Question: hello, this is one question just have 3 instructions to it please help me solve it. 1. You need to determine an interest rate to

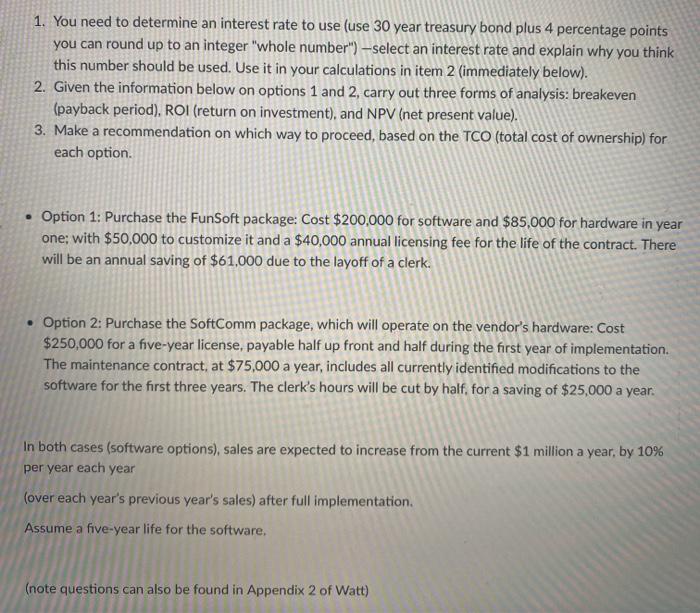

1. You need to determine an interest rate to use (use 30 year treasury bond plus 4 percentage points you can round up to an integer "whole number") -select an interest rate and explain why you think this number should be used. Use it in your calculations in item 2 (immediately below). 2. Given the information below on options 1 and 2, carry out three forms of analysis: breakeven (payback period), ROI (return on investment), and NPV (net present value). 3. Make a recommendation on which way to proceed, based on the TCO (total cost of ownership) for each option Option 1: Purchase the FunSoft package: Cost $200,000 for software and $85,000 for hardware in year one; with $50,000 to customize it and a $40,000 annual licensing fee for the life of the contract. There will be an annual saving of $61,000 due to the layoff of a clerk. Option 2: Purchase the SoftComm package, which will operate on the vendor's hardware: Cost $250,000 for a five-year license, payable half up front and half during the first year of implementation. The maintenance contract, at $75,000 a year, includes all currently identified modifications to the software for the first three years. The clerk's hours will be cut by half, for a saving of $25,000 a year. In both cases (software options), sales are expected to increase from the current $1 million a year, by 10% per year each year (over each year's previous year's sales) after full implementation Assume a five-year life for the software, (note questions can also be found in Appendix 2 of Watt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts