Question: hello these are same questions, C my folder M Question 3 - CH 4 Homework Connect ework Saved Help Save & Exit Submit Check my

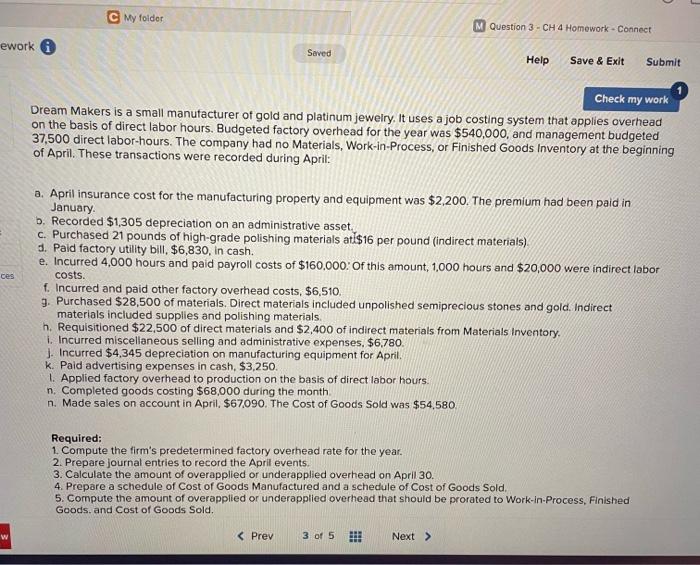

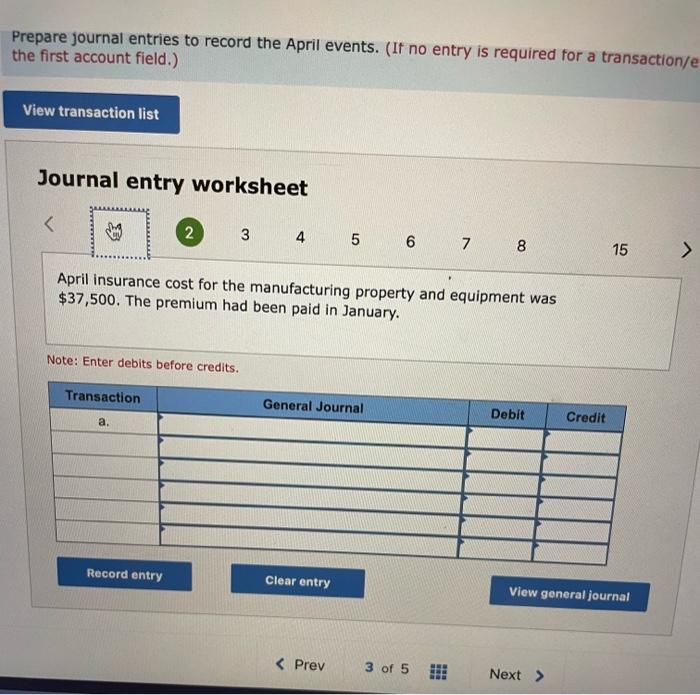

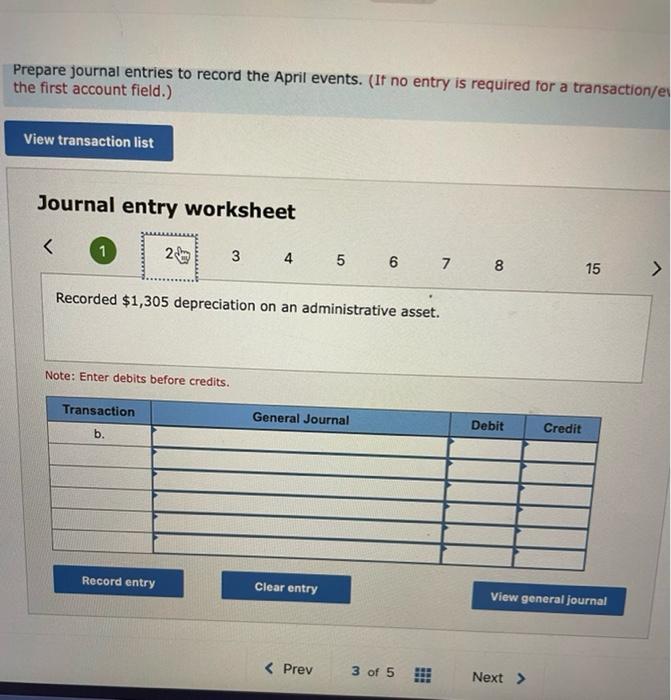

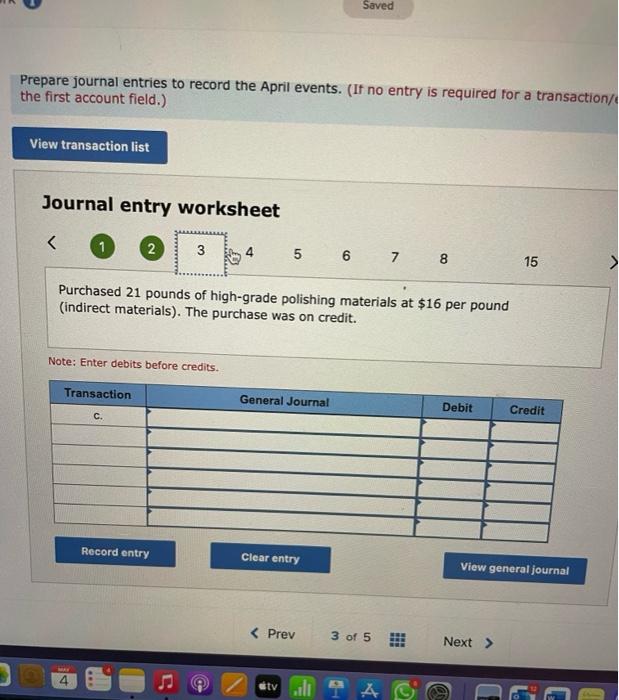

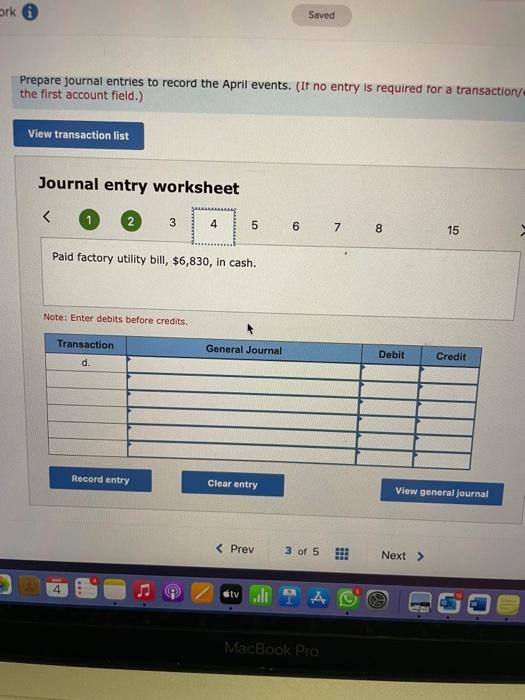

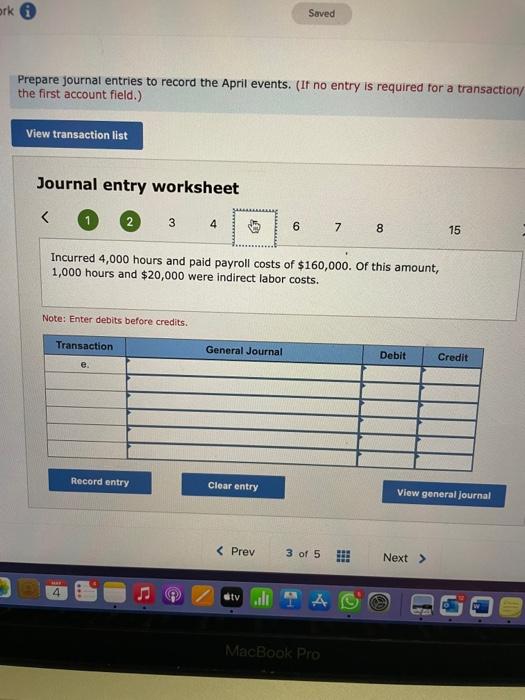

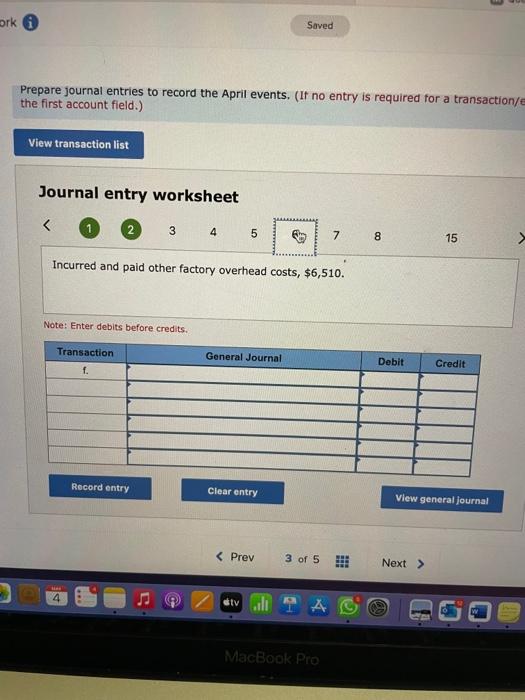

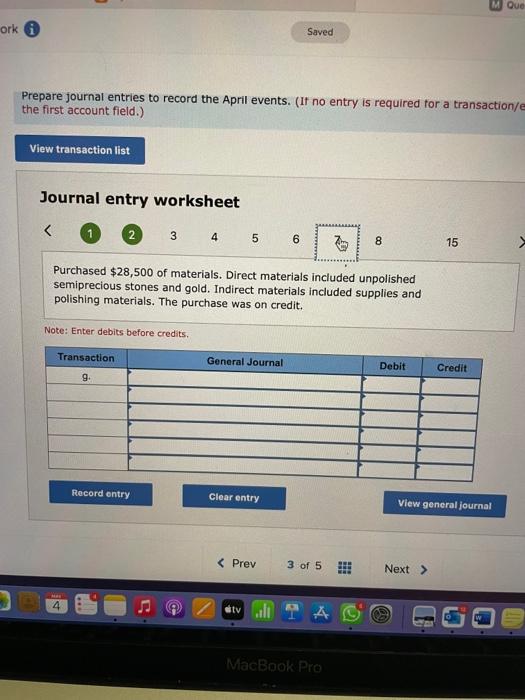

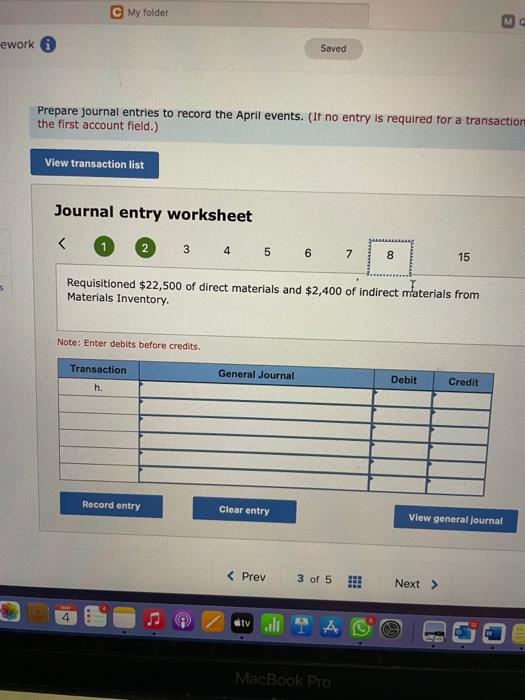

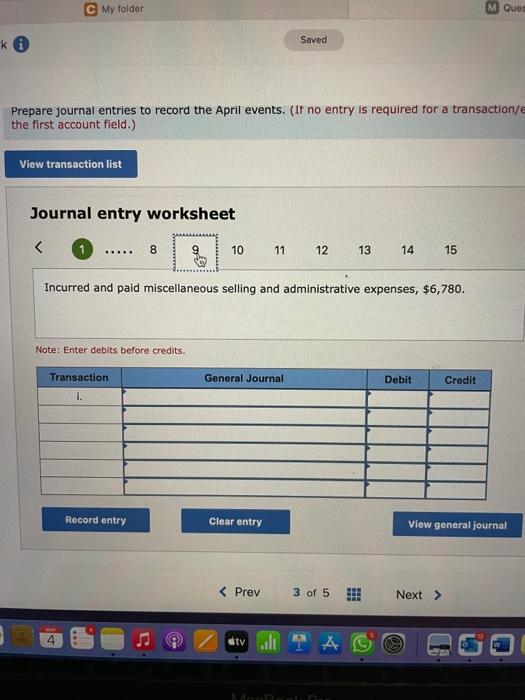

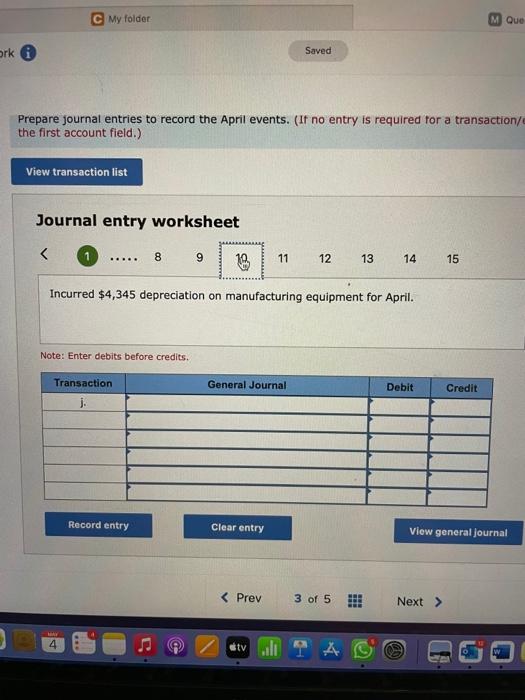

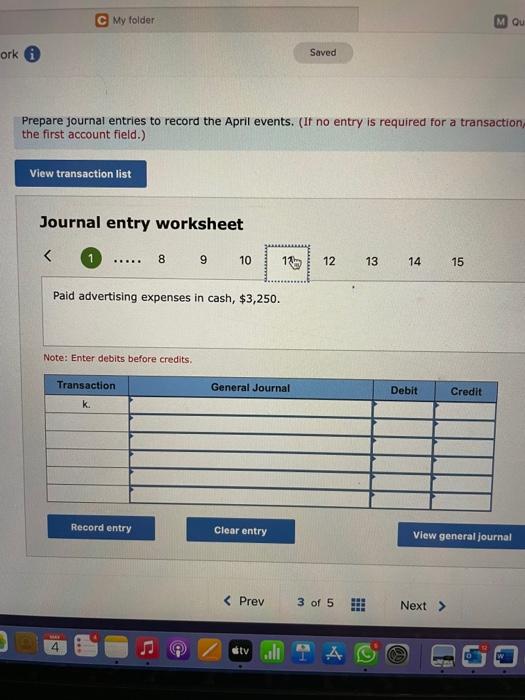

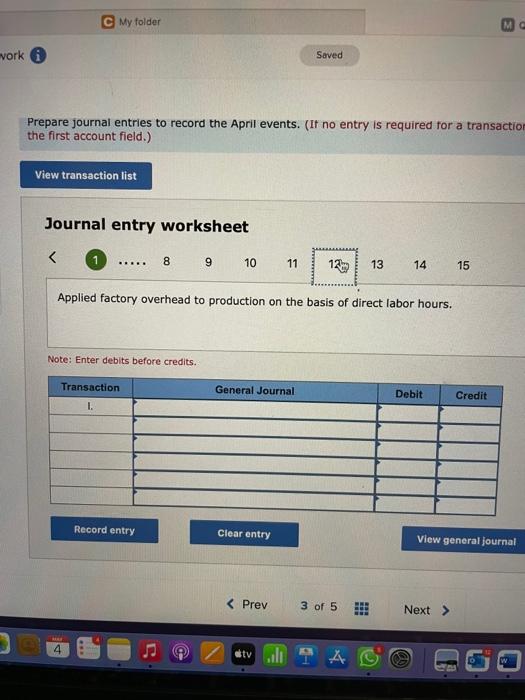

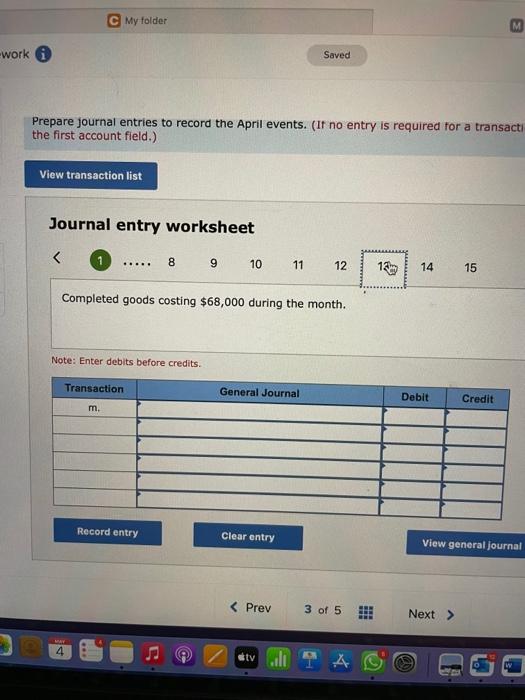

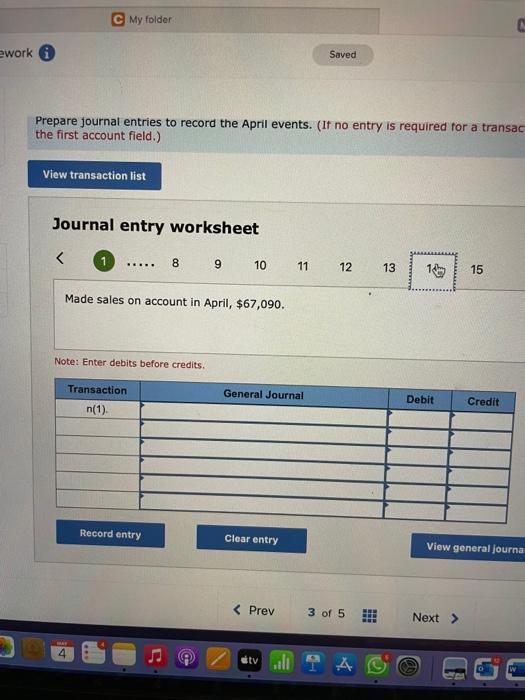

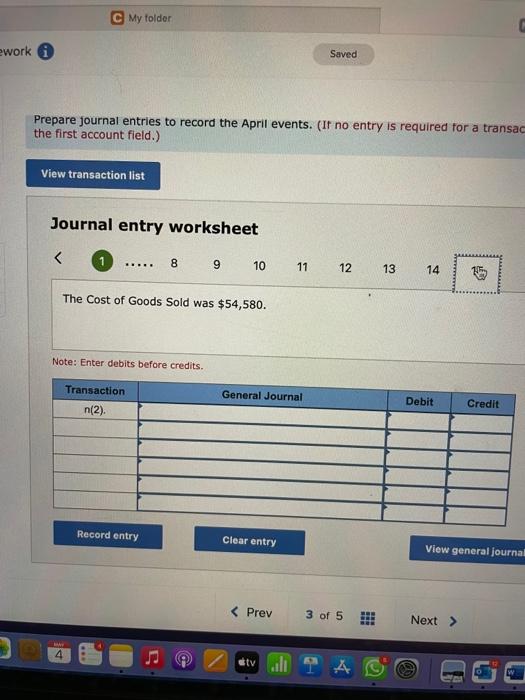

C my folder M Question 3 - CH 4 Homework Connect ework Saved Help Save & Exit Submit Check my work Dream Makers is a small manufacturer of gold and platinum jewelry. It uses a job costing system that applies overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $540,000, and management budgeted 37,500 direct labor-hours. The company had no Materials, Work-in-process, or Finished Goods Inventory at the beginning of April. These transactions were recorded during April: ces a. April insurance cost for the manufacturing property and equipment was $2,200. The premium had been paid in January b. Recorded $1,305 depreciation on an administrative asset c. Purchased 21 pounds of high-grade polishing materials atl$16 per pound (indirect materials) d. Paid factory utility bill, $6,830, in cash. e. Incurred 4,000 hours and paid payroll costs of $160,000. Of this amount, 1.000 hours and $20,000 were indirect labor costs. f. Incurred and paid other factory overhead costs, $6,510, 9. Purchased $28,500 of materials. Direct materials included unpolished semiprecious stones and gold. Indirect materials included supplies and polishing materials h. Requisitioned $22.500 of direct materials and $2,400 of indirect materials from Materials Inventory. 1. Incurred miscellaneous selling and administrative expenses. $6,780. J. Incurred $4,345 depreciation on manufacturing equipment for April k. Paid advertising expenses in cash. $3,250. 1. Applied factory overhead to production on the basis of direct labor hours. n. Completed goods costing $68,000 during the month n. Made sales on account in April. $67090. The Cost of Goods Sold was $54,580 Required: 1. Compute the firm's predetermined factory overhead rate for the year. 2. Prepare journal entries to record the April events. 3. Calculate the amount of overapplied or underapplied overhead on April 30. 4. Prepare a schedule of Cost of Goods Manufactured and a schedule of Cost of Goods Sold. 5. Compute the amount of overapplied or underapplied overhead that should be prorated to Work-In-Process, Finished Goods. and Cost of Goods Sold. w Prepare journal entries to record the April events. (If no entry is required for a transaction/e the first account field.) View transaction list Journal entry worksheet Prepare journal entries to record the April events. (If no entry is required for a transaction/e the first account field.) View transaction list Journal entry worksheet Saved Prepare journal entries to record the April events. (If no entry is required for a transaction/ the first account field.) View transaction list Journal entry worksheet Purchased 21 pounds of high-grade polishing materials at $16 per pound (indirect materials). The purchase was on credit. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal 4 dtv.ili MacBook Pro ork Saved Prepare journal entries to record the April events. (If no entry is required for a transaction/ the first account field.) View transaction list Journal entry worksheet atv li MacBook Pro ork Saved Prepare journal entries to record the April events. (If no entry is required for a transactione the first account field.) View transaction list Journal entry worksheet 2 3 4 5 7 8 15 Incurred and paid other factory overhead costs, $6,510. Note: Enter debits before credits Transaction General Journal Debit Credit f. Record entry Clear entry View general Journal &tv .li A MacBook Pro Que ork Saved Prepare journal entries to record the April events. (if no entry is required for a transaction/ the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 00 8 15 Purchased $28,500 of materials. Direct materials included unpolished semiprecious stones and gold. Indirect materials included supplies and polishing materials. The purchase was on credit. Note: Enter debits before credits Transaction General Journal Debit Credit g Record entry Clear entry View general journal 4 atv li A MacBook Pro My folder ework Saved Prepare journal entries to record the April events. (If no entry is required for a transaction the first account field.) View transaction list Journal entry worksheet 4 dtv li TA MacBook Pro C My folder M Ques k Saved Prepare journal entries to record the April events. (If no entry is required for a transaction/ the first account field.) View transaction list Journal entry worksheet &tv li A My folder M Que ork Saved Prepare journal entries to record the April events. (If no entry is required for a transaction/ the first account field.) View transaction list Journal entry worksheet 4 etv li TA My folder Qu ork 0 Saved Prepare journal entries to record the April events. (If no entry is required for a transaction the first account field.) View transaction list Journal entry worksheet st &tvli A My folder G vork 6 Saved Prepare journal entries to record the April events. (If no entry is required for a transaction the first account field.) View transaction list Journal entry worksheet 4 etv IA My folder work Saved Prepare journal entries to record the April events. (If no entry is required for a transacti the first account field.) View transaction list Journal entry worksheet BB MAT 4 &tv ji C My folder ework Saved Prepare journal entries to record the April events. (If no entry is required for a transac the first account field.) View transaction list Journal entry worksheet 4 etv .ll AS 9 My folder ework Saved Prepare journal entries to record the April events. (If no entry is required for a transac the first account field.) View transaction list Journal entry worksheet dtvill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts