Question: Hello there, please explain answer and please show steps to draw diagram and any calculations used so I can easily learn from it. Thank you.

Hello there, please explain answer and please show steps to draw diagram and any calculations used so I can easily learn from it. Thank you.

I will thumbs up for clarity!

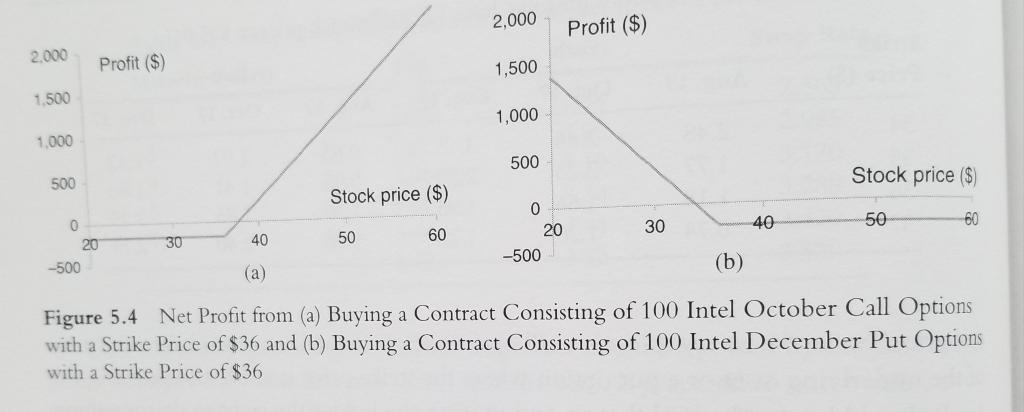

What position is equivalent to a short position in a European put option for an asset with the strike price of K on a certain date and a long position in a European call option for the same asset with the same strike price of K on the same date? Illustrate your answer by drawing some diagrams similar to those figures below.

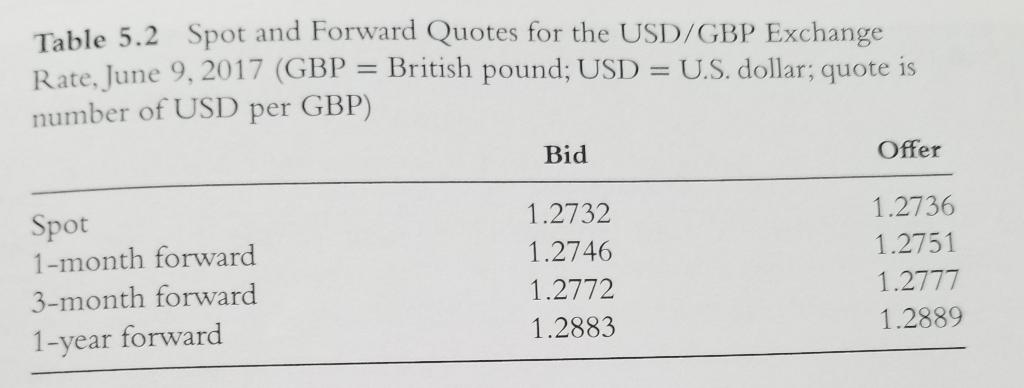

Table 5.2 Spot and Forward Quotes for the USD/GBP Exchange Rate, June 9, 2017 (GBP = British pound; USD = U.S. dollar; quote is number of USD per GBP) Bid Offer Spot 1-month forward 3-month forward 1-year forward 1.2732 1.2746 1.2772 1.2883 1.2736 1.2751 1.2777 1.2889 2,000 Profit ($) 2.000 Profit ($) 1,500 1.500 1,000 1.000 500 Stock price ($) 500 Stock price ($) 30 40 50 60 40 50 60 0 20 -500 0 20 -500 30 (b) (a) Figure 5.4 Net Profit from (a) Buying a Contract Consisting of 100 Intel October Call Options with a Strike Price of $36 and (b) Buying a Contract Consisting of 100 Intel December Put Options with a Strike Price of $36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts