to your ID number. This may indicate ID theft or other fraudIncorrect information could result in a false diagnosis on your medical record creating a dangerous situation for you or a covered family member Summary box, including the total billed by the provider for the services, show the benefits approved and paid by your health insurer. You may owe the remainder. If these amounts are well above what you were led to believe, this may indicate your bill is being inflated to increase payment beyond what was authorized. Report this to your insurer. 7-8. Check descriptions and dates of services. Wrong information may indicate that services are being misrepresented to receive higher payment than authorized. Contact your insurer if you find errors in this field. Amount billed by the provider for each service. If these amounts are well above what you were led to believe, this may indicate your bill is being inflated to increase payment beyond what was authorized. Report this to your insurer. (See #10.) Amount you may be responsible for paying. If services and costs are beyond expectations then you may have paid too much. Contact your insurer to determine if you are due a refund from your provider 9. 10. AND SO IT CONTINUES The lack of security for our most precious personal medical information is both a sad and continuing story. In March 2008, a Salt Lake City schoolteacher was visiting a local surplus store to purchase scrap paper for her fourth-grade students. For about $20 she got what she was looking for and much more. What she received horrified her; the scrap paper was in reality the medical files of 28 Central Florida Regional Hospital patients. The files had been shipped in December 2007 via United Parcel Service (UPS) to Las Vegas for a Medicare audit and never arrived at the intended address. Assuming the package was lost, both the hospital and UPS tried to trace it without success. Apparently, the package was undeliverable and was sold off at auction by UPS. (It is common for shipping companies to sell off packages that cannot be delivered as addressed or cannot be returned to sender.) Eventually, the missing files found their way to the surplus store. A document found when the files were purchased noted that the contents were sold because the shipper could not deliver it to the address or locate the original mailer. The files contained all the information that would be expected to be found in such medical files. To make matters worse, the hospital knew the files were missing for several months and never informed 110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts