Question: Hello. This's completely a single question. Short Answer Question 5 Over the past six months, Ying has come to think of you as her mentor.

Hello. This's completely a single question.

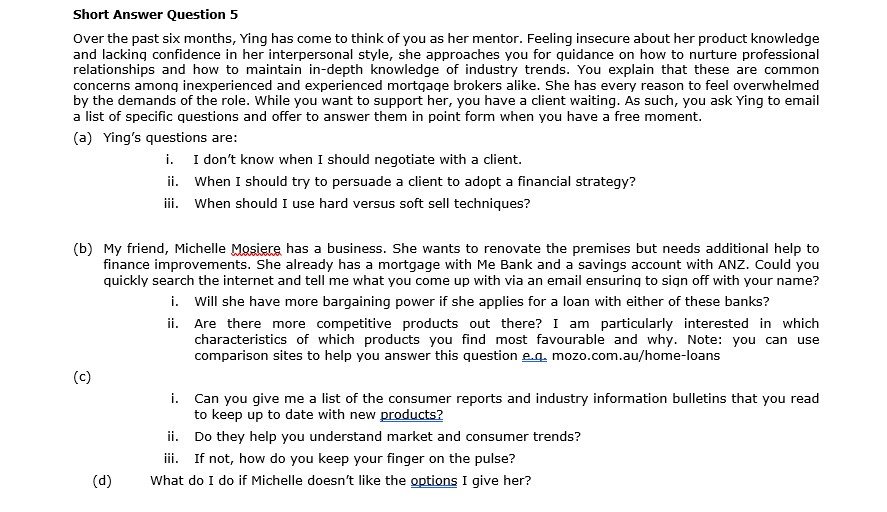

Short Answer Question 5 Over the past six months, Ying has come to think of you as her mentor. Feeling insecure about her product knowledge and lacking confidence in her interpersonal style, she approaches you for guidance on how to nurture professional relationships and how to maintain in-depth knowledge of industry trends. You explain that these are common concerns among inexperienced and experienced mortgage brokers alike. She has every reason to feel overwhelmed by the demands of the role. While you want to support her, you have a client waiting. As such, you ask Ying to email a list of specific questions and offer to answer them in point form when you have a free moment. (a) Ying's questions are: i. I don't know when I should negotiate with a client. ii. When I should try to persuade a client to adopt a financial strategy? iii. When should I use hard versus soft sell techniques? (b) My friend, Michelle Mosiere has a business. She wants to renovate the premises but needs additional help to finance improvements. She already has a mortgage with Me Bank and a savings account with ANZ. Could you quickly search the internet and tell me what you come up with via an email ensuring to sign off with your name? i. Will she have more bargaining power if she applies for a loan with either of these banks? ii. Are there more competitive products out there? I am particularly interested in which characteristics of which products you find most favourable and why. Note: you can use comparison sites to help you answer this question e.q. mozo.com.au/home-loans (c) i. Can you give me a list of the consumer reports and industry information bulletins that you read to keep up to date with new products? ii. Do they help you understand market and consumer trends? iii. If not, how do you keep your finger on the pulse? (d) What do I do if Michelle doesn't like the options I give her? Short Answer Question 5 Over the past six months, Ying has come to think of you as her mentor. Feeling insecure about her product knowledge and lacking confidence in her interpersonal style, she approaches you for guidance on how to nurture professional relationships and how to maintain in-depth knowledge of industry trends. You explain that these are common concerns among inexperienced and experienced mortgage brokers alike. She has every reason to feel overwhelmed by the demands of the role. While you want to support her, you have a client waiting. As such, you ask Ying to email a list of specific questions and offer to answer them in point form when you have a free moment. (a) Ying's questions are: i. I don't know when I should negotiate with a client. ii. When I should try to persuade a client to adopt a financial strategy? iii. When should I use hard versus soft sell techniques? (b) My friend, Michelle Mosiere has a business. She wants to renovate the premises but needs additional help to finance improvements. She already has a mortgage with Me Bank and a savings account with ANZ. Could you quickly search the internet and tell me what you come up with via an email ensuring to sign off with your name? i. Will she have more bargaining power if she applies for a loan with either of these banks? ii. Are there more competitive products out there? I am particularly interested in which characteristics of which products you find most favourable and why. Note: you can use comparison sites to help you answer this question e.q. mozo.com.au/home-loans (c) i. Can you give me a list of the consumer reports and industry information bulletins that you read to keep up to date with new products? ii. Do they help you understand market and consumer trends? iii. If not, how do you keep your finger on the pulse? (d) What do I do if Michelle doesn't like the options I give her

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts