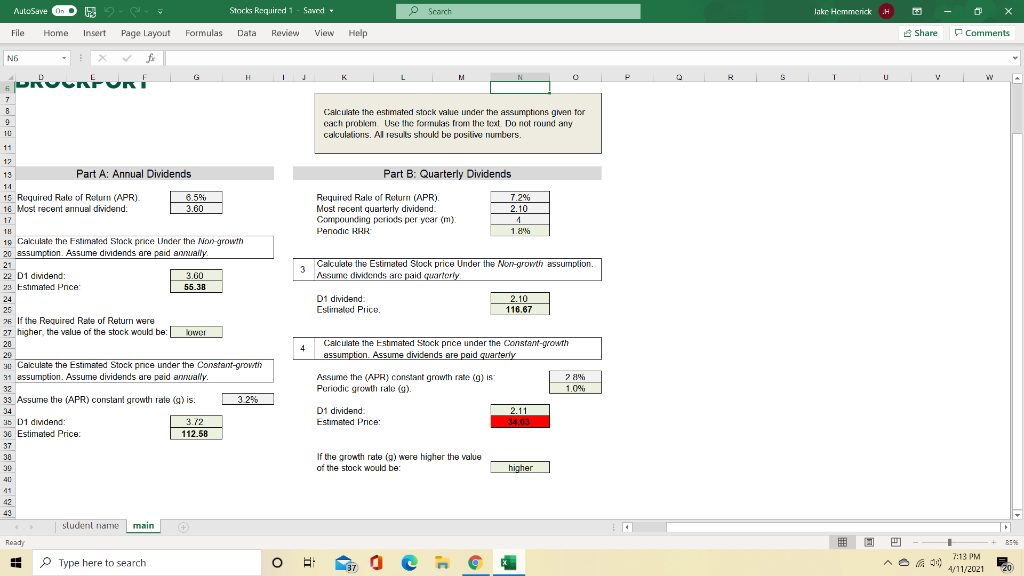

Question: Hello, The cell highlighted in red is the one that I am struggling with. They are looking for the constant growth assumption quarterly. I have

Hello,

The cell highlighted in red is the one that I am struggling with. They are looking for the constant growth assumption quarterly. I have been using D1/(Periodic RRR-Periodic growth rate (g). What am I missing?

AutoSave On Stocks Required 1 - Saved O Scarch Jake Hommerick File Home Insert Page Layout Formulas Data Review View Help Share Comments NG H K U V Prventura 7 Calculate the estimated stock value under the assumptions given for cach problem. Use the formulas from the text. Do not round any calculations. Al resuls should be positive numbers. Part B: Quarterly Dividends 7.2% 2.10 Required Rale of Return (APR). Most recent quarterly dividend Compounding periods per year (m) Penodic RRR 1.8% 3 Calculate the Estimated Stock price Under the Non-growth assumption. Assure dividends are paid quarterly B 9 10 11 12 19 Part A: Annual Dividends 14 15 Required Rale of Rolumn (APR). 6.5% 16 Most recent annual dividend: 3.60 17 18 19 Calculate the Estimated Stock price Under the Non-growth 20 assumption. Assume dividends are paid annally 21 22 D1 dividend: 3.60 29 Estimated Pnce 55.38 24 25 26 If the Required Rate of Return were 27 higher, the value of the stock would be lower 28 20 30 Calculate the Estimated Stock price under the Constant-growth 31 assumption. Assume dividends are paid annally. 32 39 Assume the (APR) constant growth rate (g) is: 3.2% 34 35 D1 dividend: 3.72 36 Estimated Price: 112.58 37 38 39 D1 dividend Estimated Price. 2.10 116.67 4 Calculate the Estimated Stock pnce under the Constant-growth assumption. Assume dividends are paid quarterly Assume the (APR) constant growth rate (g) is Periodic growth rale () 28% 1.0% D1 dividend: Estimated Price: 2.11 34.03 If the growth rate (g) were higher the value of the stock would be higher 40 41 42 43 sludent name main + Ready BE Type here to search O 37 7:13 PM 4/11/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts