Question: Hello, So i'm having trouble with parts 4 and 5 here. So for part 4 I'm not sure what Vd and Vs are suppose to

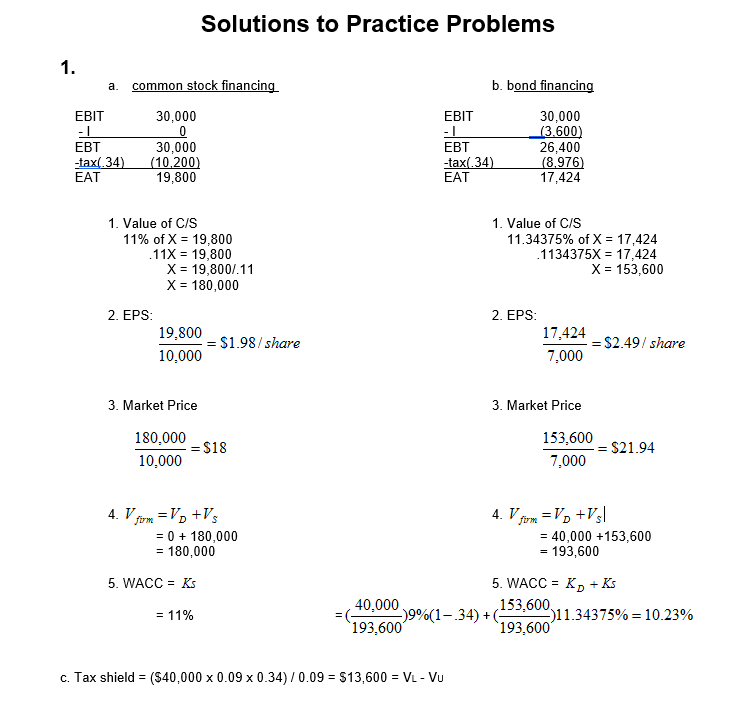

Hello, So i'm having trouble with parts 4 and 5 here. So for part 4 I'm not sure what Vd and Vs are suppose to stand for, those i can make a guess and say that Vs is the value of the common stock. And for part 5 The WACC I'm not entierly sure why we picked the numbers that we did. I'd appreciate it if someone could go into detail for these two parts! Thanks!

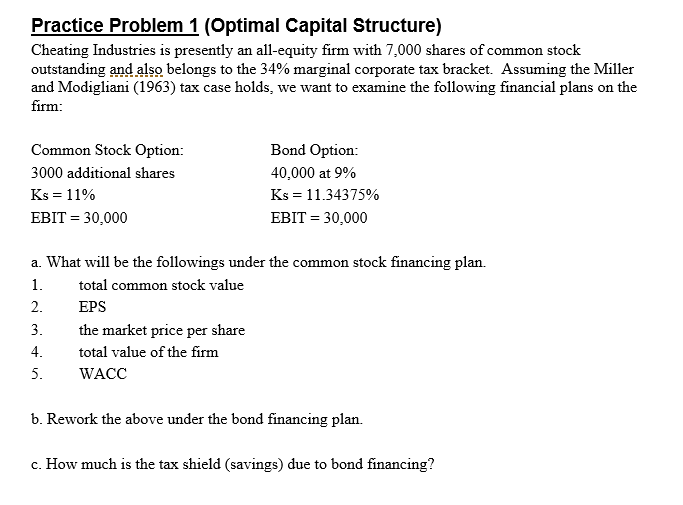

Practice Problem 1 (Optimal Capital Structure) Cheating Industries is presently an all-equity firm with 7,000 shares of common stock outstanding and also belongs to the 34% marginal corporate tax bracket. Assuming the Miller and Modigliani (1963) tax case holds, we want to examine the following financial plans on the firm Common Stock option: Bond Option: 40,000 at 9 3000 additional shares Ks 11.34375% EBIT 30,000 EBIT 30,000 a. What will be the followings under the common stock financing plan. 1. total common stock value EPS the market price per share 4. total value of the firm WACC b. Rework the above under the bond financing plan. c. How much is the tax shield (savings) due to bond financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts