Question: Hello, Read Question: Leon Inc. has the following capital structure, which it considers to be optimal: Debt 25% Preferred stock 15 Common equity 60 Leons

Hello,

Read Question:

Leon Inc. has the following capital structure, which it considers to be optimal:

| Debt | 25% |

| Preferred stock | 15 |

| Common equity | 60 |

Leons expected net income this year is $34,285.72, its established dividend payout ratio is 30%, its federal-plus-state tax rate is 25%, and investors expect future earnings and dividends to grow at a constant rate of 9%. Leon paid a dividend of $3.60 per share last year, and its stock currently sells for $54.00 per share. Leon can obtain new capital in the following ways:

- New preferred stock with a dividend of $11.00 can be sold to the public at a price of $95.00 per share.

- Debt can be sold at an interest rate of 12%.

Questions A-D

Part A:

Determine the cost of each capital component.

Cost of Common Equity = %

Cost of Preferred Stock = %

Cost of Debt = %

Part B:

Calculate the WACC. (Note: answer is a percentage, enter only the number)

Part C:

Part D:

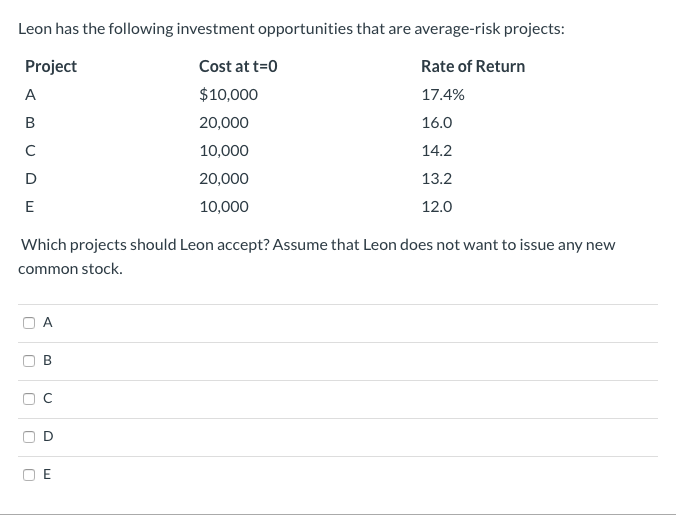

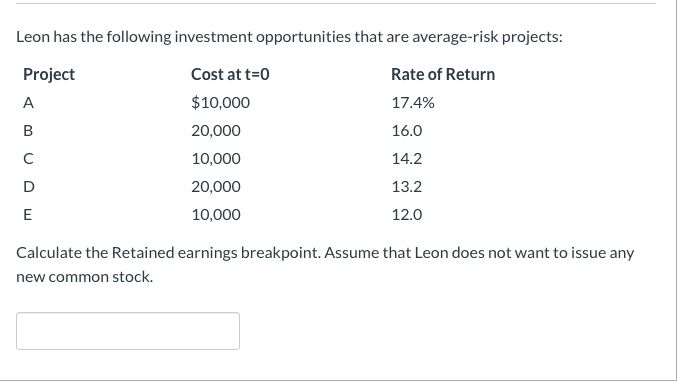

Leon has the following investment opportunities that are average-risk projects: Project Cost at t=0 $10,000 20,000 10,000 20,000 10,000 Rate of Return 17.4% 16.0 14.2 13.2 12.0 Which projects should Leon accept? Assume that Leon does not want to issue any new common stock. OB OD Leon has the following investment opportunities that are average-risk projects: Project Rate of Return 17.4% Cost at t=0 $10,000 20,000 10,000 20,000 10,000 16.0 14.2 13.2 12.0 Calculate the Retained earnings breakpoint. Assume that Leon does not want to issue any new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts