Question: HELLO THERE PLEASE ANSWERS ALL QUESTION WITH WORKINGS SHOWN.PLS DO NOT GIVE ME THE ONE QUESTION POLICY RULE BECAUSE THIS IS ACTUALLY CONSIDERED AS ONE

HELLO THERE PLEASE ANSWERS ALL QUESTION WITH WORKINGS SHOWN.PLS DO NOT GIVE ME THE ONE QUESTION POLICY RULE BECAUSE THIS IS ACTUALLY CONSIDERED AS ONE QUESTION.SO IF YOU GOING TO ANSWER ONE PART ONLY PLEASE DONT ATTEMPT TO ASNWER.THOSE WHO ANSWER ALL QUESTIONS WILL GET GOOD COMMENTS AND UPVOTE.FORMAT IS THE NUMBER OF DECIMAL POINTS OF THE ANSWER .THANK YOU.CR MEANS CAPITAL RECOVERY,AEC MEANS ANNUAL CAPITAL COSR

HELLO THERE PLEASE ANSWERS ALL QUESTION WITH WORKINGS SHOWN.PLS DO NOT GIVE ME THE ONE QUESTION POLICY RULE BECAUSE THIS IS ACTUALLY CONSIDERED AS ONE QUESTION.SO IF YOU GOING TO ANSWER ONE PART ONLY PLEASE DONT ATTEMPT TO ASNWER.THOSE WHO ANSWER ALL QUESTIONS WILL GET GOOD COMMENTS AND UPVOTE.FORMAT IS THE NUMBER OF DECIMAL POINTS OF THE ANSWER .THANK YOU.CR MEANS CAPITAL RECOVERY,AEC MEANS ANNUAL CAPITAL COSR

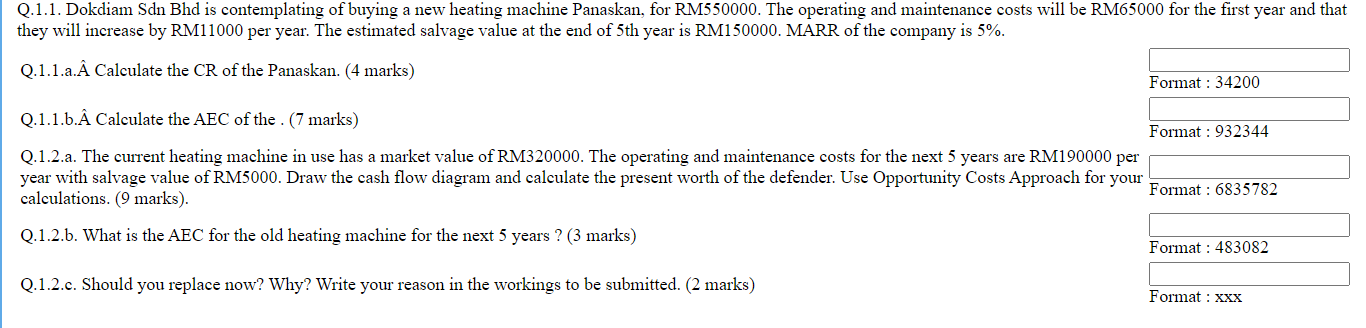

Q.1.1. Dokdiam Sdn Bhd is contemplating of buying a new heating machine Panaskan, for RM550000. The operating and maintenance costs will be RM65000 for the first year and that they will increase by RM11000 per year. The estimated salvage value at the end of 5th year is RM150000. MARR of the company is 5%. Q.1.1.a. Calculate the CR of the Panaskan. (4 marks) Format : 34200 Q.1.1.b. Calculate the AEC of the . (7 marks) Format : 932344 Q.1.2.a. The current heating machine in use has a market value of RM320000. The operating and maintenance costs for the next 5 years are RM190000 per year with salvage value of RM5000. Draw the cash flow diagram and calculate the present worth of the defender. Use Opportunity Costs Approach for your Format : 6835782 calculations. (9 marks). Q.1.2.b. What is the AEC for the old heating machine for the next 5 years ? (3 marks) Format : 483082 Q.1.2.c. Should you replace now? Why? Write your reason in the workings to be submitted. (2 marks) Format : xxx Q.1.1. Dokdiam Sdn Bhd is contemplating of buying a new heating machine Panaskan, for RM550000. The operating and maintenance costs will be RM65000 for the first year and that they will increase by RM11000 per year. The estimated salvage value at the end of 5th year is RM150000. MARR of the company is 5%. Q.1.1.a. Calculate the CR of the Panaskan. (4 marks) Format : 34200 Q.1.1.b. Calculate the AEC of the . (7 marks) Format : 932344 Q.1.2.a. The current heating machine in use has a market value of RM320000. The operating and maintenance costs for the next 5 years are RM190000 per year with salvage value of RM5000. Draw the cash flow diagram and calculate the present worth of the defender. Use Opportunity Costs Approach for your Format : 6835782 calculations. (9 marks). Q.1.2.b. What is the AEC for the old heating machine for the next 5 years ? (3 marks) Format : 483082 Q.1.2.c. Should you replace now? Why? Write your reason in the workings to be submitted. (2 marks) Format : xxx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts