Question: Hello, this is the main question I cant get past. Can you please explain the solutions for A and B to me? thank you if

Hello, this is the main question I cant get past. Can you please explain the solutions for A and B to me?

thank you if you can help me!

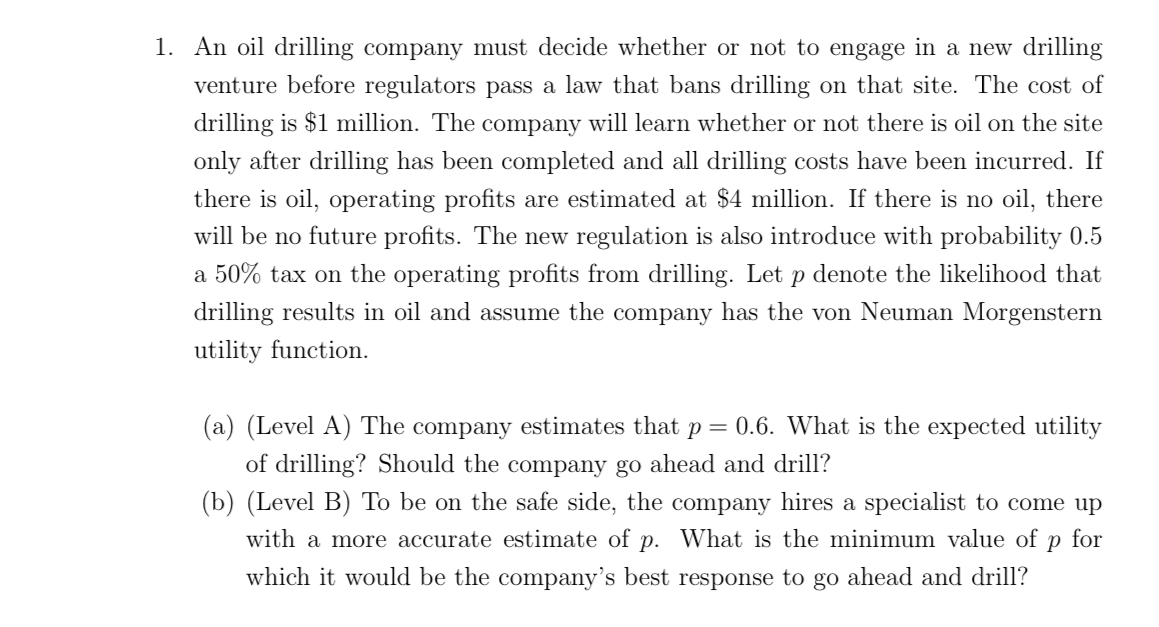

1. An oil drilling company must decide whether or not to engage in a new drilling venture before regulators pass a law that bans drilling on that site. The cost of drilling is $1 million. The company will learn whether or not there is oil on the site only after drilling has been completed and all drilling costs have been incurred. If there is oil, operating prots are estimated at $4 million. If there is no oil1 there will be no future prots. The new regulation is also introduce with probability 0.5 a 50% tax on the operating prots from drilling. Let p denote the likelihood that drilling results in oil and assume the company has the von Neuman Morgenstern utility function. (a) (Level A) The company estimates that p = 0.6. What is the expected utility of drilling? Should the company go ahead and drill? (b) (Level B) To be on the safe side1 the company hires a specialist to come up with a more accurate estimate of 39. What is the minimum value of p for which it would be the company's best response to go ahead and drill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts