Question: Hello, this is an academic assignment. Answer the question between 250 and 300 words. Question: Can you think of any alliances that you think AT&T

Hello, this is an academic assignment. Answer the question between 250 and 300 words.

Question:

Can you think of any alliances that you think AT&T or Apple should consider today to help them achieve their strategic objectives?

Case study:

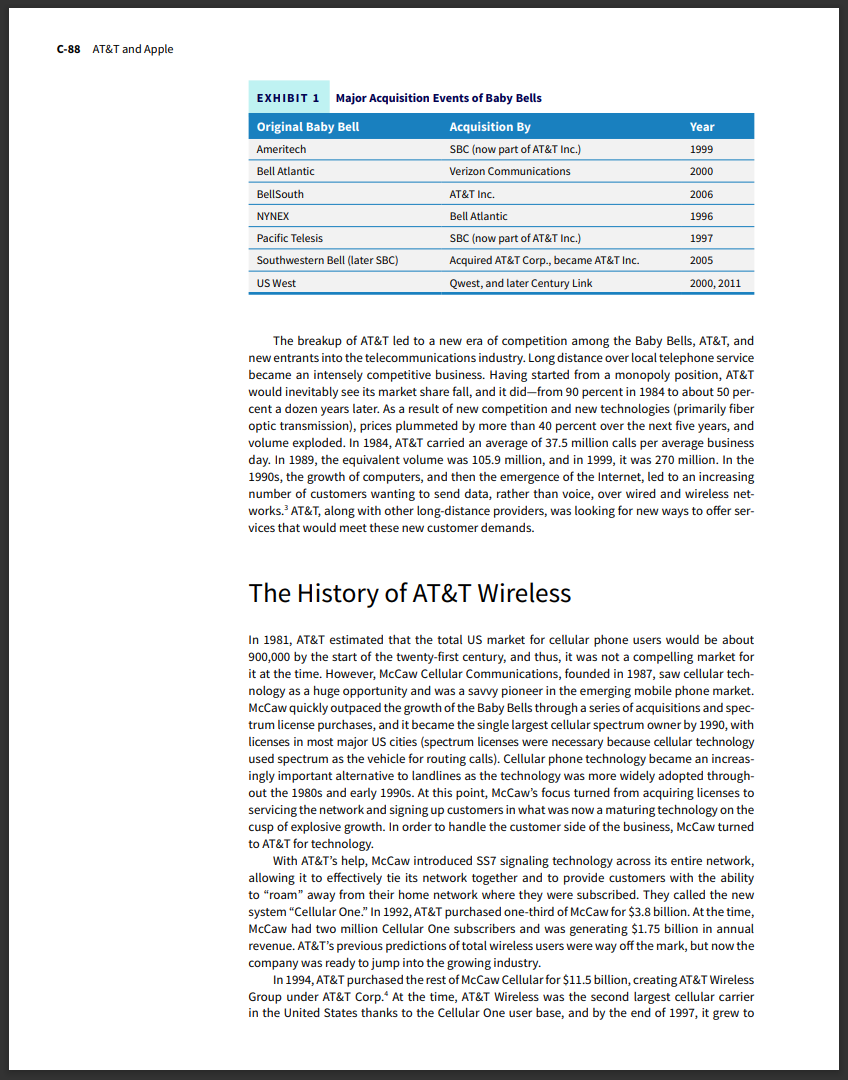

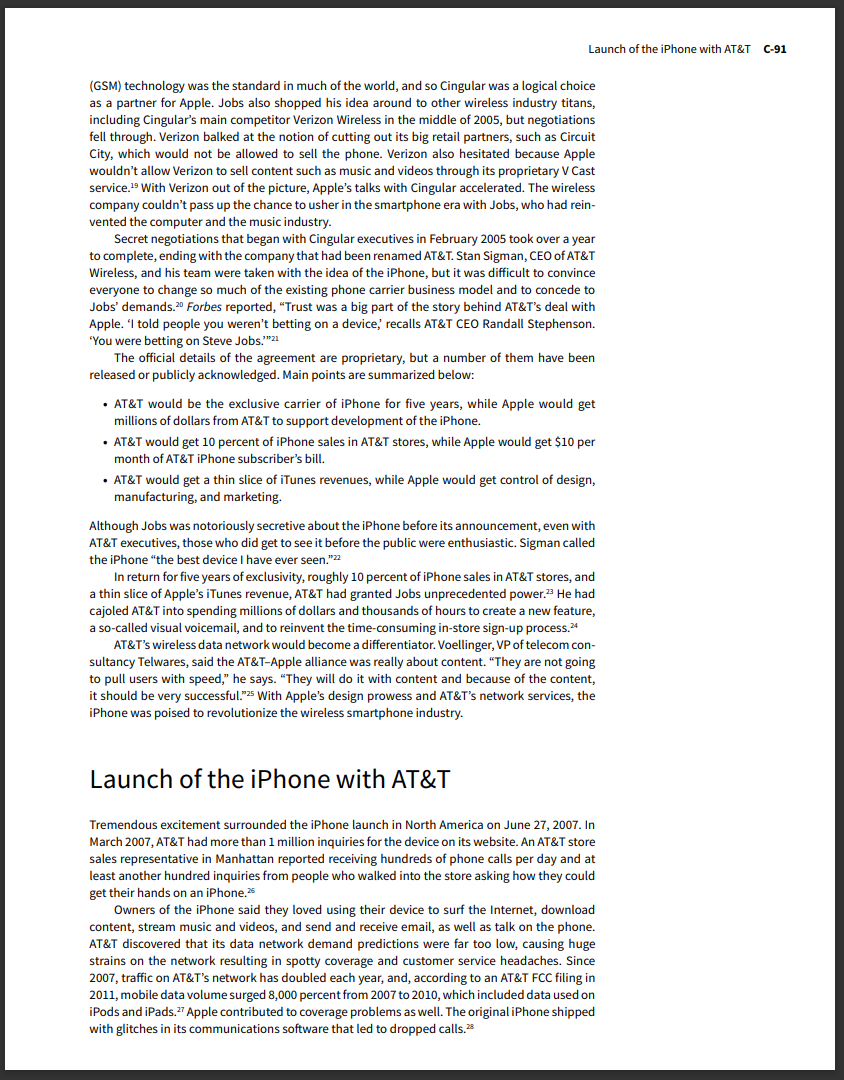

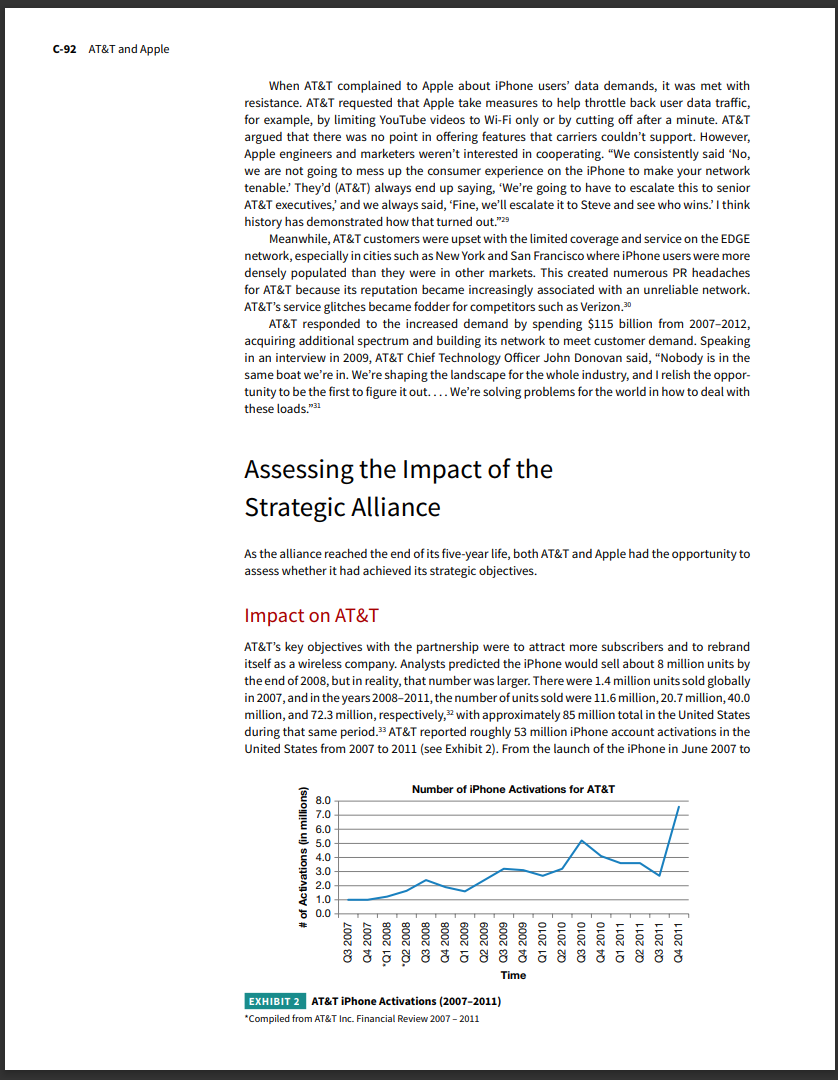

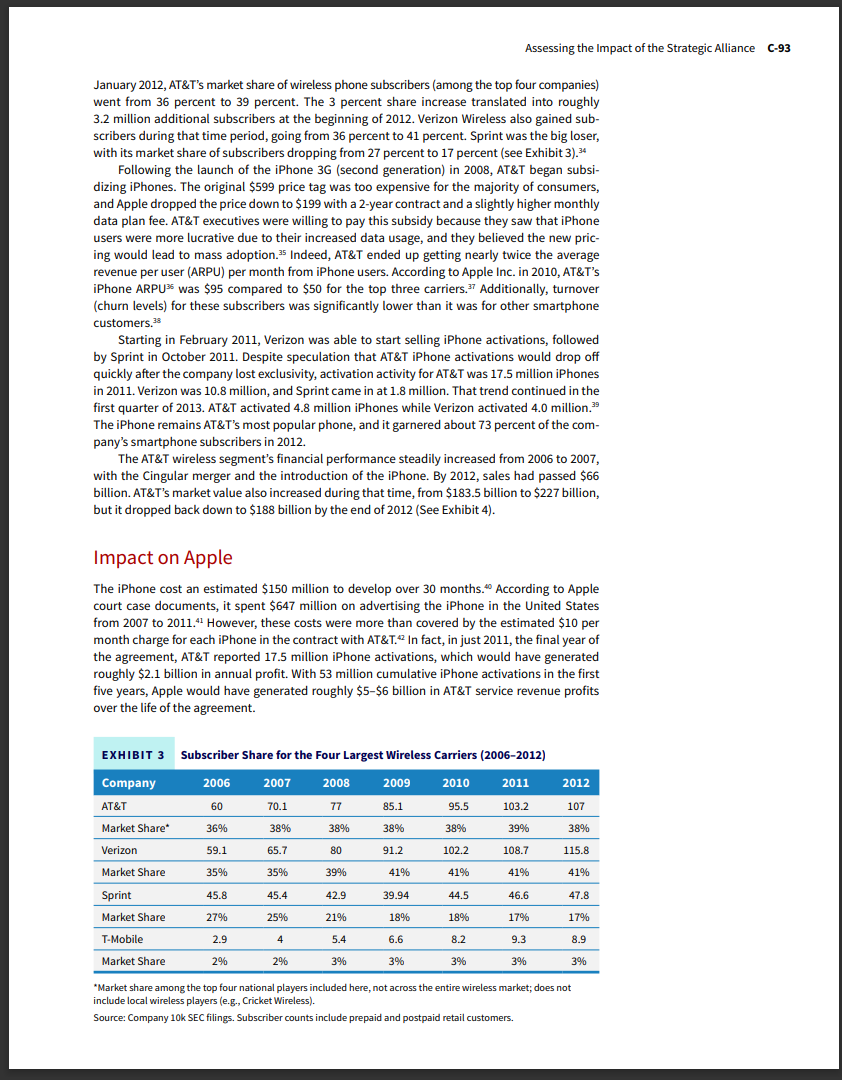

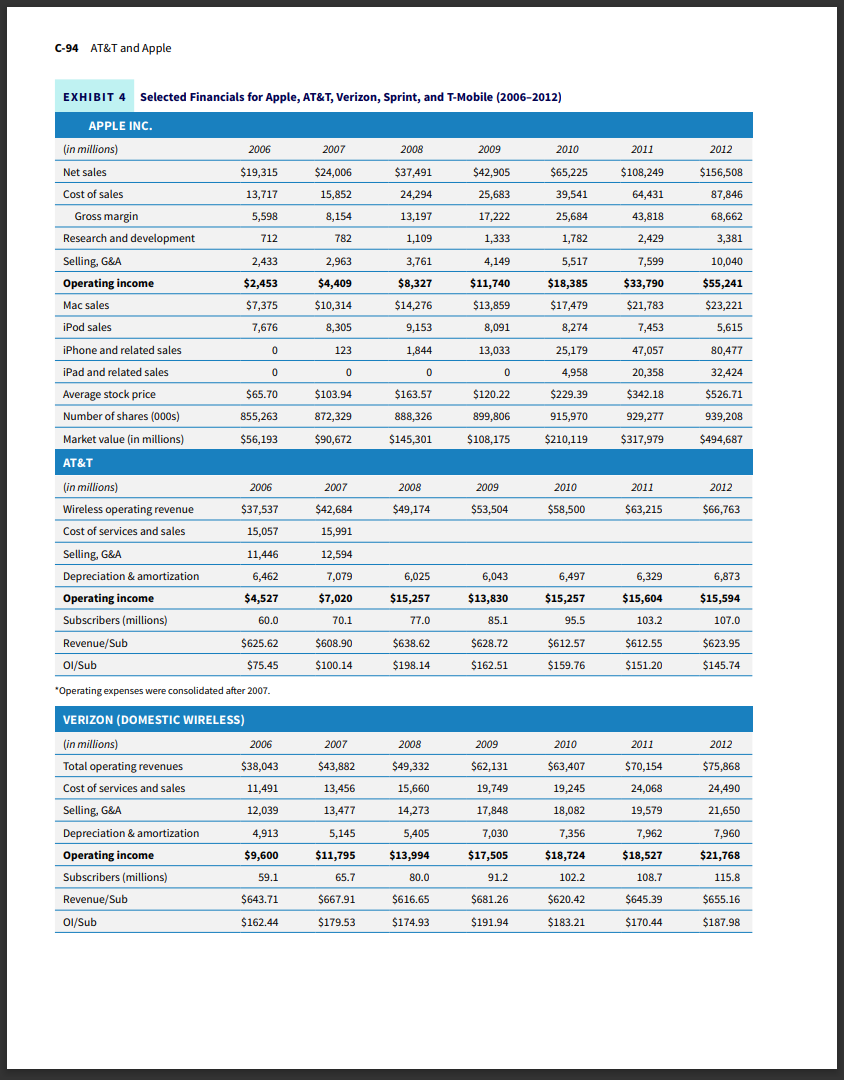

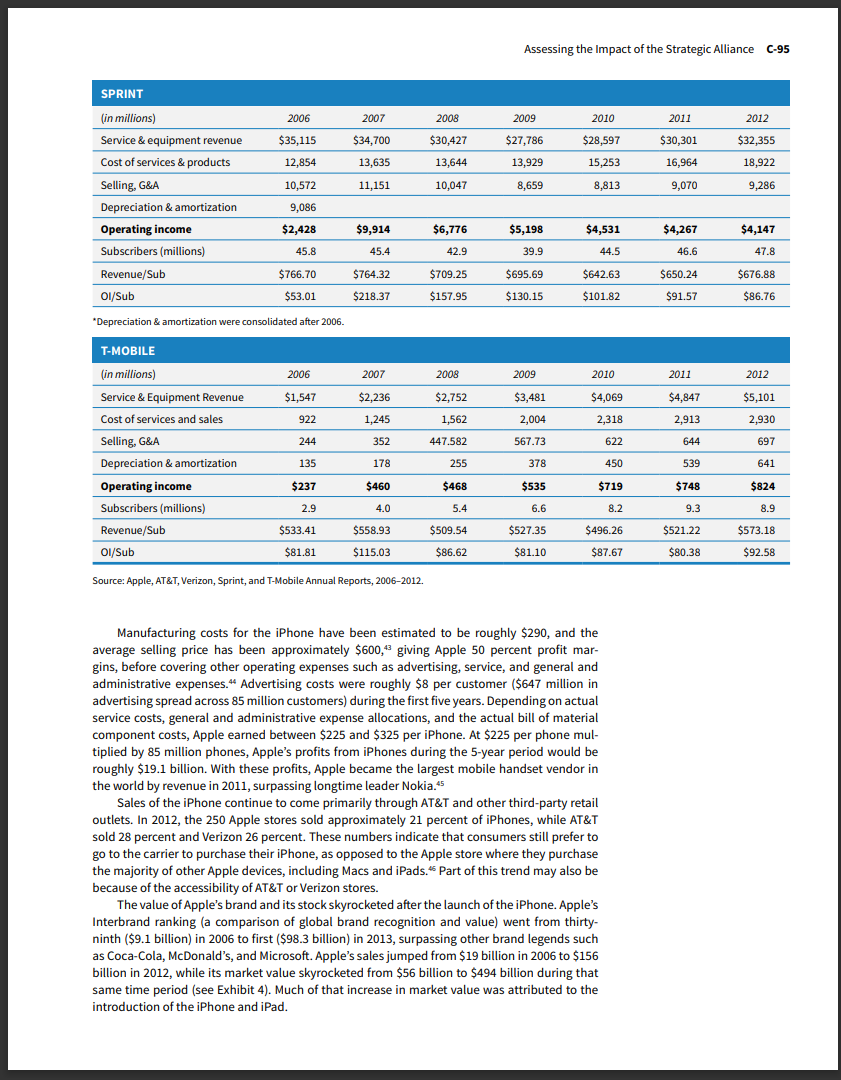

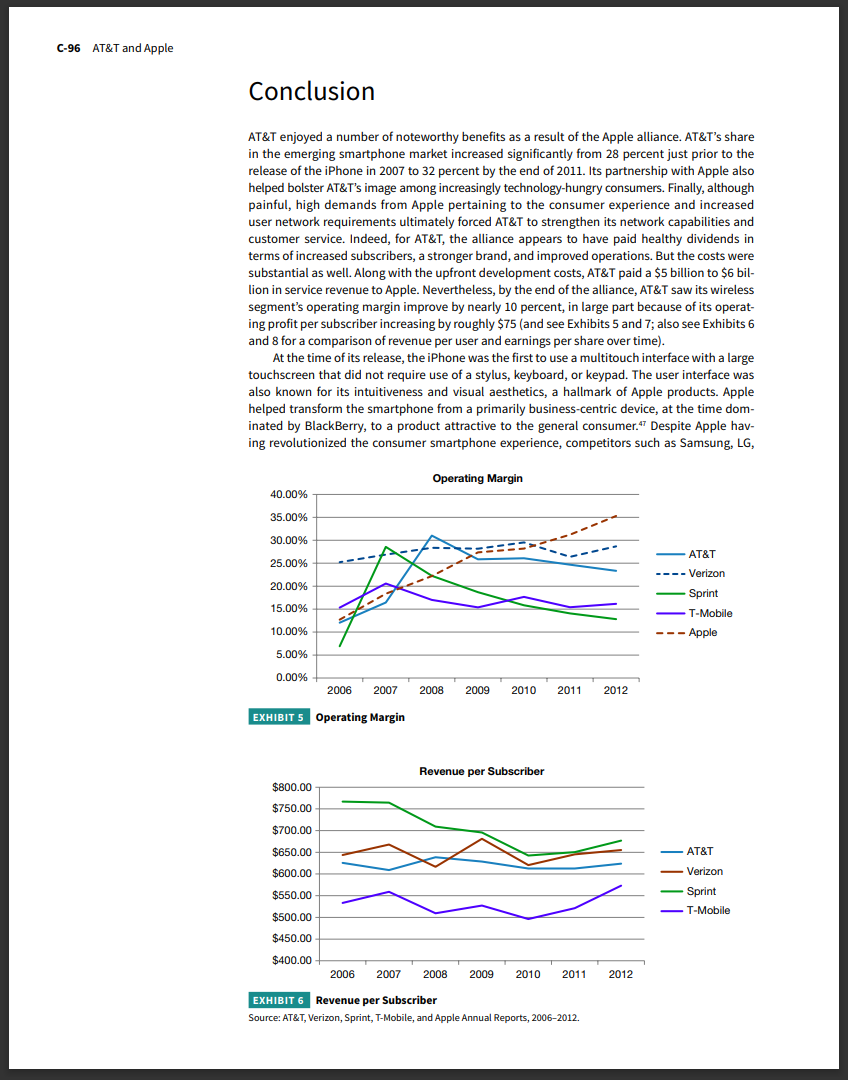

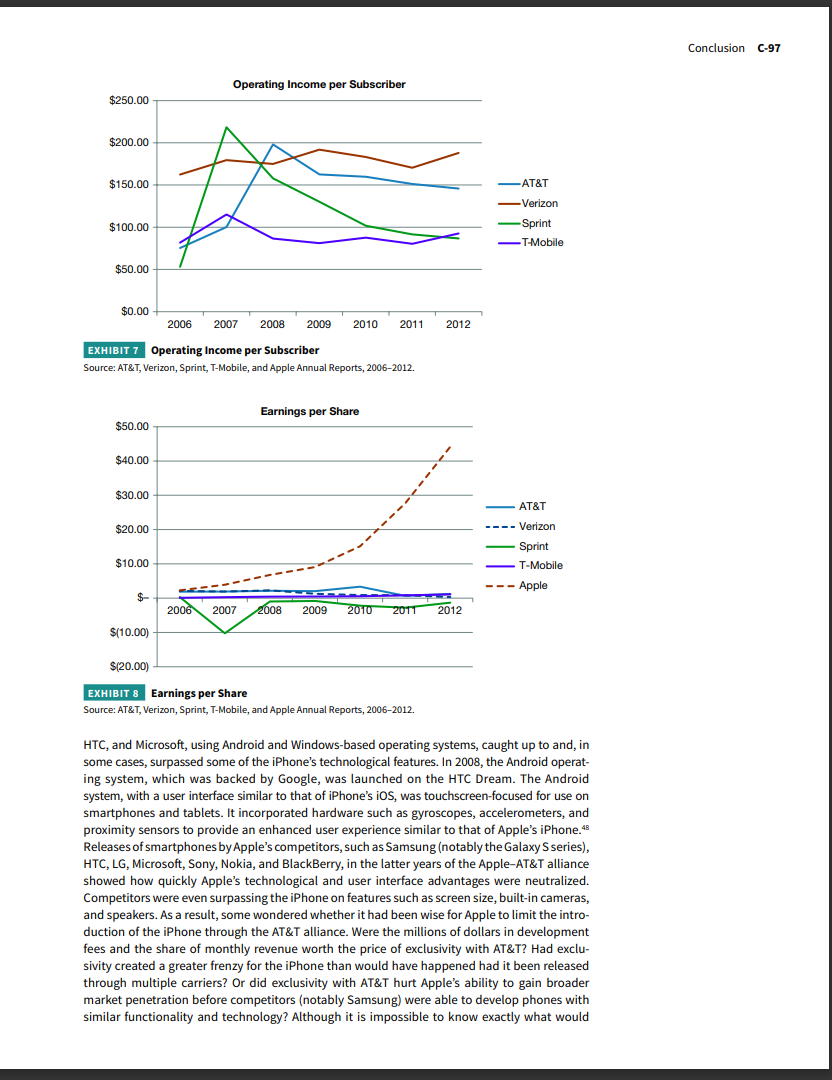

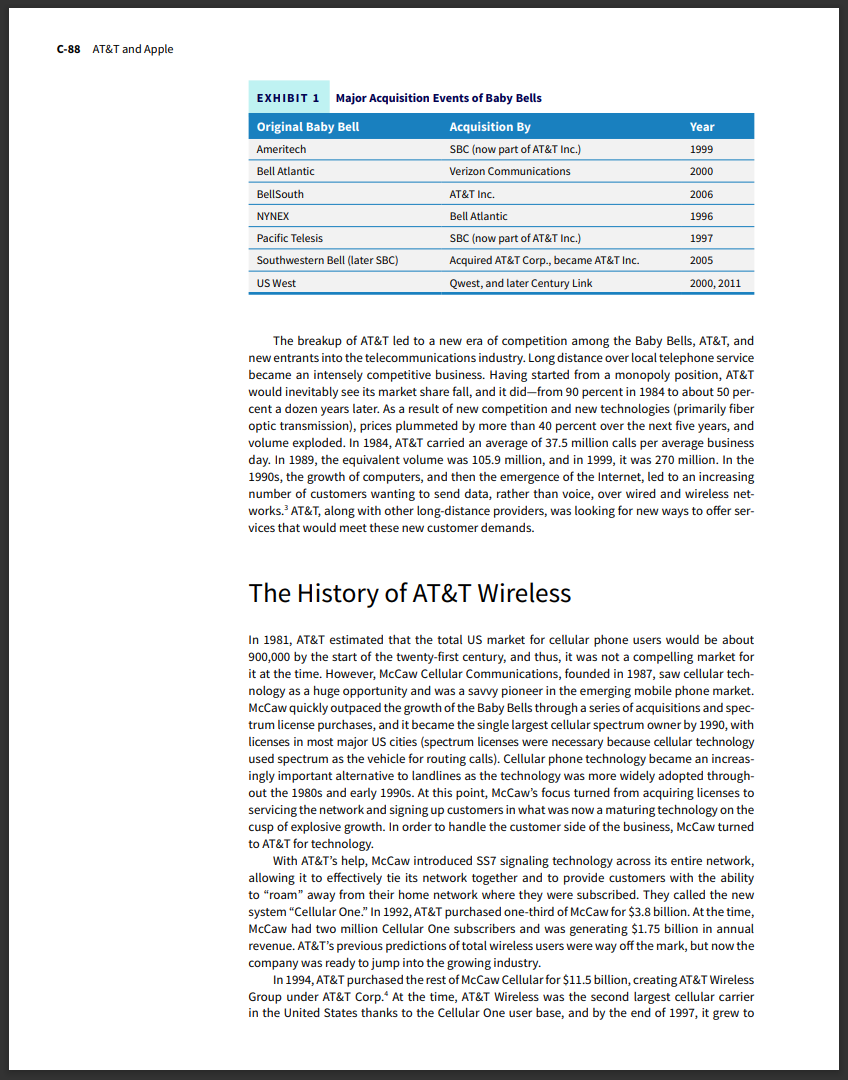

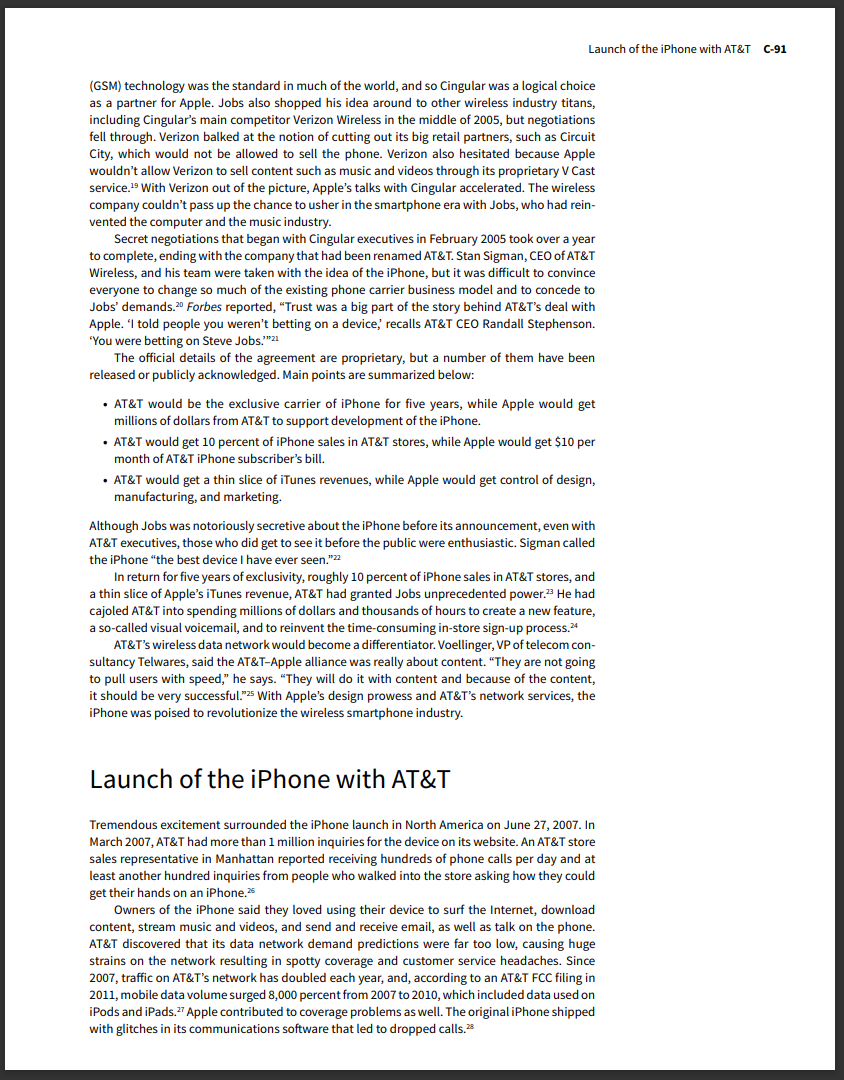

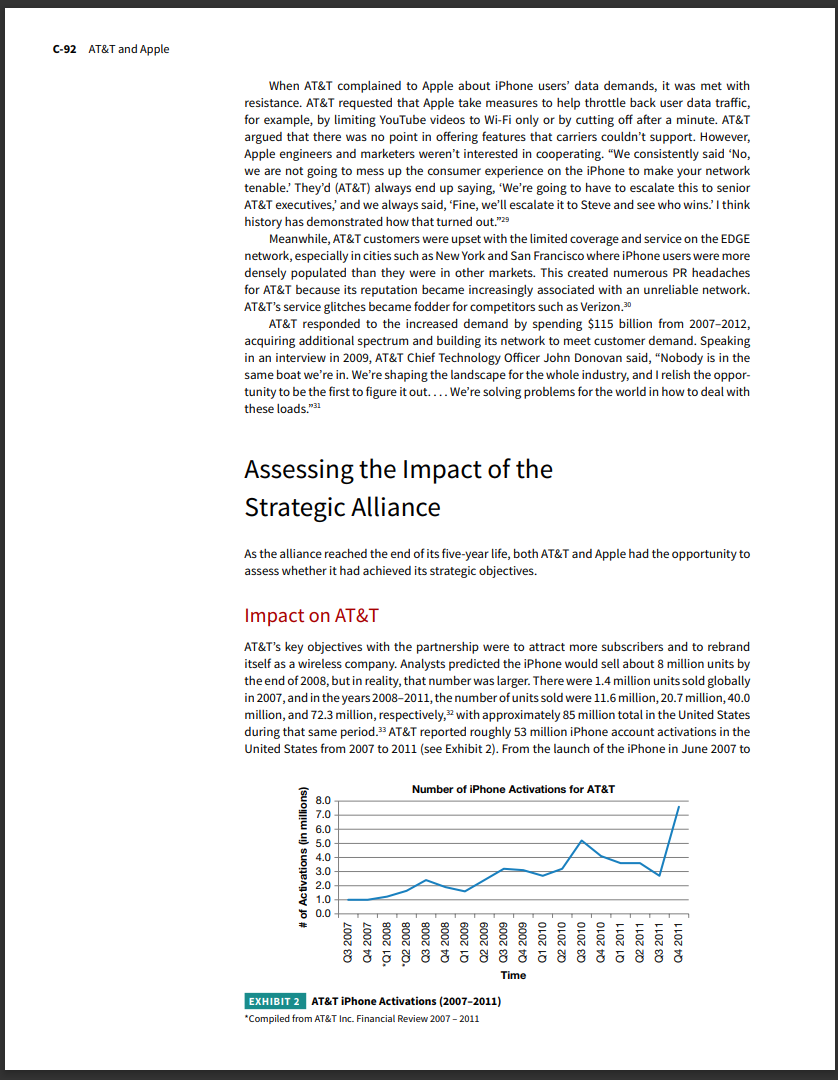

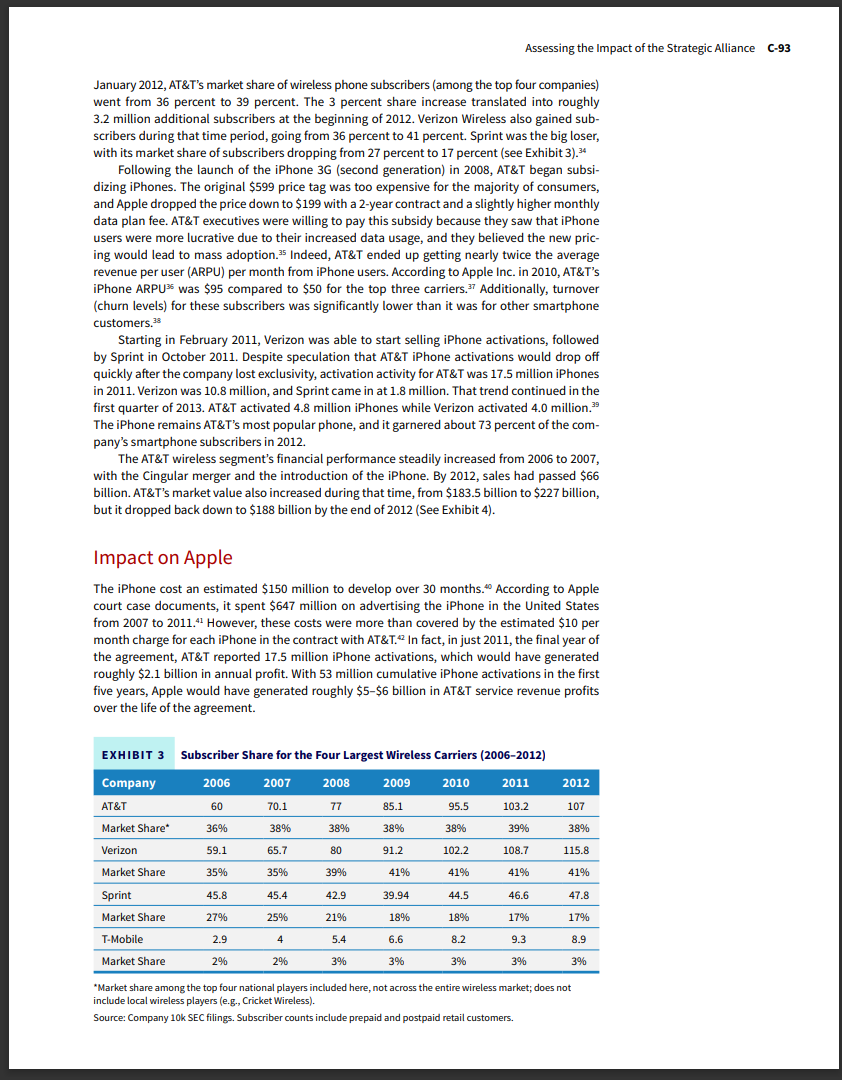

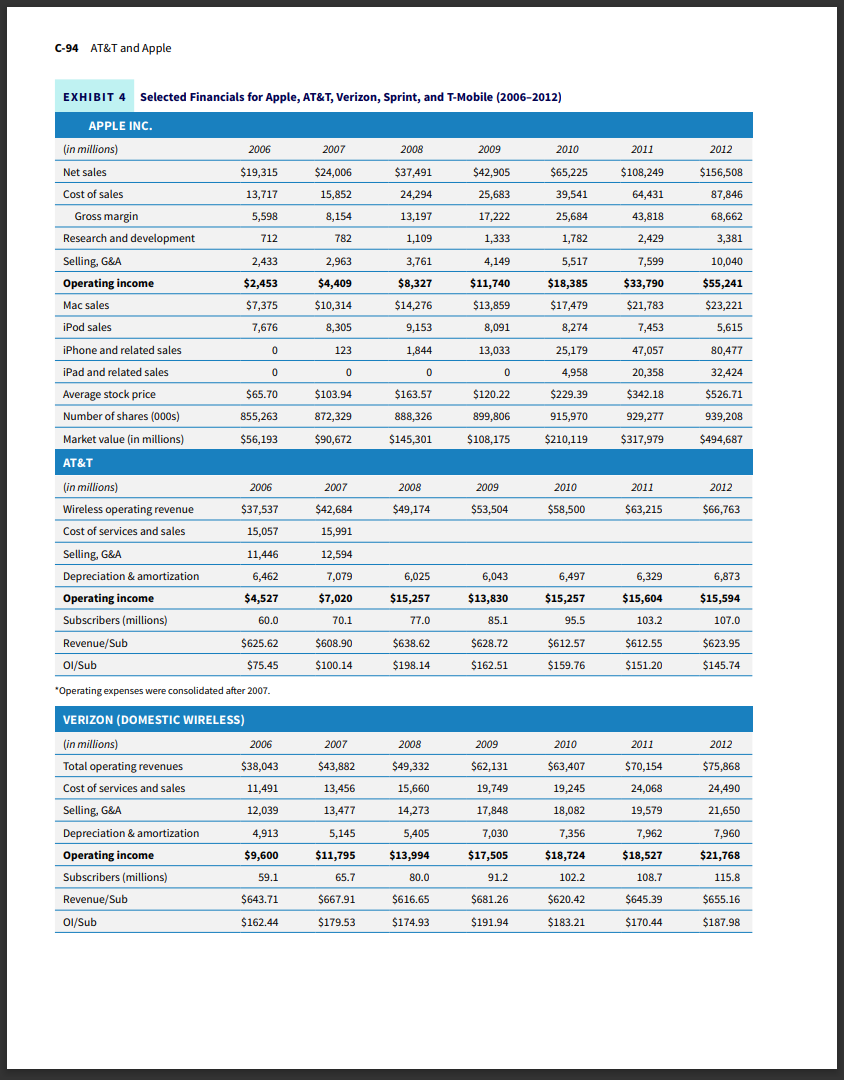

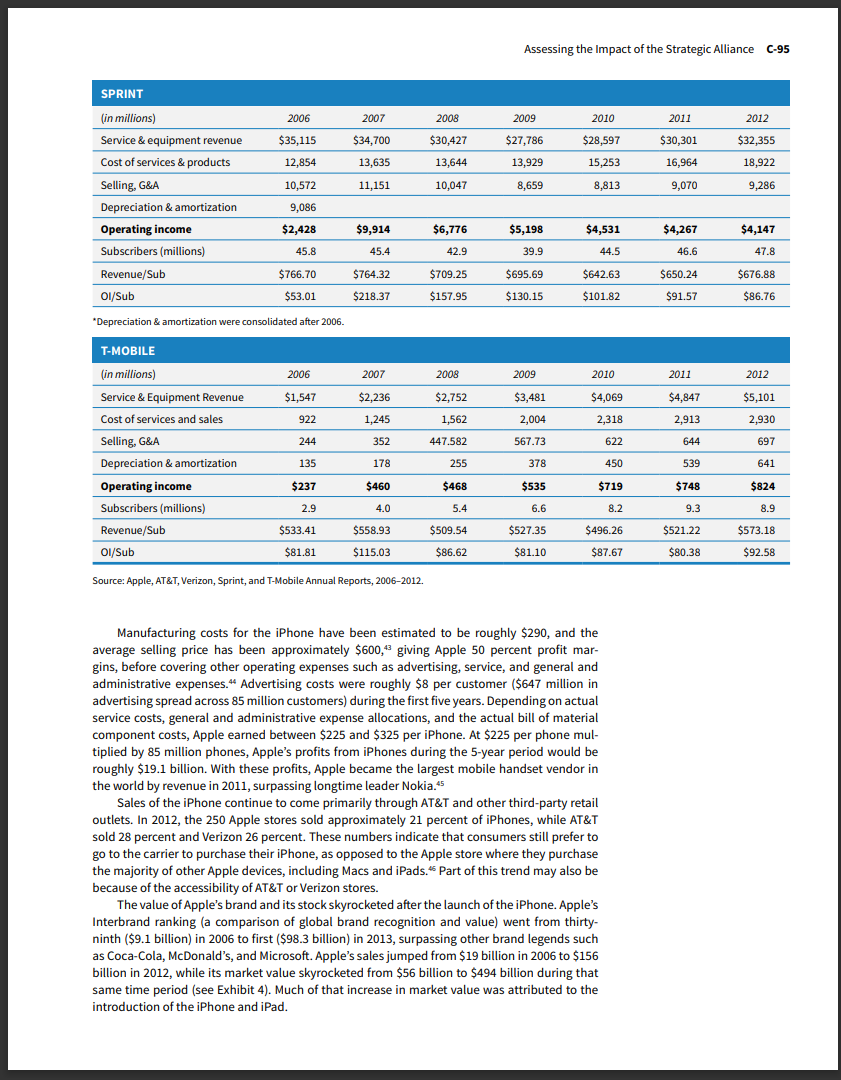

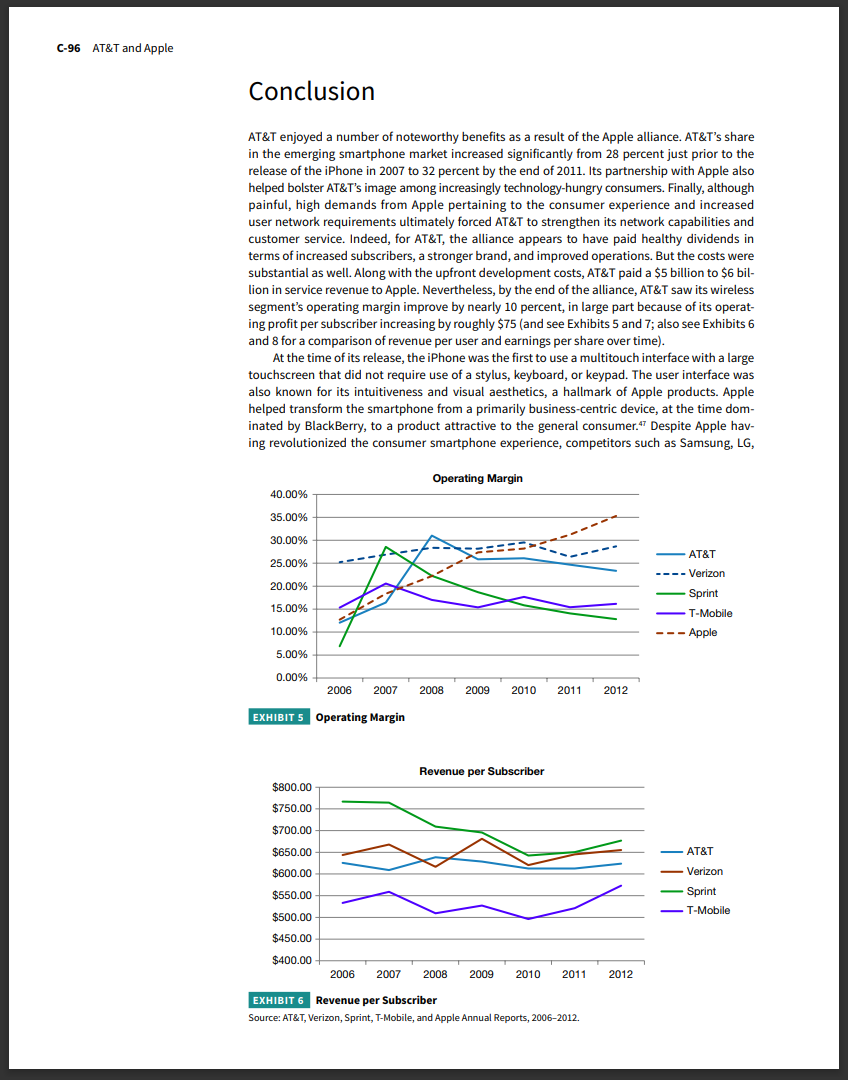

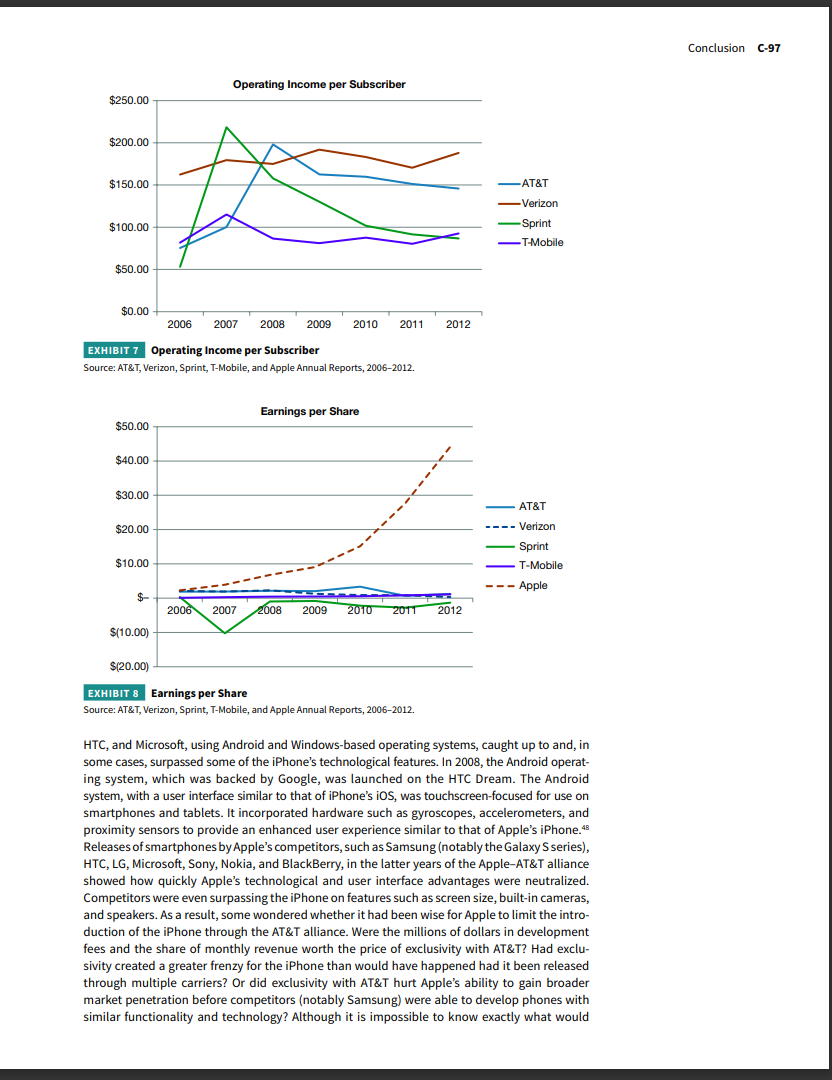

AT\&T and Apple A Strategic Alliance Randall Stephenson, CEO of AT\&T, sat at his desk in January 2011 during a moment of quiet reflection. Verizon Wireless had just announced it would offer the Apple iPhone beginning in a few weeks. AT\&T had been the sole carrier of the iPhone since its launch to the market in June 2007, and the strategic alliance between AT\&T and Apple that had existed for almost five years would soon end. Stephenson and the AT\&T leadership team were now in a position to evaluate whether the Apple alliance had helped AT\&T achieve its objectives-and to consider what might happen going forward given that AT\&T would no longer be the exclusive service provider for the iPhone. At the inception of the alliance, AT\&T was looking to rebrand itself as a wireless phone carrier. Apple was designing the iPhone and looking for the optimal way to launch it into the new smartphone market. The two companies ultimately decided that combining their resources and capabilities in a strategic alliance centered on the iPhone would help both companies achieve their strategic objectives. But now that the alliance was over, the AT\&T leadership team needed to look to the future to determine what other strategic initiatives-including other potential alliances or acquisitions-would provide the best vehicles for helping the company achieve its strategic objectives. The History of AT\&T The American Telephone and Telegraph Company (AT\&T) was founded in 1885 by Alexander Graham Bell after his invention of the telephone. After a merger with the Bell telephone company in 1900, AT\&T became the main phone company in the United States. In 1913, AT\&T also became a government-sanctioned monopoly of the telephone market, as a result of the Kingsbury Commitment. (Essentially, the company was allowed to be a monopoly "provided [AT\&T] is independent, intelligent, considerate, thorough and just."1) The government agreed to allow AT\&T's monopolistic operation after the company agreed to allow independents to interconnect to the long distance network under certain conditions and to abstain from acquiring companies if the ICC 2 objected. For decades afterwards, AT\&T continued to be the only truly nationwide phone company, and it continually had to walk a fine line between being a monopoly and acting like one. Litigation in the 1970s ultimately led to the breakup of the AT\&T Bell System in 1982, resulting in AT\&T divesting itself of its local telephone operations while still maintaining its long-distance network. The seven new regional Bell operating companies (RBOCs), also called Baby Bells, were Ameritech, Bell Atlantic, BellSouth, NYNEX, Pacific Telesis, Southwestern Bell, and US West. Although these Baby Bells remained independent for many years, all were acquired over the years as the industry consolidated into a few players. Major acquisition events are summarized in Exhibit 1. EXHIBIT 1 Major Acquisition Events of Baby Bells The breakup of AT\&T led to a new era of competition among the Baby Bells, AT\&T, and new entrants into the telecommunications industry. Long distance over local telephone service became an intensely competitive business. Having started from a monopoly position, AT\&T would inevitably see its market share fall, and it did-from 90 percent in 1984 to about 50 percent a dozen years later. As a result of new competition and new technologies (primarily fiber optic transmission), prices plummeted by more than 40 percent over the next five years, and volume exploded. In 1984, AT\&T carried an average of 37.5 million calls per average business day. In 1989, the equivalent volume was 105.9 million, and in 1999, it was 270 million. In the 1990 s, the growth of computers, and then the emergence of the Internet, led to an increasing number of customers wanting to send data, rather than voice, over wired and wireless networks. 3 AT\&T, along with other long-distance providers, was looking for new ways to offer services that would meet these new customer demands. The History of AT\&T Wireless In 1981, AT\&T estimated that the total US market for cellular phone users would be about 900,000 by the start of the twenty-first century, and thus, it was not a compelling market for it at the time. However, McCaw Cellular Communications, founded in 1987, saw cellular technology as a huge opportunity and was a savvy pioneer in the emerging mobile phone market. McCaw quickly outpaced the growth of the Baby Bells through a series of acquisitions and spectrum license purchases, and it became the single largest cellular spectrum owner by 1990, with licenses in most major US cities (spectrum licenses were necessary because cellular technology used spectrum as the vehicle for routing calls). Cellular phone technology became an increasingly important alternative to landlines as the technology was more widely adopted throughout the 1980 s and early 1990s. At this point, McCaw's focus turned from acquiring licenses to servicing the network and signing up customers in what was now a maturing technology on the cusp of explosive growth. In order to handle the customer side of the business, McCaw turned to AT\&T for technology. With AT\&T's help, McCaw introduced SS7 signaling technology across its entire network, allowing it to effectively tie its network together and to provide customers with the ability to "roam" away from their home network where they were subscribed. They called the new system "Cellular One." In 1992, AT\&T purchased one-third of McCaw for $3.8 billion. At the time, McCaw had two million Cellular One subscribers and was generating $1.75 billion in annual revenue. AT\&T's previous predictions of total wireless users were way off the mark, but now the company was ready to jump into the growing industry. In 1994, AT\&T purchased the rest of McCaw Cellular for $11.5 billion, creating AT\&T Wireless Group under AT\&T Corp. 4 At the time, AT\&T Wireless was the second largest cellular carrier in the United States thanks to the Cellular One user base, and by the end of 1997, it grew to become the largest cellular provider. However, the cellular industry began to consolidate, and by 1999 and 2000, Verizon Wireless and Cingular Wireless became the first and second largest national carriers, respectively. AT\&T Wireless became a separate company from AT\&T Corp. in 2001, and it continued to expand its operations until, in 2003 and 2004, the Federal Communications Commission (FCC) mandated that AT\&T allow customers to port their phone numbers to other carriers. AT\&T Wireless experienced a mass exodus of many customers who were fed up with years of poor service. When the new process for porting numbers in or out of its system was poorly implemented, AT\&T Wireless only accelerated the exodus of customers. The AT\&T Wireless management team received so much criticism that the company eventually agreed to accept bids to be acquired in early 2004.5 In 2004, Cingular Wireless won the bid and acquired AT\&T Wireless for $41 billion, nearly double the company's recent trading value. Cingular, headed by CEO Stan Sigman, was a joint venture between two Baby Bells; 40 percent owned by BellSouth and 60 percent owned by SBC Communications, Inc. Six months after the merger, the AT\&T Wireless brand was retired by Cingular. According to a pre spin-off agreement, the name AT\&T Wireless and the use of the AT\&T name in wireless phone service would revert to AT\&T Corp. The brand would be brought back about a year later after SBC Communications, Inc. completed a merger with AT\&T Corp. in 2005, at which time SBC renamed itself "AT\&T Inc." In December 2006, the new AT\&T acquired Bellsouth, just as the negotiations with Apple commenced. Randall Stephenson took over as CEO of the new AT\&T in June 2007 and was the leader as the strategic alliance with Apple was finalized. "This is a once-in-a-lifetime moment to change how the public views AT\&T as a wireless company," said Stephenson, "and to change internally how we view AT\&T as a wireless company. m6 After the acquisition of Bellsouth, AT\&T changed the name of its wireless branch, Cingular, to "AT\&T" and rolled it out as part of the alliance with Apple. "I don't care if you have to go to every store in America and get a paper bag and paint a globe on it and put it over the signage in each store. We're going to launch this under the AT\&T brand," Stephenson remembers telling his team. "And it was the smartest thing we ever did, because AT\&T became synonymously branded with that Apple product [iPhone] at that moment in time.."B The History of Apple Apple Computer was incorporated on January 3, 1977, by founders Steve Jobs and Steve Wozniak. Apple Computer launched several computer models, including the Apple II in 1977, which introduced VisiCalc, a spreadsheet program that was one of the first "killer apps." 19 The Apple III was released in 1980 to compete with IBM and Microsoft in the business-computing market, followed by the Apple Lisa in 1983 and the Macintosh in 1984, two of the first personal computers to use a graphical user interface or GUI. The Macintosh debut was heralded by the now famous "1984" Super Bowl XVIII commercial directed by Ridley Scott, which depicted an Orwellian "1984" world that is changed by the introduction of the Macintosh. The Macintosh, in combination with LaserWriter and PageMaker, kept Apple growing and ushered in the desktop publishing market. 10 In 1985, Jobs resigned from Apple Computer. The board of directors had removed him from his managerial duties following a power struggle with then CEO John Sculley, who had been hired two years earlier. 11 Jobs founded NeXT Inc. later that same year. Between 1986 and 1997, Apple Computer continued to release numerous new computers, including the Macintosh Portable in 1989 and the PowerBook in 1991 with upgrades to its OS. However, following the flops of several consumer-targeted products, such as digital cameras, portable CD players, speakers, video consoles, and TV appliances, Sculley was replaced as CEO by Michael Spindler in 1993. Spindler continued as CEO until 1996 when he was replaced by Gil Amelio, after Apple experienced a significant decline in revenues and profits. 12 After several failed attempts at improving the Mac OS, Amelio decided to acquire NeXT Inc., bringing Jobs C-90 AT\&T and Apple back to Apple Computer as an advisor. In 1997, Amelio was ousted as CEO by the board of directors, and Jobs became interim CEO. A year after Jobs returned as CEO, Apple Computer released the iMac, which was commercially popular and successful. The iMac integrated notable new design aesthetics and technology, selling nearly 800,000 units in the first five months. 13 During the next several years, Apple Computer acquired several companies to complete its iLife suite, which included iMovie, GarageBand, iPhoto for consumers, and Final Cut Pro for professionals. In 2001, Apple Computer opened its first Apple Retail Stores and introduced the wildly successful iPod, which sold more than 100 million units by 2007. To complement the iPod and provide an even better user experience, Apple introduced the iTunes Store in 2003. During the period between 2003 and 2006, the price of Apple Computer's stock went from about $7 per share to more than $80 per share. 14 At this point, Apple began to seriously consider entering the smartphone market. The company had partnered with Motorola to release the Motorola ROKR in 2004, which was carried exclusively by Cingular and used iTunes software to play iTunes songs. However, Apple executives felt the design and execution (controlled primarily by Motorola and Cingular) were clunky. 15 In 2005, Apple engineers were working on touchscreen technology for a tablet PC and were convinced that they could use the same technology for a smaller device. Moreover, the new processor chips were fast and efficient enough to power a combined phone, computer, and iPod device in a single mobile device. Apple saw the success of BlackBerry and the rising demand for phones that used data and the Internet. As mobile phones became more integrated with other applications (such as music), Apple could see that the iPod business would be negatively affected because of increased competition from phones. Apple was looking for its next big product and thought that the smartphone market was where the company needed to be, but only on its own terms. Terms of the Strategic Alliance Jobs referred to telecom operators as "commodities" who would never understand the web and entertainment the way Apple did. Apple was trying to buck the "rules" of the cellphone industry and maintain complete control of the design and marketing of its first cellphone. In order to maintain complete control, Apple considered creating the device and buying excess capacity from existing carriers to service the device themselves. This was what Virgin had done when it launched Virgin Mobile (though Virgin didn't try to design its own phone). 16 But this option would require substantial investment and would put Apple into direct competition with the major carriers: Verizon, AT\&T, Sprint, and T-Mobile. So Apple decided to explore the option of partnering with one of the major carriers. Ideally, Apple was looking for a partner that could help fund the development of the iPhone but would grant Apple full control of the development and design. Apple also wanted a partner with a large retail network that would be effective at selling the iPhone. This meant that AT\&T and Verizon were prime targets. In addition, Apple wanted a partner that would give it a percentage of the annual service bill for iPhone users (anticipated to be roughly $1,000 per year). Finally, Apple didn't want to provide long-term exclusivity to any one carrier. AT\&T (called Cingular before 2005) was a top candidate because its wireless data network was the largest wireless data network available at the time, reaching 270 million people worldwide-about 50 million more than the next largest wireless network. 17 However, according to at least one industry expert, AT\&T was a "sclerotic mess of assets" with a future that lay in "a glitchy, hodgepodge cellular network cobbled from deals past." "18 As its voice business continued to fade fast because of fierce competition and price wars, AT\&T had a large incentive to grow its wireless business-and add more data customers through expanded smartphone use. AT\&T was looking for a competitive advantage in the wireless market and to fully transition its brand into that of a wireless company. In early 2005, Jobs pitched his idea to then Cingular Wireless chief executive Stan Sigman. They agreed to explore the idea further. Cingular's global network for mobile communications Launch of the iPhone with AT\&T C-91 (GSM) technology was the standard in much of the world, and so Cingular was a logical choice as a partner for Apple. Jobs also shopped his idea around to other wireless industry titans, including Cingular's main competitor Verizon Wireless in the middle of 2005, but negotiations fell through. Verizon balked at the notion of cutting out its big retail partners, such as Circuit City, which would not be allowed to sell the phone. Verizon also hesitated because Apple wouldn't allow Verizon to sell content such as music and videos through its proprietary V Cast service. 19 With Verizon out of the picture, Apple's talks with Cingular accelerated. The wireless company couldn't pass up the chance to usher in the smartphone era with Jobs, who had reinvented the computer and the music industry. Secret negotiations that began with Cingular executives in February 2005 took over a year to complete, ending with the company that had been renamed AT\&T. Stan Sigman, CEO of AT\&T Wireless, and his team were taken with the idea of the iPhone, but it was difficult to convince everyone to change so much of the existing phone carrier business model and to concede to Jobs' demands. 20 Forbes reported, "Trust was a big part of the story behind AT\&T's deal with Apple. 'I told people you weren't betting on a device,' recalls AT\&T CEO Randall Stephenson. 'You were betting on Steve Jobs.'"21 The official details of the agreement are proprietary, but a number of them have been released or publicly acknowledged. Main points are summarized below: - AT\&T would be the exclusive carrier of iPhone for five years, while Apple would get millions of dollars from AT\&T to support development of the iPhone. - AT\&T would get 10 percent of iPhone sales in AT\&T stores, while Apple would get $10 per month of AT\&T iPhone subscriber's bill. - AT\&T would get a thin slice of iTunes revenues, while Apple would get control of design, manufacturing, and marketing. Although Jobs was notoriously secretive about the iPhone before its announcement, even with AT\&T executives, those who did get to see it before the public were enthusiastic. Sigman called the iPhone "the best device I have ever seen." " In return for five years of exclusivity, roughly 10 percent of iPhone sales in AT\&T stores, and a thin slice of Apple's iTunes revenue, AT\&T had granted Jobs unprecedented power. 23He had cajoled AT\&T into spending millions of dollars and thousands of hours to create a new feature, a so-called visual voicemail, and to reinvent the time-consuming in-store sign-up process. 24 AT\&T's wireless data network would become a differentiator. Voellinger, VP of telecom consultancy Telwares, said the AT\&T-Apple alliance was really about content. "They are not going to pull users with speed," he says. "They will do it with content and because of the content, it should be very successful." n25 With Apple's design prowess and AT\&T's network services, the iPhone was poised to revolutionize the wireless smartphone industry. Launch of the iPhone with AT\&T Tremendous excitement surrounded the iPhone launch in North America on June 27, 2007. In March 2007, AT\&T had more than 1 million inquiries for the device on its website. An AT\&T store sales representative in Manhattan reported receiving hundreds of phone calls per day and at least another hundred inquiries from people who walked into the store asking how they could get their hands on an iPhone.. Owners of the iPhone said they loved using their device to surf the Internet, download content, stream music and videos, and send and receive email, as well as talk on the phone. AT\&T discovered that its data network demand predictions were far too low, causing huge strains on the network resulting in spotty coverage and customer service headaches. Since 2007, traffic on AT\&T's network has doubled each year, and, according to an AT\&T FCC filing in 2011 , mobile data volume surged 8,000 percent from 2007 to 2010 , which included data used on iPods and iPads. 27 Apple contributed to coverage problems as well. The original iPhone shipped with glitches in its communications software that led to dropped calls. 28 C-92 AT\&T and Apple When AT\&T complained to Apple about iPhone users' data demands, it was met with resistance. AT\&T requested that Apple take measures to help throttle back user data traffic, for example, by limiting YouTube videos to Wi-Fi only or by cutting off after a minute. AT\&T argued that there was no point in offering features that carriers couldn't support. However, Apple engineers and marketers weren't interested in cooperating. "We consistently said 'No, we are not going to mess up the consumer experience on the iPhone to make your network tenable.' They'd (AT\&T) always end up saying, 'We're going to have to escalate this to senior AT\&T executives,' and we always said, 'Fine, we'll escalate it to Steve and see who wins.' I think history has demonstrated how that turned out.. n29 Meanwhile, AT\&T customers were upset with the limited coverage and service on the EDGE network, especially in cities such as New York and San Francisco where iPhone users were more densely populated than they were in other markets. This created numerous PR headaches for AT\&T because its reputation became increasingly associated with an unreliable network. AT\&T's service glitches became fodder for competitors such as Verizon. 30 AT\&T responded to the increased demand by spending \$115 billion from 2007-2012, acquiring additional spectrum and building its network to meet customer demand. Speaking in an interview in 2009, AT\&T Chief Technology Officer John Donovan said, "Nobody is in the same boat we're in. We're shaping the landscape for the whole industry, and I relish the opportunity to be the first to figure it out.... We're solving problems for the world in how to deal with these loads. n1 Assessing the Impact of the Strategic Alliance As the alliance reached the end of its five-year life, both AT\&T and Apple had the opportunity to assess whether it had achieved its strategic objectives. Impact on AT\&T AT\&T's key objectives with the partnership were to attract more subscribers and to rebrand itself as a wireless company. Analysts predicted the iPhone would sell about 8 million units by the end of 2008 , but in reality, that number was larger. There were 1.4 million units sold globally in 2007, and in the years 2008-2011, the number of units sold were 11.6 million, 20.7 million, 40.0 million, and 72.3 million, respectively, 32 with approximately 85 million total in the United States during that same period. 33 AT\&T reported roughly 53 million iPhone account activations in the United States from 2007 to 2011 (see Exhibit 2). From the launch of the iPhone in June 2007 to EXHIBIT 2 AT\&T iPhone Activations (2007-2011) "Compiled from AT\&T Inc. Financial Review 2007 - 2011 January 2012, AT\&T's market share of wireless phone subscribers (among the top four companies) went from 36 percent to 39 percent. The 3 percent share increase translated into roughly 3.2 million additional subscribers at the beginning of 2012 . Verizon Wireless also gained subscribers during that time period, going from 36 percent to 41 percent. Sprint was the big loser, with its market share of subscribers dropping from 27 percent to 17 percent (see Exhibit 3). 34 Following the launch of the iPhone 3G (second generation) in 2008, AT\&T began subsidizing iPhones. The original $599 price tag was too expensive for the majority of consumers, and Apple dropped the price down to $199 with a 2-year contract and a slightly higher monthly data plan fee. AT\&T executives were willing to pay this subsidy because they saw that iPhone users were more lucrative due to their increased data usage, and they believed the new pricing would lead to mass adoption. 35 Indeed, AT\&T ended up getting nearly twice the average revenue per user (ARPU) per month from iPhone users. According to Apple Inc. in 2010, AT\&T's iPhone ARPU 35 was $95 compared to $50 for the top three carriers. 37 Additionally, turnover (churn levels) for these subscribers was significantly lower than it was for other smartphone customers. 38 Starting in February 2011, Verizon was able to start selling iPhone activations, followed by Sprint in October 2011. Despite speculation that AT\&T iPhone activations would drop off quickly after the company lost exclusivity, activation activity for AT\&T was 17.5 million iPhones in 2011. Verizon was 10.8 million, and Sprint came in at 1.8 million. That trend continued in the first quarter of 2013. AT\&T activated 4.8 million iPhones while Verizon activated 4.0 million. 39 The iPhone remains AT\&T's most popular phone, and it garnered about 73 percent of the company's smartphone subscribers in 2012. The AT\&T wireless segment's financial performance steadily increased from 2006 to 2007, with the Cingular merger and the introduction of the iPhone. By 2012, sales had passed \$66 billion. AT\&T's market value also increased during that time, from $183.5 billion to $227 billion, but it dropped back down to $188 billion by the end of 2012 (See Exhibit 4). Impact on Apple The iPhone cost an estimated $150 million to develop over 30 months. 40 According to Apple court case documents, it spent $647 million on advertising the iPhone in the United States from 2007 to 2011.41 However, these costs were more than covered by the estimated $10 per month charge for each iPhone in the contract with AT\&T. 42 In fact, in just 2011, the final year of the agreement, AT\&T reported 17.5 million iPhone activations, which would have generated roughly $2.1 billion in annual profit. With 53 million cumulative iPhone activations in the first five years, Apple would have generated roughly $5$6 billion in AT\&T service revenue profits over the life of the agreement. EXHIBIT 3 Subscriber Share for the Four Largest Wireless Carriers (2006-2012) "Market share among the top four national players included here, not across the entire wireless market; does not include local wireless players (e.g., Cricket Wireless). Source: Company 10k SEC filings. Subscriber counts include prepaid and postpaid retail customers. C-94 AT\&T and Apple EXHIBIT 4 Selected Financials for Apple, AT\&T, Verizon, Sprint, and T-Mobile (2006-2012) "Operating expenses were consolidated after 2007. Assessing the Impact of the Strategic Alliance C-95 "Depreciation \& amortization were consolidated after 2006. Source: Apple, AT\&T, Verizon, Sprint, and T-Mobile Annual Reports, 2006-2012. Manufacturing costs for the iPhone have been estimated to be roughly $290, and the average selling price has been approximately $600,43 giving Apple 50 percent profit margins, before covering other operating expenses such as advertising, service, and general and administrative expenses. 44 Advertising costs were roughly $8 per customer ( $647 million in advertising spread across 85 million customers) during the first five years. Depending on actual service costs, general and administrative expense allocations, and the actual bill of material component costs, Apple earned between \$225 and \$325 per iPhone. At \$225 per phone multiplied by 85 million phones, Apple's profits from iPhones during the 5 -year period would be roughly $19.1 billion. With these profits, Apple became the largest mobile handset vendor in the world by revenue in 2011 , surpassing longtime leader Nokia. 45 Sales of the iPhone continue to come primarily through AT\&T and other third-party retail outlets. In 2012, the 250 Apple stores sold approximately 21 percent of iPhones, while AT\&T sold 28 percent and Verizon 26 percent. These numbers indicate that consumers still prefer to go to the carrier to purchase their iPhone, as opposed to the Apple store where they purchase the majority of other Apple devices, including Macs and iPads. 45 Part of this trend may also be because of the accessibility of AT\&T or Verizon stores. The value of Apple's brand and its stock skyrocketed after the launch of the iPhone. Apple's Interbrand ranking (a comparison of global brand recognition and value) went from thirtyninth ( $9.1 billion) in 2006 to first ( $98.3 billion) in 2013, surpassing other brand legends such as Coca-Cola, McDonald's, and Microsoft. Apple's sales jumped from \$19 billion in 2006 to $156 billion in 2012, while its market value skyrocketed from $56 billion to $494 billion during that same time period (see Exhibit 4). Much of that increase in market value was attributed to the introduction of the iPhone and iPad. AT\&T enjoyed a number of noteworthy benefits as a result of the Apple alliance. AT\&T's share in the emerging smartphone market increased significantly from 28 percent just prior to the release of the iPhone in 2007 to 32 percent by the end of 2011. Its partnership with Apple also helped bolster AT\&T's image among increasingly technology-hungry consumers. Finally, although painful, high demands from Apple pertaining to the consumer experience and increased user network requirements ultimately forced AT\&T to strengthen its network capabilities and customer service. Indeed, for AT\&T, the alliance appears to have paid healthy dividends in terms of increased subscribers, a stronger brand, and improved operations. But the costs were substantial as well. Along with the upfront development costs, AT\&T paid a $5 billion to $6 billion in service revenue to Apple. Nevertheless, by the end of the alliance, AT\&T saw its wireless segment's operating margin improve by nearly 10 percent, in large part because of its operating profit per subscriber increasing by roughly $75 (and see Exhibits 5 and 7 ; also see Exhibits 6 and 8 for a comparison of revenue per user and earnings per share over time). At the time of its release, the iPhone was the first to use a multitouch interface with a large touchscreen that did not require use of a stylus, keyboard, or keypad. The user interface was also known for its intuitiveness and visual aesthetics, a hallmark of Apple products. Apple helped transform the smartphone from a primarily business-centric device, at the time dominated by BlackBerry, to a product attractive to the general consumer. 47 Despite Apple having revolutionized the consumer smartphone experience, competitors such as Samsung, LG, ExFIIITT Uperating income per subscriper Source: AT\&T, Verizon, Sprint, T-Mobile, and Apple Annual Reports, 2006-2012. EXHIBIT 8 Earnings per Share Source: AT\&T, Verizon, Sprint, T-Mobile, and Apple Annual Reports, 2006-2012. HTC, and Microsoft, using Android and Windows-based operating systems, caught up to and, in some cases, surpassed some of the iPhone's technological features. In 2008, the Android operating system, which was backed by Google, was launched on the HTC Dream. The Android system, with a user interface similar to that of iPhone's iOS, was touchscreen-focused for use on smartphones and tablets. It incorporated hardware such as gyroscopes, accelerometers, and proximity sensors to provide an enhanced user experience similar to that of Apple's iPhone. 48 Releases of smartphones by Apple's competitors, such as Samsung (notably the Galaxy S series), HTC, LG, Microsoft, Sony, Nokia, and BlackBerry, in the latter years of the Apple-AT\&T alliance showed how quickly Apple's technological and user interface advantages were neutralized. Competitors were even surpassing the iPhone on features such as screen size, built-in cameras, and speakers. As a result, some wondered whether it had been wise for Apple to limit the introduction of the iPhone through the AT\&T alliance. Were the millions of dollars in development fees and the share of monthly revenue worth the price of exclusivity with AT\&T? Had exclusivity created a greater frenzy for the iPhone than would have happened had it been released through multiple carriers? Or did exclusivity with AT\&T hurt Apple's ability to gain broader market penetration before competitors (notably Samsung) were able to develop phones with similar functionality and technology? Although it is impossible to know exactly what would C-98 AT\&T and Apple have happened without the strategic alliance, there is no doubt that its effects helped to shape both companies' footholds and futures in the smartphone market. As Stephenson and the AT\&T leadership team looked to the future, it was apparent that they would continue to use alliances, and acquisitions, as vehicles for accessing key resources in other firms. Between 2011 and 2014, AT\&T announced a series of strategic alliances to help improve the company's position providing telecommunication and Internet services to business customers. In particular, AT\&T announced alliances with Akamai and CSC to develop nextgeneration technology solutions for enterprise businesses. For example, CSC, a recognized leader in enterprise cloud computing, will deliver its BizCloud TM and other cloud services through AT\&T's global cloud infrastructure platform and networks. AT\&T also announced alliances with McAfee, to provide enhanced security benefits to business customers, and Microsoft, to combine the Microsoft Azure platform (one of the most popular PaaS services) and AT\&T's network services. 49 But AT\& & 's biggest strategic move was done through acquisition rather than alliance. To expand its broadband U-Verse television service, AT\&T proposed an acquisition of DirecTV, the largest satellite TV operator in the United States and Latin America. "What it does is it gives us the pieces to fulfill a vision we've had for a couple of years," said AT\&T CEO Randall Stephenson, "the ability to take premium content and deliver it across multiple points: your smartphone, tablet, television or laptop. m50 Even as the acquisition was announced, there was considerable debate as to whether it was wise to acquire DirecTV, with some suggesting that AT\&T could have used an alliance instead of an acquisition to achieve its strategic objectives. Undoubtedly, like the Apple alliance, the success of the DirecTV acquisition was likely to be debated in years to come