Question: hello there need help with this budgeting exercise please Exercises 3 Use the following data to prepare a planned operating budget for Hi-Lo Company for

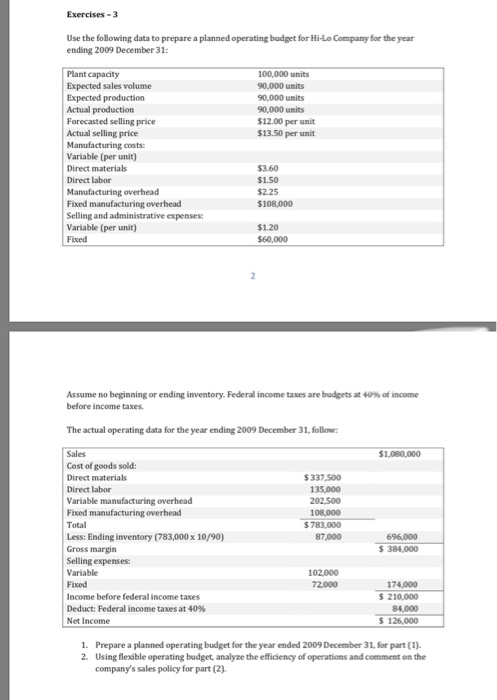

Exercises 3 Use the following data to prepare a planned operating budget for Hi-Lo Company for the year ending 2009 December 31: Plant capacity Expected sales volume Expected production Actual production Forecasted selling price Actual selling price Manufacturing costs: Variable (per unit) Direct materials Direct labor Manufacturing overhead Fixed manufacturing overhead Selling and administrative expenses Variable (per unit) Fixed 100,000 units 90,000 units 90,000 units 90,000 units $12.00 per unit $13.50 per unit $3.60 $1.50 $2.25 $108,000 $1.20 $60,000 Assume no beginning or ending inventory. Federal income taxes are budgets at 40% of income before income taxes. The actual operating data for the year ending 2009 December 31, follow Sales Cost of goods sold: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total Less: Ending inventory (783,000 x 10/90) Gross margin Selling expenses: Variable Fixed Income before federal income taxes Deduct: Federal income taxes at 40% Net Income 1,080,000 $ 337,500 135,000 202.500 108,000 $783,000 87000 S 384,000 102000 5 210,000 84,000 5 126,000 1. 2. Prepare a planned operating budget for the year ended 2009 December 31 for part (1). Using flexible operating budget, analyze the efficiency of operations and comment on the company's sales policy for part (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts