Question: Hello, really need help on this finance problem. help is appreciated! 2. Currently, the risk-free interest rate (RF) is 1% and the required market return

Hello, really need help on this finance problem. help is appreciated!

Hello, really need help on this finance problem. help is appreciated!

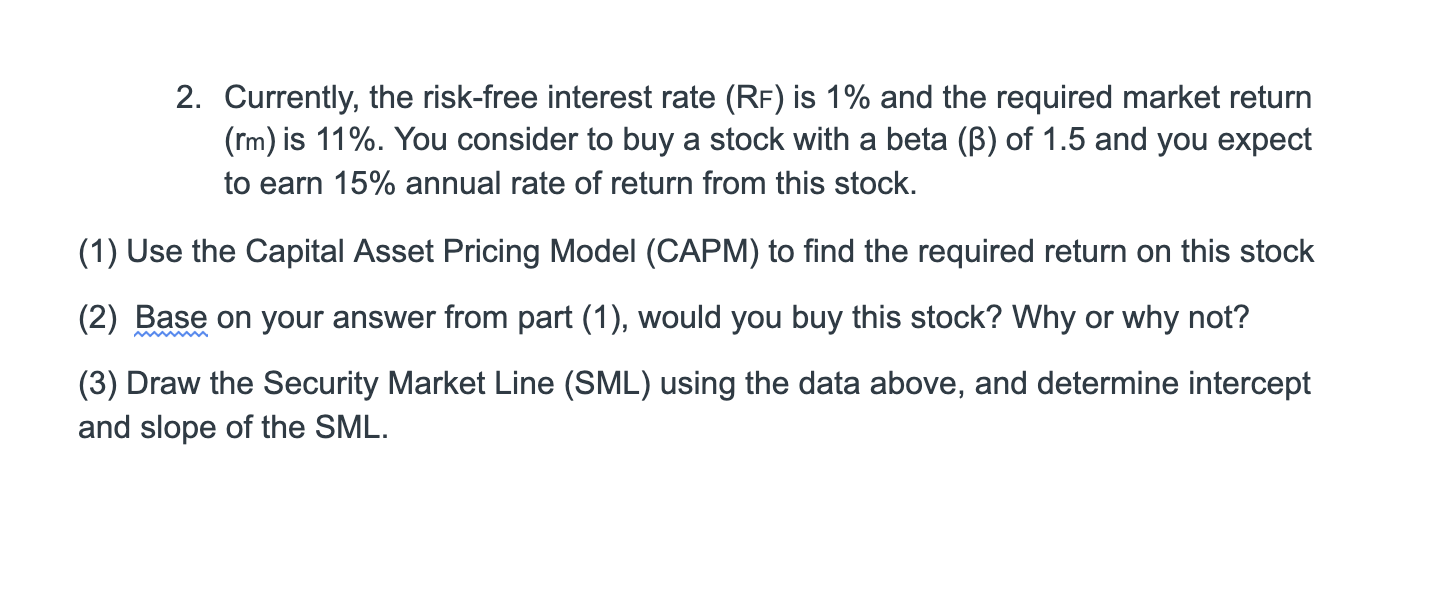

2. Currently, the risk-free interest rate (RF) is 1% and the required market return (rm) is 11%. You consider to buy a stock with a beta () of 1.5 and you expect to earn 15% annual rate of return from this stock. (1) Use the Capital Asset Pricing Model (CAPM) to find the required return on this stock (2) Base on your answer from part (1), would you buy this stock? Why or why not? (3) Draw the Security Market Line (SML) using the data above, and determine intercept and slope of the SML

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts